- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

Is There Still Opportunity in American Superconductor After 35% Price Drop and New Partnerships?

Reviewed by Bailey Pemberton

- Wondering if American Superconductor's rapid rise is still leaving some value on the table, or if the best days are behind it? You're not alone. Let's dig into the numbers to find out.

- The stock is up a staggering 52.1% year-to-date but just took a sharp turn, dropping 35.9% over the last week and 30.9% in the past month. This definitely has investors taking a closer look.

- These swings come on the heels of recent news highlighting American Superconductor’s expanding partnerships and new orders in the renewable energy and grid solutions space, signaling both opportunities and unpredictability. High-profile contract announcements continue to keep the company in the spotlight, driving attention to both its prospects and vulnerabilities.

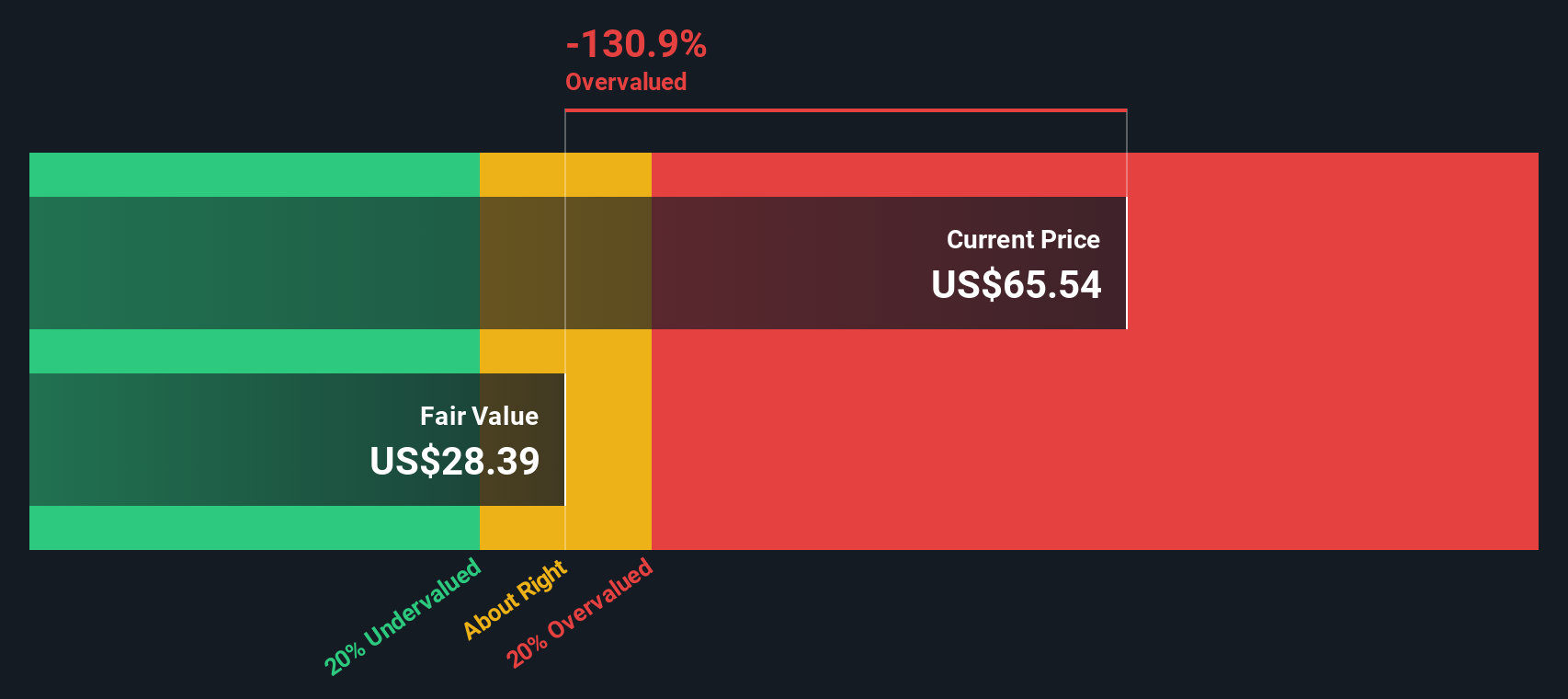

- With a valuation score of 1 out of 6 on our checklist, it seems the case for undervaluation is pretty thin by standard measures. However, there are some key nuances to assessing value, especially for a company moving this fast.

American Superconductor scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: American Superconductor Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollar value. This approach aims to capture both short-term and long-term growth, relying on the idea that the worth of a company comes from its ability to generate cash over time.

For American Superconductor, the latest reported Free Cash Flow (FCF) stands at $19.8 million. Projections indicate this figure could grow substantially, with estimates for 2028 reaching $52.1 million. Over the next ten years, Simply Wall St extrapolates further growth, showing 2035 FCF potentially as high as $146.2 million, all in USD. Only the first five years are rooted in direct analyst estimates. Longer-term numbers reflect modeled growth trends based on industry outlook and company performance.

Based on these cash flow projections and discounting them back to today, American Superconductor’s fair value comes out to $34.75 per share. This is about 11.8% higher than the current market price, signaling that the stock is slightly overvalued by DCF standards.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American Superconductor may be overvalued by 11.8%. Discover 881 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: American Superconductor Price vs Earnings

For profitable companies like American Superconductor, the Price-to-Earnings (PE) ratio is often the go-to metric since it directly links a company’s stock price to its actual earnings performance. A higher PE can signal strong growth expectations, while a lower one may indicate more risk or slower growth prospects. Deciding what makes a “normal” or “fair” PE ratio means considering both how quickly earnings are expected to grow and what level of business risk is present.

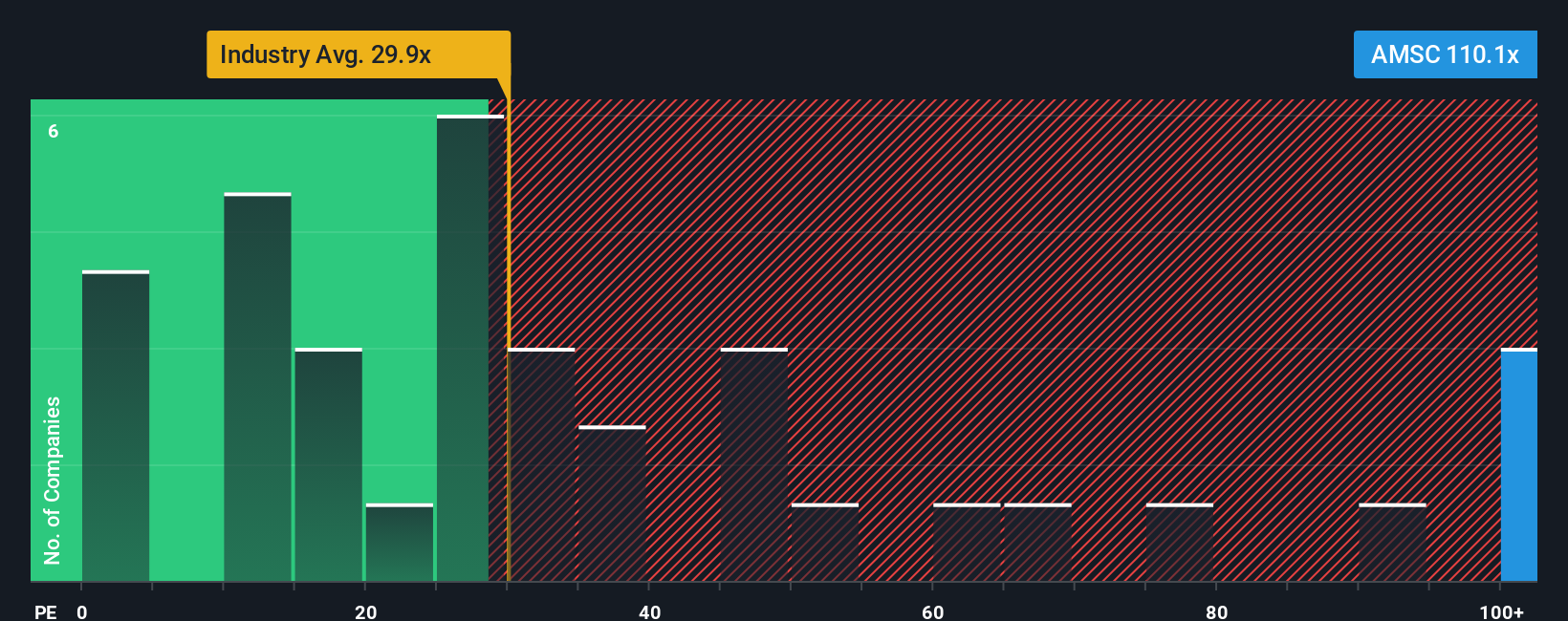

Right now, American Superconductor trades at a hefty 115.95x PE, which is substantially above both the Electrical industry average of 29.95x and its listed peers at 29.35x. At first glance, this kind of premium could raise eyebrows, especially in a sector that typically sees much lower earnings multiples.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. It factors in American Superconductor’s specific growth outlook, profit margins, risk factors, industry group, and market capitalization. The Fair Ratio for AMSC is calculated at 63.99x. Unlike a simple industry or peer comparison, this approach gives a tailored benchmark that recognizes what makes the company unique, including both its upside potential and the hurdles it faces.

Comparing American Superconductor’s actual PE of 115.95x to its Fair Ratio of 63.99x, the stock looks meaningfully overvalued on a multiple basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Superconductor Narrative

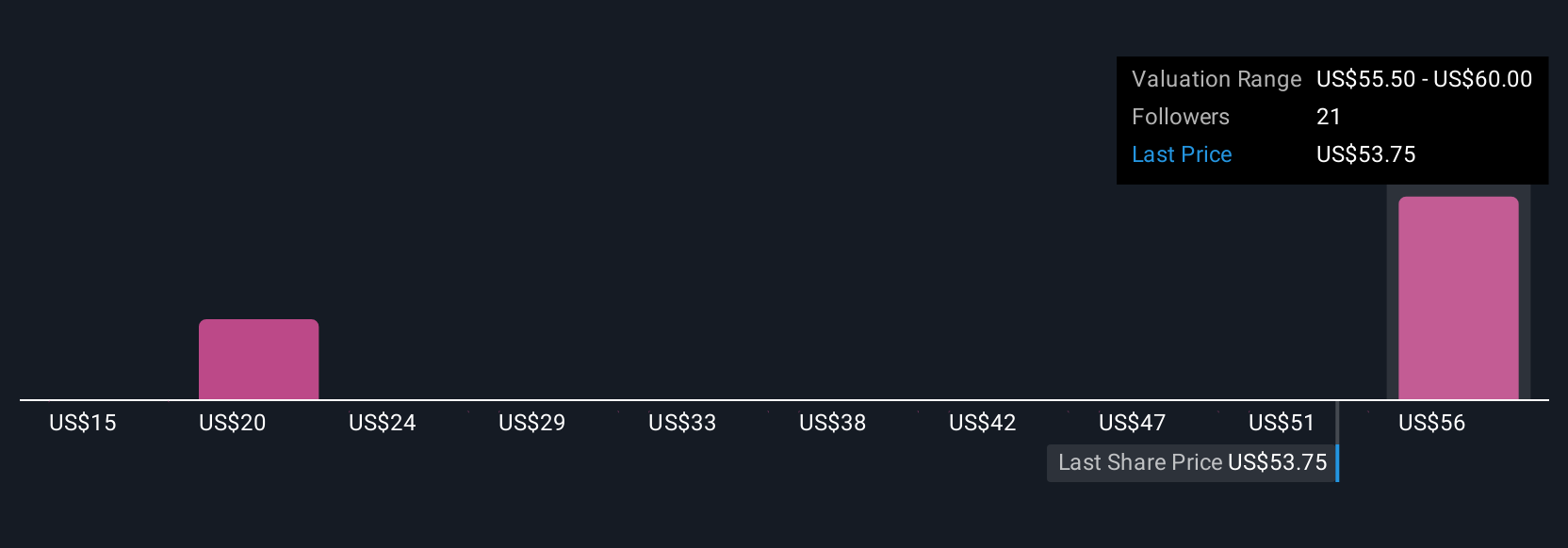

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you build around a company, connecting your expectations for its future earnings, margins, and revenue to your own sense of what the business is worth. Narratives let you bring your perspective to the numbers, linking your personal or research-based insights about where American Superconductor is headed directly to a financial forecast and, ultimately, to a fair value per share.

This approach makes valuation both simple and powerful. Narratives are available on the Simply Wall St Community page and are already used by millions of investors. This makes it easy for anyone to share, update, or browse collective wisdom. They help you cut through the noise of daily market moves by framing buy and sell decisions as a comparison between your Fair Value and the current price. This process automatically stays relevant as news and earnings updates roll in.

For example, some American Superconductor Narratives forecast strong tailwinds from data center demand and set a fair value near $66.67. Others, factoring in competitive risks and slowing guidance, estimate a fair value at $63.00. By comparing these diverse perspectives, you can decide which story and which valuation make the most sense for your own investing strategy.

Do you think there's more to the story for American Superconductor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives