- United States

- /

- Banks

- /

- NYSE:WFC

Is Now a Good Time to Reevaluate Wells Fargo After 22.6% Rally in 2024?

Reviewed by Bailey Pemberton

- Wondering if Wells Fargo is a bargain, overpriced, or somewhere in between? Let’s dig into what really drives the value behind this major bank stock.

- Wells Fargo’s shares are up 22.6% so far this year and an impressive 25.5% over the last twelve months, with just a slight dip of 1.1% this past week. This hints at some ongoing volatility.

- Recent headlines spotlight Wells Fargo’s continued efforts to diversify its revenue streams and further streamline operations. These developments coincide with sector-wide optimism around rising interest rates. Regulatory discussions and strategic investments have also kept Wells Fargo on the radar for investors looking at the next chapter in U.S. banking.

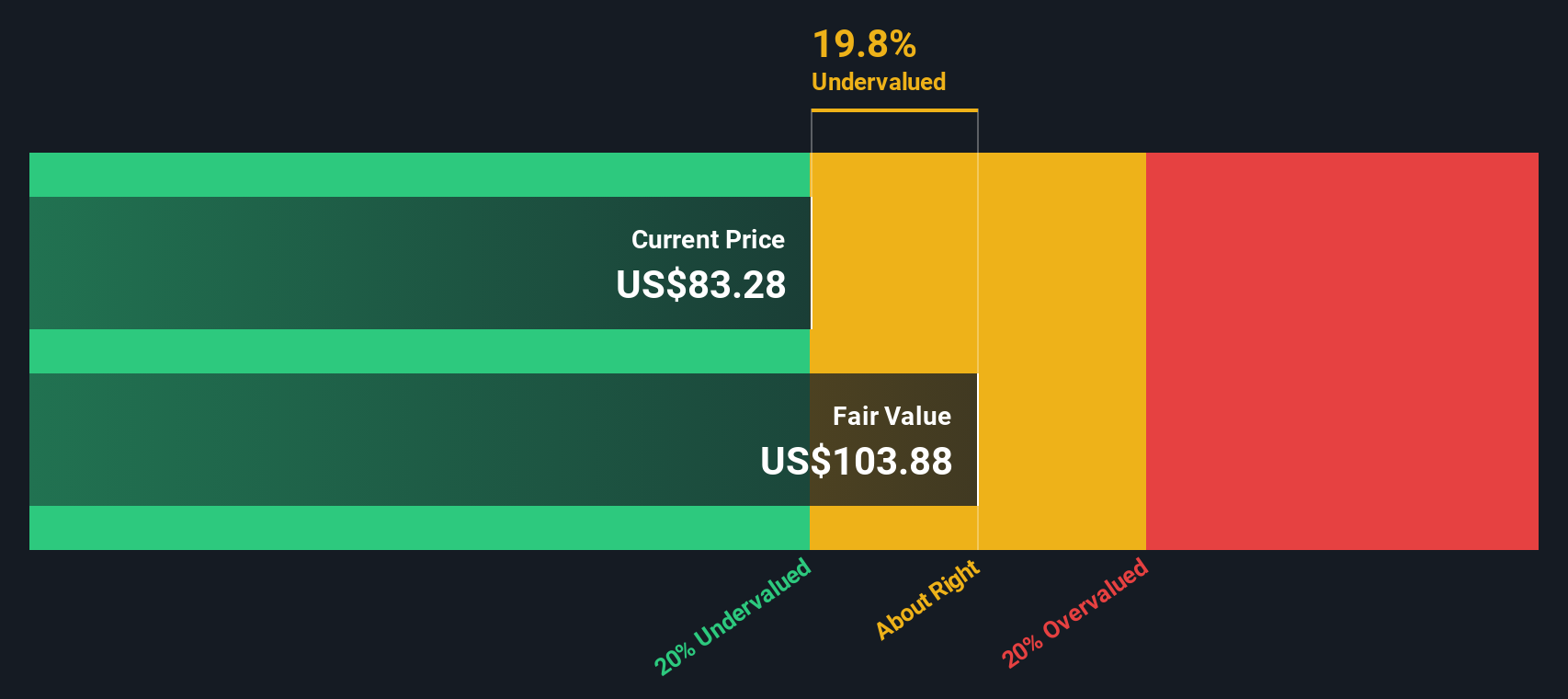

- On our 6-point valuation scale, Wells Fargo scores a 3/6. This suggests it is currently undervalued in half of the key metrics we track. But what do these checks really tell us, and is there a smarter way to evaluate Wells Fargo’s price? We’ll break down the usual valuation methods, then uncover an even more insightful approach later in the article.

Approach 1: Wells Fargo Excess Returns Analysis

The Excess Returns valuation model gauges a company's value by examining how much profit it generates from its own invested capital, above and beyond the required cost of equity. This approach focuses on the long-term ability of Wells Fargo to generate returns in excess of shareholder requirements, rather than just short-term profits or growth projections.

For Wells Fargo, the Excess Returns method uses the following key figures:

- Book Value: $52.25 per share

- Stable Earnings Per Share (EPS): $7.21 per share (from analyst-weighted future Return on Equity estimates)

- Cost of Equity: $4.58 per share

- Excess Return: $2.63 per share

- Average Return on Equity: 12.92%

- Stable Book Value: $55.82 per share (from analyst projections)

These figures suggest Wells Fargo is continually earning more on its equity than what investors would demand for taking on risk, which is a promising sign of financial health. The Excess Returns model estimates Wells Fargo's intrinsic value at a level indicating the stock is trading at a 20.9% discount to its calculated fair value. This means Wells Fargo currently appears to be undervalued according to this methodology.

Result: UNDERVALUED

Our Excess Returns analysis suggests Wells Fargo is undervalued by 20.9%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: Wells Fargo Price vs Earnings

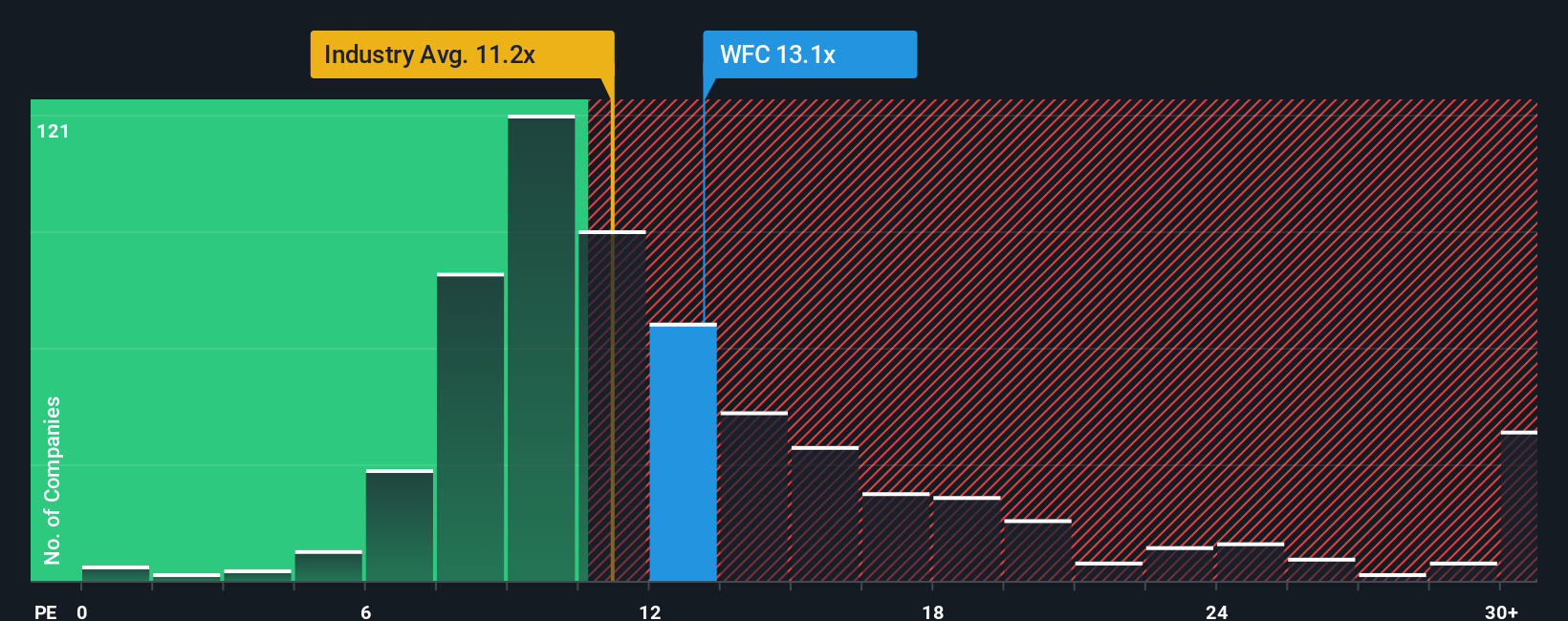

The Price-to-Earnings (PE) ratio is a widely used valuation metric for established and profitable companies like Wells Fargo because it connects a company's market price directly to its bottom-line earnings. This makes it an efficient way for investors to assess whether they are paying a reasonable price for each dollar of future profit.

Generally, a company's PE ratio is shaped by both its expected growth and risk profile. Higher growth prospects can justify a higher PE, while greater risks may warrant a lower one. It is important to compare a company not only to its direct peers but also to broader industry benchmarks to understand if its current valuation is justified.

Wells Fargo currently trades at a PE ratio of 13.52x. By comparison, the average for American banks is 11.10x, and Wells Fargo’s peer group sits at 12.43x. These figures show that Wells Fargo trades at a modest premium to both the industry and its peers, which could reflect optimism about its growth or stability.

Simply Wall St’s proprietary “Fair Ratio” for Wells Fargo is 13.92x. This figure factors in much more than the standard industry approach, including the company’s earnings growth, risk profile, profit margin, size, and sector dynamics. Unlike simple comparisons, the Fair Ratio aims to present a holistic view of what would be a justified multiple for the company right now.

Given that Wells Fargo’s actual PE (13.52x) is very close to the Fair Ratio (13.92x), the stock appears to be valued about right based on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wells Fargo Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about a company, connecting your perspective on its future to the numbers that matter, such as what you believe is fair value, and your own projections of revenue, earnings, and profit margins.

Instead of just taking the PE ratio or analyst targets at face value, Narratives let you explain why you think Wells Fargo will perform a certain way, linking your view of the business to a financial forecast and resulting fair value. This makes your investment reasoning more transparent and actionable.

With Simply Wall St's Narratives feature, available right now on our Community page and used by millions, you can easily build your own scenario for Wells Fargo, track how your fair value compares to the market price, and see how new news and earnings updates affect your outlook. These updates happen automatically and in real-time.

Narratives help you decide when to buy or sell by showing if your fair value is above or below the current price, and they update as soon as new information arrives so your decisions are always informed by the latest data.

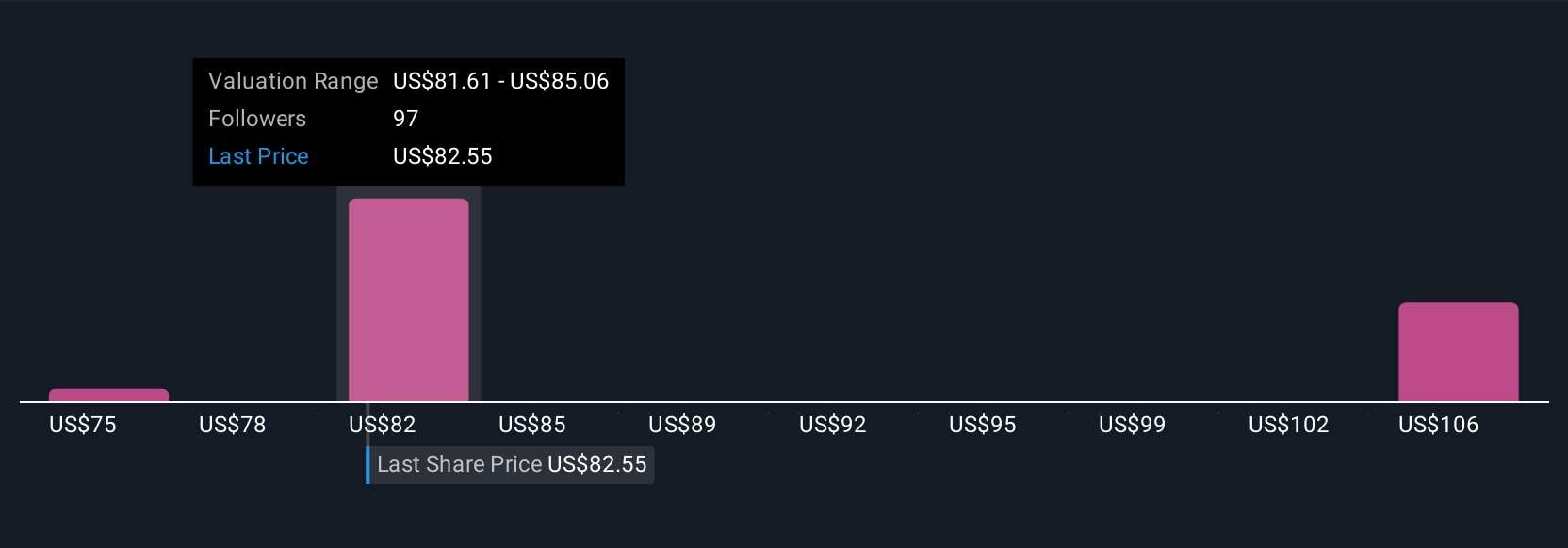

For example, some investors recently valued Wells Fargo as high as $93.13 or as low as $74.70, depending on their views about future profit growth, margins, and banking sector headwinds.

For Wells Fargo, we present previews of two leading Wells Fargo narratives: 🐂 Wells Fargo Bull CaseFair value: $93.13

Current price is 7.6% below fair value

Revenue growth rate: 6.93%

- Recent regulatory restrictions have been lifted, enabling aggressive balance sheet growth and supporting diversified revenue streams.

- Strategic digital initiatives and technology investments are driving higher margins and improved competitiveness. Expanding wealth management should also support more stable long-term profits.

- Analysts’ consensus assumes moderate revenue and earnings growth ahead, with a fair value 7.6% above the current price. They warn to monitor execution risks and continued regulatory pressures.

Fair value: $74.70

Current price is 15.1% above fair value

Revenue growth rate: 3.0%

- Despite a low forward P/E, modest growth expectations and challenging economic conditions may justify Wells Fargo trading below the broader market multiple.

- Sluggishness in key sectors like housing and manufacturing still weighs on near-term opportunities, though management aims to capitalize on potential regulatory changes.

- While strong fundamentals and a large customer base support the case for undervaluation, continued caution is urged given only moderate projected revenue and earnings growth.

Do you think there's more to the story for Wells Fargo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives