- United States

- /

- Banks

- /

- NYSE:NPB

Northpointe Bancshares (NPB) Margin Expansion Reinforces Bullish Sector Narrative

Reviewed by Simply Wall St

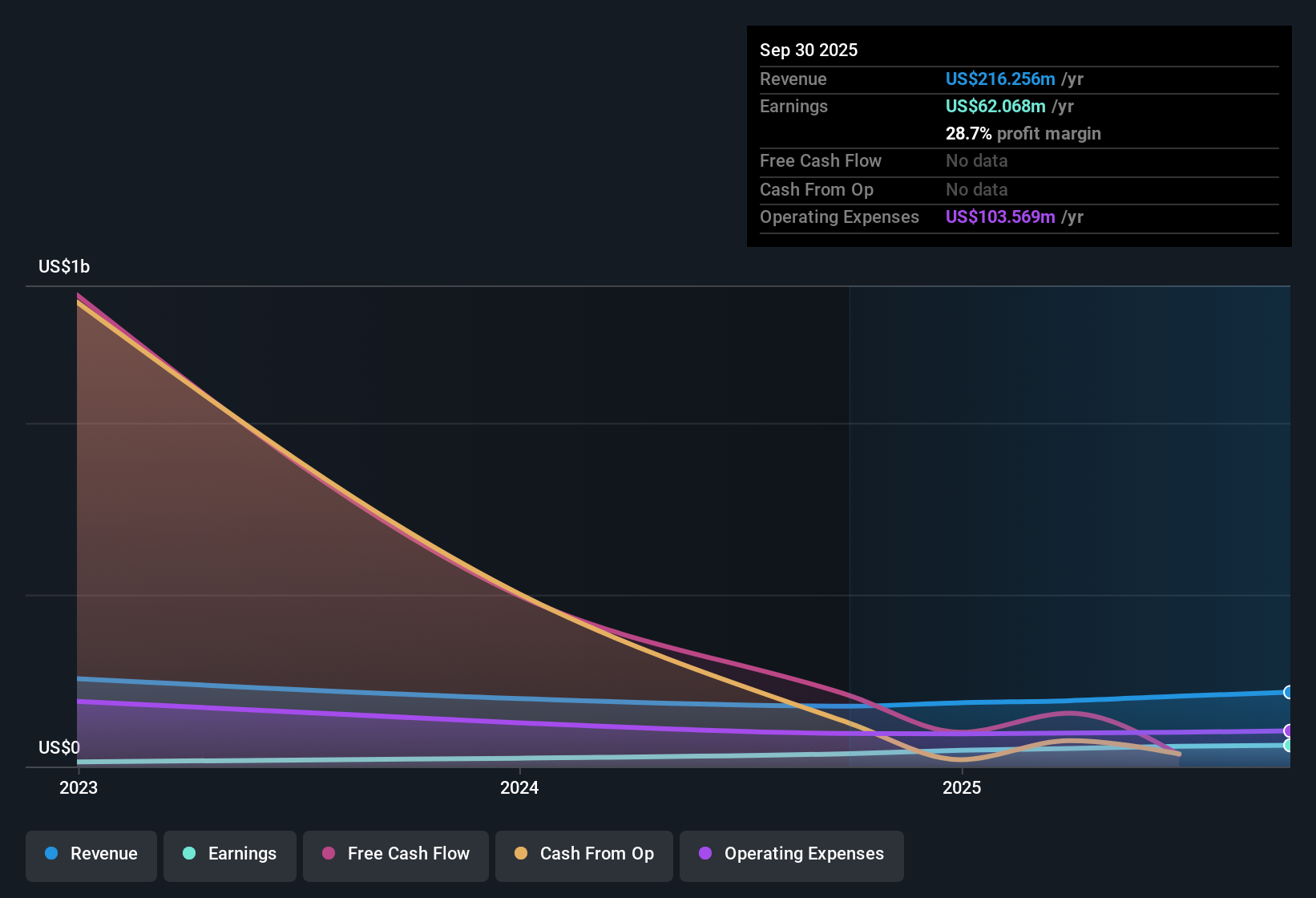

Northpointe Bancshares (NPB) reported forecasted earnings growth of 23.4% per year, surpassing the US market’s 15.5% pace. Revenue is expected to expand at 13.8% annually, ahead of the market average of 10.1%. Net profit margins improved to 28.7% from 21.4% last year, and the company’s shares are currently trading at $16.65, notably below the discounted cash flow estimate of $24.12. With high quality earnings, expanding profitability, and valuations that appear attractive relative to peers, investors have reason to view these results as a positive sign for the company’s sector standing.

See our full analysis for Northpointe Bancshares.Next, we will set these latest earnings results against widely followed market narratives to see which storylines get confirmed and which might get a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Expand to 28.7%

- Net profit margins climbed to 28.7%, up from 21.4% last year, signaling stronger profitability and operational efficiency over the past year.

- What is notable is how this level of margin expansion directly supports views that Northpointe Bancshares is weathering sector pressures just as well as, or better than, larger regional peers.

- Bulls highlight that high quality earnings and improved profitability stand out in a sector where cost pressures have been a theme for many banks.

- Consensus narrative notes that steady margin improvement is often interpreted as a mark of conservative risk management and disciplined lending practices, both of which reassure investors looking for stability in the regional banking space.

P/E Ratio Undercuts Peers

- The company trades at a price-to-earnings ratio of 9.2x, lower than the US Banks industry average of 11.2x and the peer group average of 14.4x.

- Analysts watching valuation metrics point out that this discount to peers, together with the company’s improved profit margins, could make Northpointe Bancshares appealing to investors seeking undervalued opportunities in the sector.

- Bulls argue that companies delivering margins close to 29% rarely trade at such a deep valuation discount compared to their sector and peers.

- Consensus narrative underscores that industry watchers may wait for further catalysts before re-rating, but note that current pricing provides a cushion against broader sector volatility.

DCF Fair Value Signals Upside

- Northpointe Bancshares’ share price of $16.65 sits notably beneath the DCF fair value estimate of $24.12, indicating the stock is trading at a sizeable discount to its intrinsic worth.

- Investors may see this valuation gap as offering upside potential, since forecasted annual earnings growth of 23.4% and annual revenue growth of 13.8% are both well above US market averages.

- The prevailing market view holds that when a profitable regional bank trades below its DCF fair value with growth trending ahead of the industry, skepticism typically relates less to current fundamentals and more to broader sector caution.

- What stands out is that with risks limited and minor at most, some investors may interpret the value gap to fair value as an overlooked opportunity.

Consensus narrative watchers see margin gains and low valuation multiples as reinforcing the view that Northpointe Bancshares remains a steady, if unexciting, sector pick.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Northpointe Bancshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Northpointe Bancshares is attractively valued and growing earnings quickly, investors may find the company’s results lack the steady, multi-year track record that signals reliable stability.

If you want to focus on companies with proven financial consistency and resilience regardless of market swings, check out stable growth stocks screener (2095 results) and sidestep the uncertainty of less predictable performers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northpointe Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NPB

Northpointe Bancshares

Operates as the bank holding company for Northpointe Bank provides various banking products and services in the United States.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives