Stock Analysis

- United States

- /

- Banks

- /

- NYSE:CUBI

Customers Bancorp's (NYSE:CUBI) 176% return outpaced the company's earnings growth over the same one-year period

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. For example, the Customers Bancorp, Inc. (NYSE:CUBI) share price had more than doubled in just one year - up 176%. Better yet, the share price has risen 4.1% in the last week. But this could be related to the buoyant market which is up about 3.3% in a week. It is also impressive that the stock is up 37% over three years, adding to the sense that it is a real winner.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Customers Bancorp

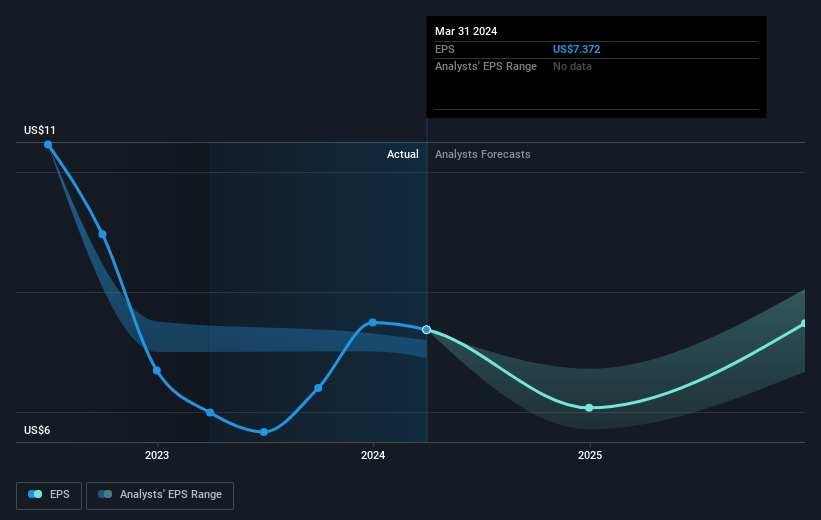

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Customers Bancorp grew its earnings per share (EPS) by 23%. The share price gain of 176% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Customers Bancorp has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

It's good to see that Customers Bancorp has rewarded shareholders with a total shareholder return of 176% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 20% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Customers Bancorp better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Customers Bancorp you should know about.

Of course Customers Bancorp may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Customers Bancorp is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CUBI

Customers Bancorp

Operates as the bank holding company for Customers Bank that provides financial products and services to individual consumers, and small and middle market businesses.

Very undervalued with flawless balance sheet.