- United States

- /

- Banks

- /

- NYSE:BAC

Did Bank of America's (BAC) Investor Day Rethink Signal a New Era for Profitability and Strategy?

Reviewed by Sasha Jovanovic

- Bank of America recently held its first major investor day since 2011, unveiling revised medium-term financial targets and updated business strategies, including a push toward higher return on tangible common equity and expanded geographic reach.

- The event featured new senior leadership and addressed longstanding investor concerns about relative performance, with management discussing asset mix shifts and plans to improve net interest income, efficiency, and loan growth across multiple business segments.

- We'll explore how Bank of America's enhanced profitability targets and leadership changes may impact its investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Bank of America Investment Narrative Recap

To be a shareholder in Bank of America, you need to believe in its ability to improve operational efficiency, grow earnings through both digital innovation and lending, and close the performance gap with peers. The latest buyback updates support the company’s long-term capital management strategy but do not materially change the biggest short-term catalyst, improved returns on tangible common equity driven by expense control and asset mix shifts. Risks such as ongoing litigation and economic uncertainties remain present but are not directly changed by this news.

Among recent announcements, the completion of an additional 1% share repurchase for US$3,643 million in the past quarter stands out. This capital return reinforces Bank of America's focus on shareholder value and may support its efforts to increase earnings per share, which aligns closely with the company's stated profitability and efficiency goals highlighted at its investor day. But while such buybacks may serve as a catalyst for valuation uplift, they coexist with risks around legal costs and interest rate competition…

Read the full narrative on Bank of America (it's free!)

Bank of America's outlook anticipates $122.0 billion in revenue and $32.9 billion in earnings by 2028. This projection is based on a 7.4% annual revenue growth rate and a $6.3 billion earnings increase from the current $26.6 billion.

Uncover how Bank of America's forecasts yield a $57.98 fair value, a 9% upside to its current price.

Exploring Other Perspectives

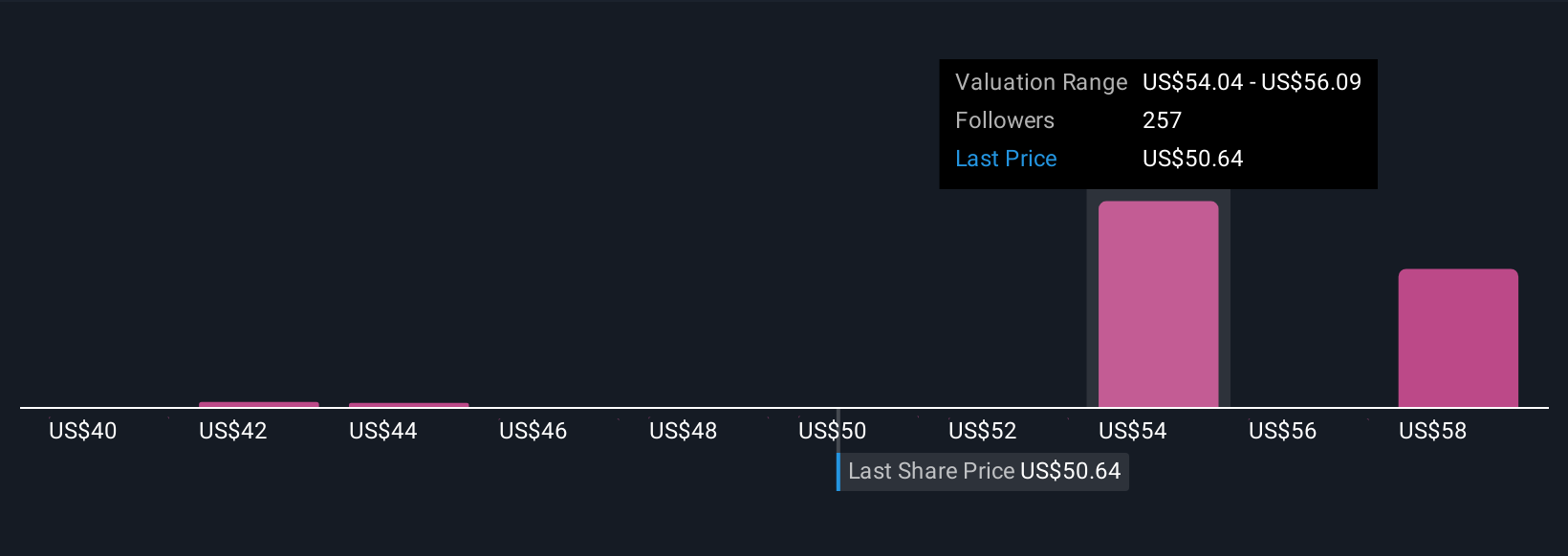

Thirteen members of the Simply Wall St Community estimate Bank of America’s fair value between US$43.34 and US$57.98 per share. While many see upside in the bank’s capital return strategy, legal issues and market volatility continue to loom for future performance, so consider a range of viewpoints as you assess your next steps.

Explore 13 other fair value estimates on Bank of America - why the stock might be worth 19% less than the current price!

Build Your Own Bank of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of America research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Bank of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of America's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives