- United States

- /

- Banks

- /

- NasdaqGS:WAFD

Does WaFd's Strong Lending and Wealth Push Signal a New Growth Phase for WAFD?

Reviewed by Sasha Jovanovic

- WaFd Inc recently reported strong fourth-quarter loan originations of US$1.4 billion, which exceeded repayments for the first time this fiscal year, and announced the launch of WaFd Wealth Management with a target of reaching US$1 billion in assets under management within two years.

- Management also provided an optimistic outlook, citing anticipated growth in its active loan portfolio and the potential for net interest margin expansion in 2026 amid evolving interest rate trends.

- We’ll now look at how WaFd’s recent business expansion and robust lending activities could influence its overall investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is WaFd's Investment Narrative?

For anyone following WaFd, the big picture centers on whether the company’s consistent lending strength, steady dividend growth, and new wealth management push are enough to offset current challenges in profitability and sector headwinds. The recent news of robust loan originations that finally outpaced repayments, combined with the launch of WaFd Wealth Management, could shift near-term momentum, potentially making active lending and fee income important short-term catalysts. However, risks remain, net interest income has recently softened, and while portfolio growth is forecast, the pace may still lag broader market expectations. The fresh focus on wealth management is promising, but its financial impact may take time to materialize. Ultimately, the latest updates reinforce management’s proactive approach, though the effect on the overall investment thesis is likely incremental rather than transformational at this stage.

But with earnings growth still trailing industry trends, there’s a risk some may overlook.

Exploring Other Perspectives

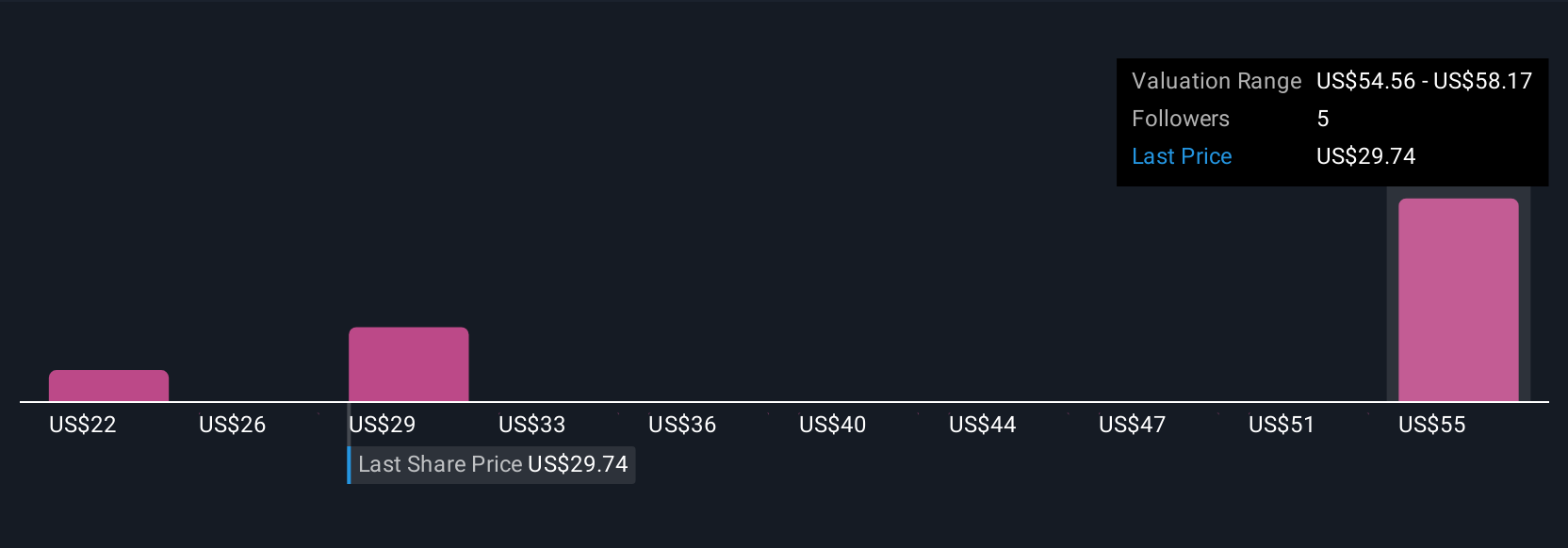

Explore 3 other fair value estimates on WaFd - why the stock might be worth as much as 41% more than the current price!

Build Your Own WaFd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WaFd research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free WaFd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WaFd's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WaFd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAFD

WaFd

Operates as the bank holding company for Washington Federal Bank that provides lending, depository, insurance, and other banking services in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives