- United States

- /

- Banks

- /

- NasdaqGS:TBBK

A Look at The Bancorp's (TBBK) Valuation Following Earnings Update, Buyback Completion, and New CFO Appointment

Reviewed by Simply Wall St

Bancorp (TBBK) shares have captured investor attention following a cluster of company developments this past week. Investors are weighing new forward guidance, third quarter results, a major share buyback, and a fresh CFO appointment.

See our latest analysis for Bancorp.

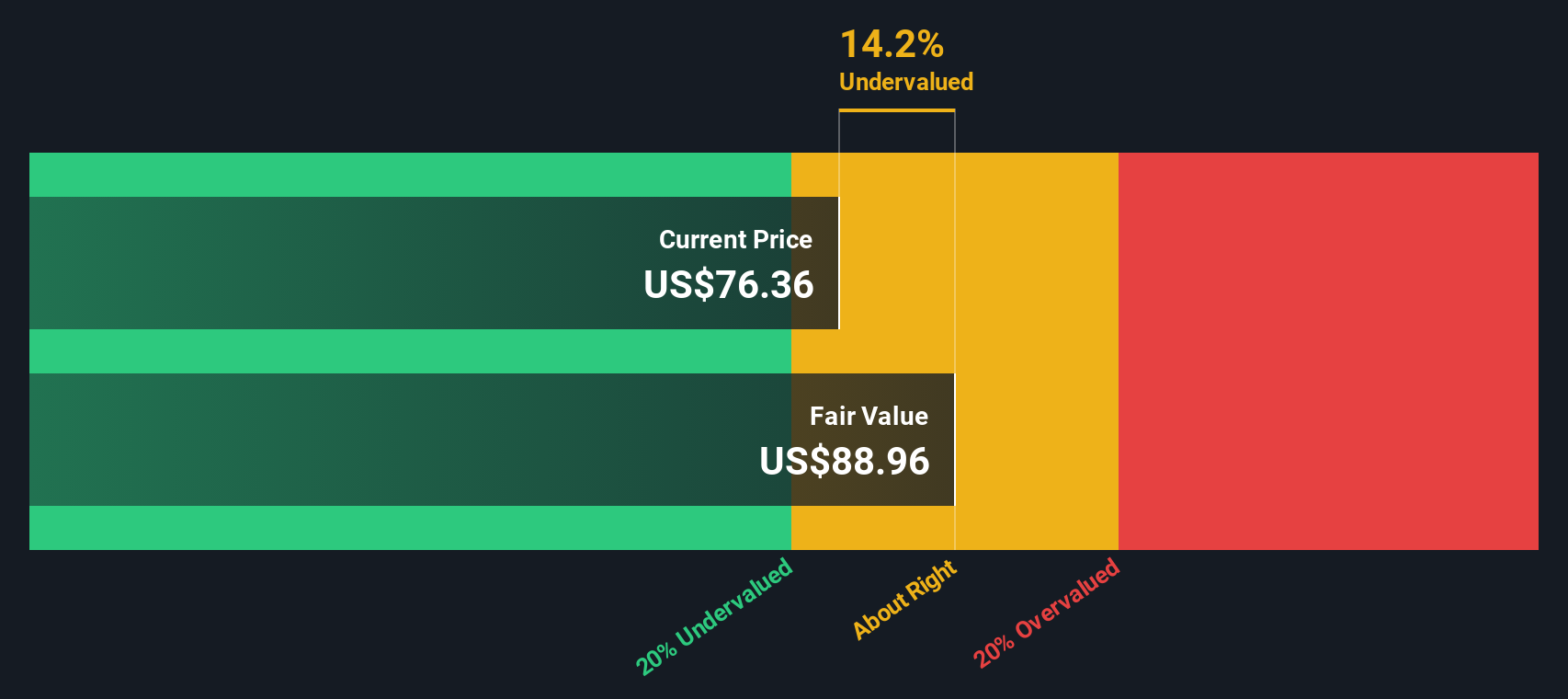

Bancorp’s share price momentum has cooled after peaking earlier in the year, with a 1-day gain of 1.22% not enough to offset a 14.2% decline over the past month. Even so, the stock still boasts a 20.41% year-to-date share price return, and its three-year total shareholder return of 111.27% shows how long-term investors have been well rewarded. Investors appear to be recalibrating growth expectations after a mix of new earnings guidance, a substantial share buyback, and fresh leadership signals some shifting priorities. However, confidence in the broader story remains apparent given those strong multi-year results.

If you’re keen to see which other companies are catching attention thanks to rapid growth and strong insider commitment, here’s your chance to discover fast growing stocks with high insider ownership

With shares now trading at a noticeable discount to analyst targets as management updates its outlook and leadership team, investors are left to ponder whether there is a real buying opportunity here or if future growth is already priced in.

Price-to-Earnings of 12.2x: Is it justified?

At a price-to-earnings (P/E) ratio of 12.2x, Bancorp trades at a premium to the US Banks industry average, raising questions about whether the market is pricing in superior profitability or growth.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of a company's earnings. For banks, it serves as a benchmark for profitability and future expectations. Lower ratios are typically considered value-priced, while higher ratios often reflect expected growth.

While Bancorp's P/E is above the industry average of 11.1x, supporting its strong growth credentials, it still sits below the estimated fair P/E ratio of 13.6x suggested by regression analysis. This implies some room for price appreciation if current earnings momentum holds, especially given the bank's forecasted earnings growth and high quality profits.

Explore the SWS fair ratio for Bancorp

Result: Price-to-Earnings of 12.2x (UNDERVALUED)

However, investors should still watch for declining annual revenue and recent share price volatility. These factors could signal headwinds despite impressive long-term returns.

Find out about the key risks to this Bancorp narrative.

Another View: What Does the SWS DCF Model Indicate?

Looking beyond multiples, the SWS DCF model paints a much more optimistic picture for Bancorp. It estimates fair value at $114.44, which is more than 45% above the current share price. This suggests the market could be seriously undervaluing the company's future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bancorp Narrative

If you’re keen to dive deeper or think a different angle deserves attention, you can craft your own analysis in just minutes. Do it your way

A great starting point for your Bancorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that great opportunities rarely wait around. Use the Simply Wall Street Screener now to find exceptional stocks that could elevate your portfolio to new heights.

- Tap into breakthrough medical technology by checking out these 32 healthcare AI stocks. These companies are redefining modern healthcare and driving innovation forward.

- Earn steady passive income by reviewing these 16 dividend stocks with yields > 3%. This screener features companies with robust yields above 3% and long-term payout reliability.

- Ride the next tech wave by seeing these 25 AI penny stocks. These are poised to benefit most as artificial intelligence reshapes entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBBK

Bancorp

Operates as the financial holding company for The Bancorp Bank, National Association that provides banking products and services in the United States.

Excellent balance sheet and good value.

Market Insights

Community Narratives