- United States

- /

- Banks

- /

- NasdaqGM:QCRH

QCR Holdings (QCRH): Assessing Valuation After Recent Share Price Rally

Reviewed by Simply Wall St

QCR Holdings (QCRH) has delivered steady revenue and net income growth over the past year, drawing attention from investors who are weighing longer-term returns. With annual revenue growing 11% and income up 6%, there is plenty to discuss.

See our latest analysis for QCR Holdings.

After a strong month, QCR Holdings’ share price has climbed over 9% in the last 30 days, revealing renewed interest from investors. While the 1-year total shareholder return still sits at -16.7%, the longer-term trend remains impressive, with total shareholder returns of nearly 50% over 3 years and 103% over 5 years. This indicates building momentum and underlying resilience despite a challenging year.

If you’re interested in broadening your search for potential outperformers, now is a great moment to discover fast growing stocks with high insider ownership

With the share price still trailing its analyst target and a notable discount to estimated intrinsic value, investors may be wondering whether QCR Holdings is undervalued at current levels or if the market is already factoring in the company’s future growth.

Most Popular Narrative: 14.6% Undervalued

The latest narrative suggests QCR Holdings' fair value is set at $89.30, which is notably above the last close price of $76.25. With bulls and skeptics fixated on the mechanics behind this gap, attention now shifts to what is driving these ambitious forecasts.

Ongoing digital transformation, specifically the implementation of a unified, efficient core banking system and new online banking platforms, is anticipated to enhance operational efficiency and reduce noninterest expenses over the next several years, supporting net margin and earnings growth starting 2027.

How are surging revenues, margin shifts, and bold expense bets combining to paint this optimistic scenario? There is a provocative earnings and efficiency equation behind these numbers, but the playbook remains sealed. Hungry for the details driving this bullish narrative? The next move is yours.

Result: Fair Value of $89.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in digital execution or unexpected volatility in key lending segments could quickly test the optimism behind QCR Holdings’ growth outlook.

Find out about the key risks to this QCR Holdings narrative.

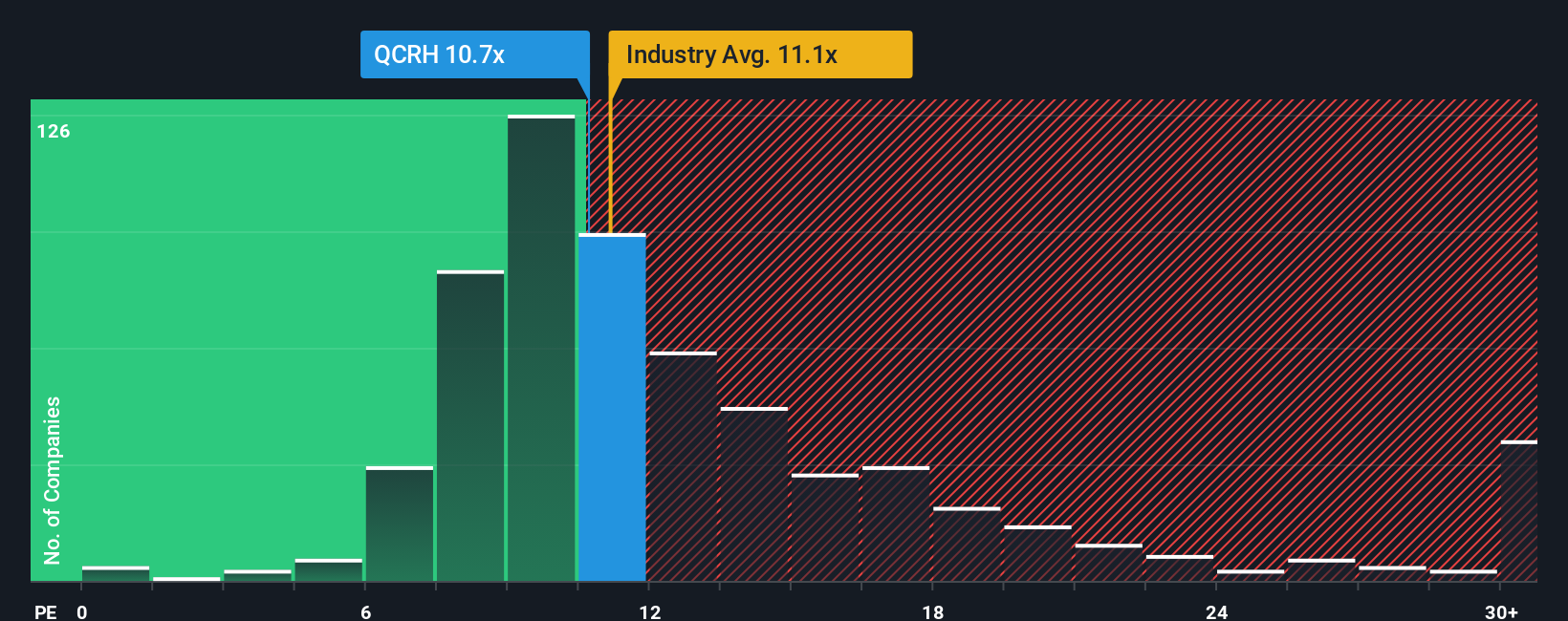

Another View: Market Ratios Tell a Different Story

While the latest fair value estimate flags QCR Holdings as undervalued, looking at the common earnings ratio tells a different tale. The company trades at 10.5 times earnings, which is slightly above both the peer average (9.9x) and its fair ratio (10.3x). This means QCR Holdings is not a deep value outlier on these metrics, and there is a risk market sentiment could shift if growth stalls. Do these competing perspectives muddy the waters or highlight hidden opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QCR Holdings Narrative

If you see things differently, or want to take charge of your own analysis, it's quick and easy to build your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding QCR Holdings.

Looking for More Investment Ideas?

Move beyond the obvious and seize fresh opportunities that others might overlook. Let these handpicked investment themes guide your next smart move. Miss them and you might be a step behind the informed crowd.

- Unlock potential with these 881 undervalued stocks based on cash flows, packed with companies trading below their true worth and poised for upward surprise.

- Cultivate consistent income by checking out these 16 dividend stocks with yields > 3%, a selection of stocks offering strong yields above market averages.

- Tap into cutting-edge innovation by exploring these 25 AI penny stocks, featuring businesses at the forefront of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QCR Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:QCRH

QCR Holdings

A multi-bank holding company, provides commercial and consumer banking, and trust and asset management services.

Flawless balance sheet and fair value.

Market Insights

Community Narratives