- United States

- /

- Banks

- /

- NasdaqGS:MCHB

Mechanics Bancorp (MCHB): One-Time $69.9M Loss Tests Bullish Profit Growth Narratives

Reviewed by Simply Wall St

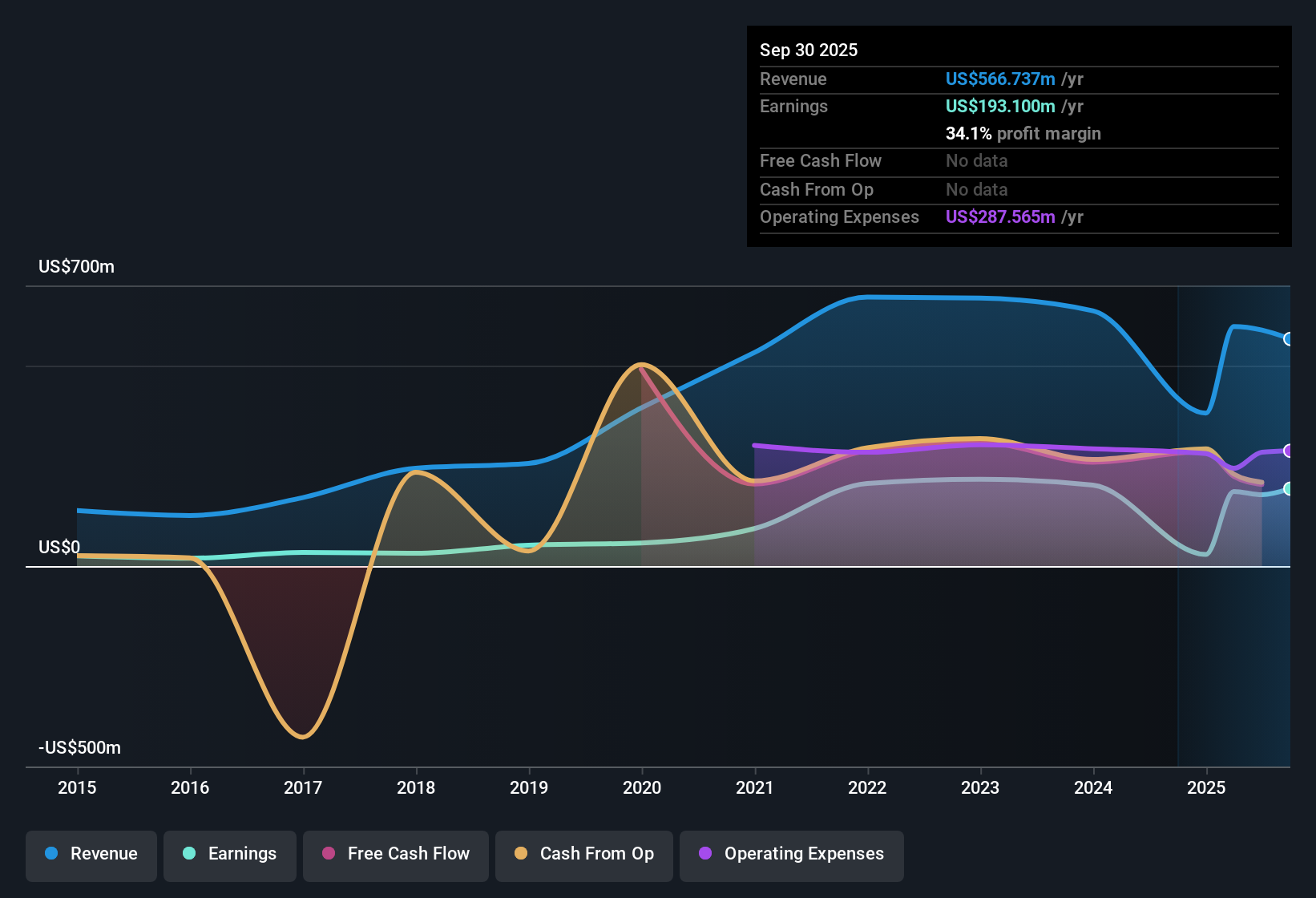

Mechanics Bancorp (MCHB) reported standout earnings growth over the past year, with net profit margins climbing to 29.4% from last year’s 16.3%, and recent earnings up 166.5%, well above its five-year average of 1.1% per year. Revenue is forecast to rise 16.3% per year and earnings are expected to grow 26.5% annually, both outpacing the broader US market’s projections. With a price-to-earnings ratio of 15.3x and a current share price of $13.39, the stock trades below its estimated fair value. However, investors are weighing the impact of a recent non-recurring $69.9 million loss, which affected reported earnings, against strong growth prospects and profitability improvements.

See our full analysis for Mechanics Bancorp.Next, we’ll see how the company’s latest results compare with the dominant narratives shaping investor sentiment. Some themes might be confirmed, while others could be in for a challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Surge to 29.4% Despite One-Time Charge

- Net profit margin improved to 29.4%, a significant step up from last year’s 16.3%, even after factoring in a one-time $69.9 million loss that otherwise reduced reported earnings quality.

- What stands out is how the bank’s underlying profitability momentum continues to impress. Revenue growth and rising margins heavily support the view that Mechanics Bancorp is outpacing broader industry trends.

- Reported earnings growth reached 166.5% year-on-year, outstripping the five-year average of 1.1% and spotlighting better-than-expected operational leverage.

- This pace of improvement directly counters any bearish concerns about the recent charge derailing profitability going forward.

Growth Forecasts Outpace National Banking Sector

- Earnings are projected to rise 26.5% per year, well above the US market’s 15.9% annual estimate. Revenue is also forecast to climb 16.3% compared to the broader market’s 10.3% pace.

- It is notable that banks with this kind of growth outlook often command premium valuations. Mechanics Bancorp trades below its estimated DCF fair value of $14.56.

- The gap between robust growth trends and affordable valuation creates a favorable backdrop for investors focused on long-term compounding.

- While the one-off loss tempers headline earnings, the trend in forward-looking growth guidance reinforces the positive outlook.

Valuation Sits Below DCF Fair Value and Peer Average

- The stock trades at $13.39 per share, below both its DCF fair value of $14.56 and the peer group’s price-to-earnings ratio average of 17.7x, even as Mechanics Bancorp runs ahead of the US banks’ 11.2x industry norm.

- This positioning supports the argument that market pricing has yet to fully account for forecasted growth and improved margins, offering an attractive entry point relative to both industry peers and modeled intrinsic value.

- The current valuation, especially against a backdrop of solid profit and revenue trajectories, bolsters the view that long-term investors might expect re-rating potential if growth materializes as projected.

- This creates an interesting tension between near-term earnings quality concerns and the strong discount to fair value.

Have a read of the narrative in full and understand what's behind the forecasts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Mechanics Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Though Mechanics Bancorp’s growth is promising, the one-off charge and recent volatility in earnings highlight concerns about the consistency and quality of its reported profits.

If you’re seeking steadier profit trends and more predictable business performance, target companies from stable growth stocks screener (2100 results) to gain confidence in their proven ability to deliver reliable results across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHB

Mechanics Bancorp

Operates as the holding company for Mechanics Bank that provides banking services in California, Oregon, Washington, and Hawaii.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives