- United States

- /

- Banks

- /

- NasdaqGS:HAFC

Hanmi Financial Corporation Just Beat Earnings Expectations: Here's What Analysts Think Will Happen Next

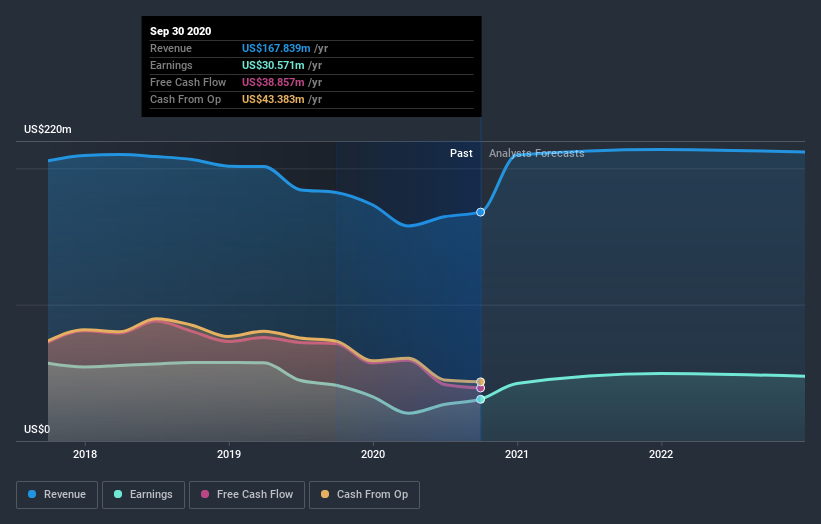

It's been a pretty great week for Hanmi Financial Corporation (NASDAQ:HAFC) shareholders, with its shares surging 14% to US$14.08 in the week since its latest full-year results. It looks to have been a bit of a mixed result. While revenues of US$168m fell 20% short of what the analysts had predicted, statutory earnings per share (EPS) of US$1.38 exceeded expectations by 7.6%. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Hanmi Financial

Following the latest results, Hanmi Financial's four analysts are now forecasting revenues of US$213.8m in 2021. This would be a sizeable 27% improvement in sales compared to the last 12 months. Per-share earnings are expected to expand 16% to US$1.62. Before this earnings report, the analysts had been forecasting revenues of US$210.1m and earnings per share (EPS) of US$1.03 in 2021. There was no real change to the revenue estimates, but the analysts do seem more bullish on earnings, given the considerable lift to earnings per share expectations following these results.

The analysts have been lifting their price targets on the back of the earnings upgrade, with the consensus price target rising 19% to US$14.50. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Hanmi Financial at US$17.00 per share, while the most bearish prices it at US$12.00. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Of course, another way to look at these forecasts is to place them into context against the industry itself. For example, we noticed that Hanmi Financial's rate of growth is expected to accelerate meaningfully, with revenues forecast to grow 27%, well above its historical decline of 4.4% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 6.3% per year. So it looks like Hanmi Financial is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Hanmi Financial's earnings potential next year. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Hanmi Financial going out to 2022, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 2 warning signs for Hanmi Financial that you need to be mindful of.

When trading Hanmi Financial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hanmi Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:HAFC

Hanmi Financial

Operates as the holding company for Hanmi Bank that provides business banking products and services in the United States.

Flawless balance sheet, undervalued and pays a dividend.