- United States

- /

- Banks

- /

- NasdaqGS:BOKF

Is BOK Financial's (BOKF) $400 Million Capital Raise Shifting Its Long-Term Risk and Earnings Profile?

Reviewed by Sasha Jovanovic

- BOK Financial Corporation recently announced a US$0.6300 per share quarterly dividend, payable on November 26, 2025, with an ex-date and record date of November 12, 2025.

- In addition, BOKF, NA has completed a US$400 million subordinated notes offering to boost its Tier II regulatory capital and fund general corporate purposes.

- We'll examine how BOK Financial’s US$400 million capital raise could influence its risk profile and longer-term earnings outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

BOK Financial Investment Narrative Recap

To be a shareholder in BOK Financial, you need to believe in its ability to balance loan growth in core markets with prudent risk management, especially as it raises capital and expands lending initiatives. The recent US$400 million subordinated notes offering strengthens the bank’s capital base but does not materially change the primary short-term catalyst: continued loan growth in the Midwest and Sun Belt markets. However, elevated credit risk from commercial real estate and energy loan concentrations remains the biggest risk. Of the recent announcements, the increase and reaffirmation of the quarterly dividend to US$0.6300 per share is most relevant, reflecting confidence in BOK Financial’s earnings stability and ongoing capital returns. While stable dividends and improving net interest income may assuage some concerns, the potential fallout from sector-specific downturns in commercial real estate warrants close attention, especially as the company’s regional focus magnifies these risks. Yet, investors should be aware that despite bolstering capital, concentration risks in specific loan portfolios still loom large and…

Read the full narrative on BOK Financial (it's free!)

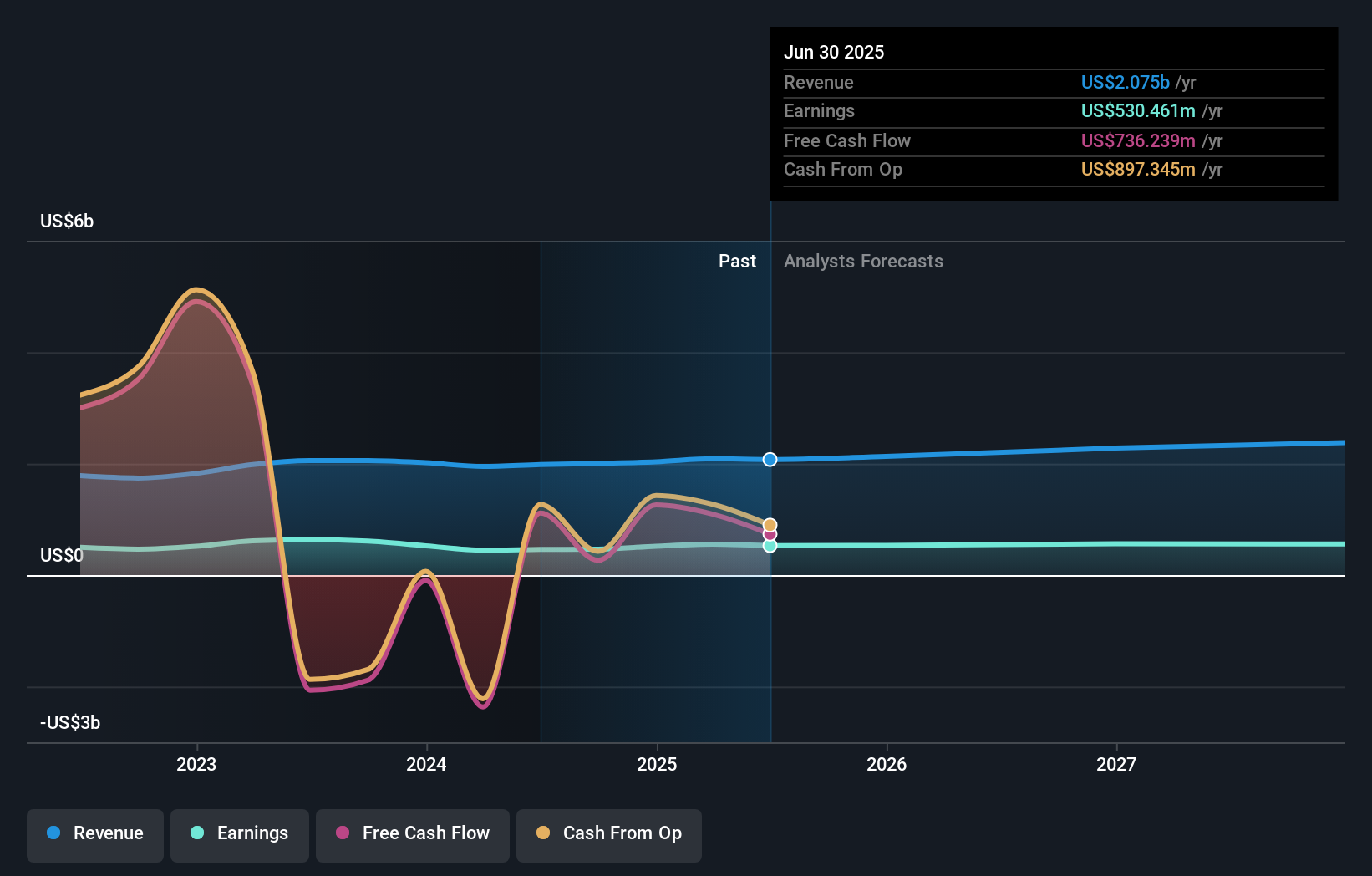

BOK Financial's narrative projects $2.5 billion in revenue and $579.1 million in earnings by 2028. This requires 5.9% yearly revenue growth and a $48.6 million earnings increase from current earnings of $530.5 million.

Uncover how BOK Financial's forecasts yield a $118.70 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate of US$120.33 has been submitted to the Simply Wall St Community so far, highlighting limited diversity in opinion. Despite this consensus, continued loan growth in core regions remains vital for supporting future earnings and addressing concerns tied to economic or sector downturns.

Explore another fair value estimate on BOK Financial - why the stock might be worth just $120.33!

Build Your Own BOK Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BOK Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free BOK Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BOK Financial's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOK Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BOKF

BOK Financial

Operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives