- United States

- /

- Auto Components

- /

- NYSE:SRI

There's Reason For Concern Over Stoneridge, Inc.'s (NYSE:SRI) Massive 36% Price Jump

Stoneridge, Inc. (NYSE:SRI) shares have continued their recent momentum with a 36% gain in the last month alone. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 50% share price drop in the last twelve months.

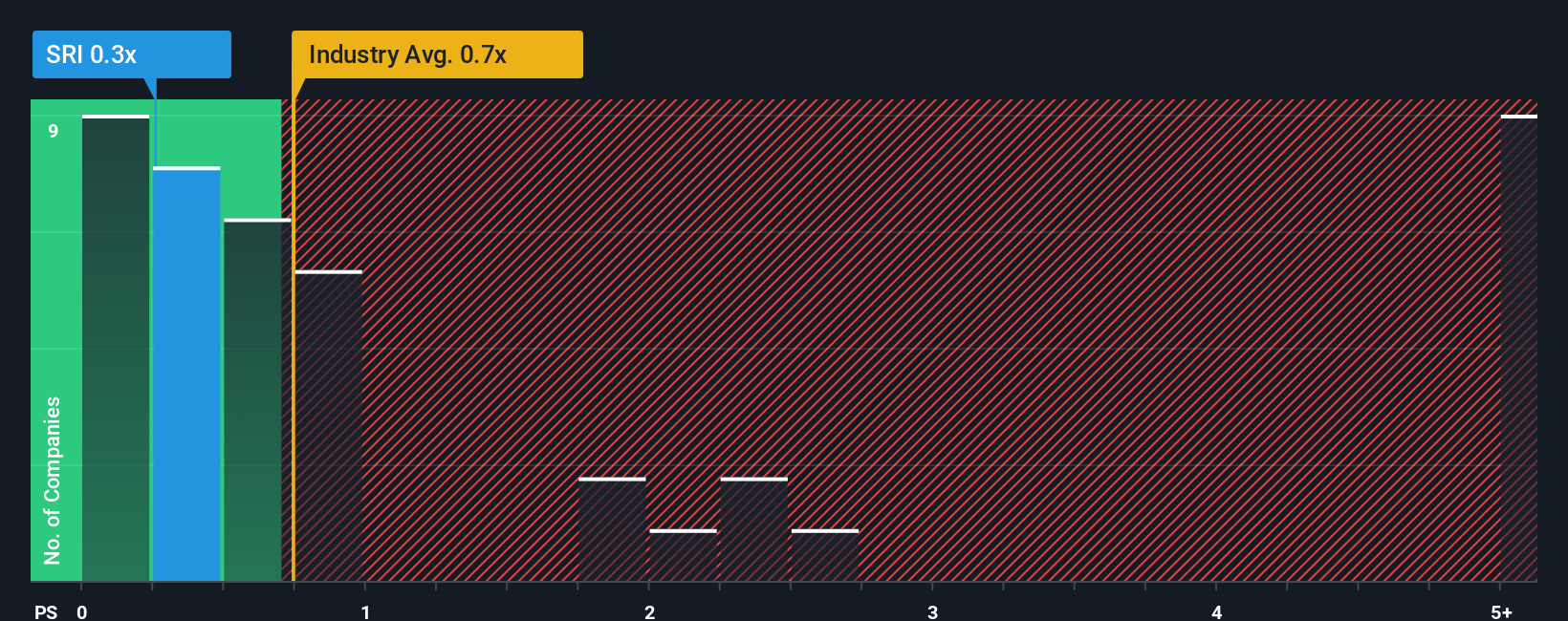

Although its price has surged higher, it's still not a stretch to say that Stoneridge's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Auto Components industry in the United States, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Stoneridge

What Does Stoneridge's Recent Performance Look Like?

Stoneridge could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Stoneridge will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Stoneridge?

In order to justify its P/S ratio, Stoneridge would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.9%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 1.0% during the coming year according to the dual analysts following the company. That's shaping up to be materially lower than the 9.9% growth forecast for the broader industry.

With this in mind, we find it intriguing that Stoneridge's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Stoneridge appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Stoneridge's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Stoneridge that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SRI

Stoneridge

Designs and manufactures engineered electrical and electronic systems, components, and modules for the automotive, commercial, off-highway, and agricultural vehicle markets in North America, South America, Europe, Mexico, China, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives