- United States

- /

- Auto Components

- /

- NYSE:APTV

The Bull Case For Aptiv (APTV) Could Change Following Raised Guidance After Major Goodwill Impairment

Reviewed by Sasha Jovanovic

- Aptiv PLC recently reported its third quarter 2025 earnings, posting sales of US$5.21 billion but recording a net loss of US$355 million, largely impacted by a goodwill impairment charge of US$648 million.

- Despite these mixed results, the company raised its full-year guidance and highlighted its plans for a software business spin-off, which has attracted positive attention from analysts and investors seeking future growth drivers.

- We'll look at how Aptiv's decision to raise its full-year outlook, even after a goodwill impairment, influences its investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Aptiv Investment Narrative Recap

For investors to stay confident in Aptiv, they need to believe in the company's ability to convert global trends such as vehicle electrification and advanced driver-assistance into sustainable growth, while managing operational and market headwinds. The recent Q3 loss, driven by a US$648 million goodwill impairment, raises near-term questions, but Aptiv's raised full-year guidance suggests its core growth catalysts remain intact; the most important short-term catalyst, the upcoming software spin-off, still appears on track, while macroeconomic uncertainty continues to be the main risk.

Among recent developments, Aptiv's confirmation and upward revision of its 2025 full-year guidance stands out. This announcement provides a level of reassurance to investors amid the one-off impairment, reinforcing the company’s continuing focus on strengthening its operations and pursuing value creation through portfolio changes like the planned software business spin-off.

In contrast, one area investors should pay close attention to is the ongoing exposure to volatile foreign exchange and commodity prices, as this can suddenly shift Aptiv’s margin outlook and...

Read the full narrative on Aptiv (it's free!)

Aptiv is projected to reach $23.3 billion in revenue and $1.9 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 5.5% and an increase in earnings of $0.9 billion from the current $1.0 billion.

Uncover how Aptiv's forecasts yield a $95.53 fair value, a 16% upside to its current price.

Exploring Other Perspectives

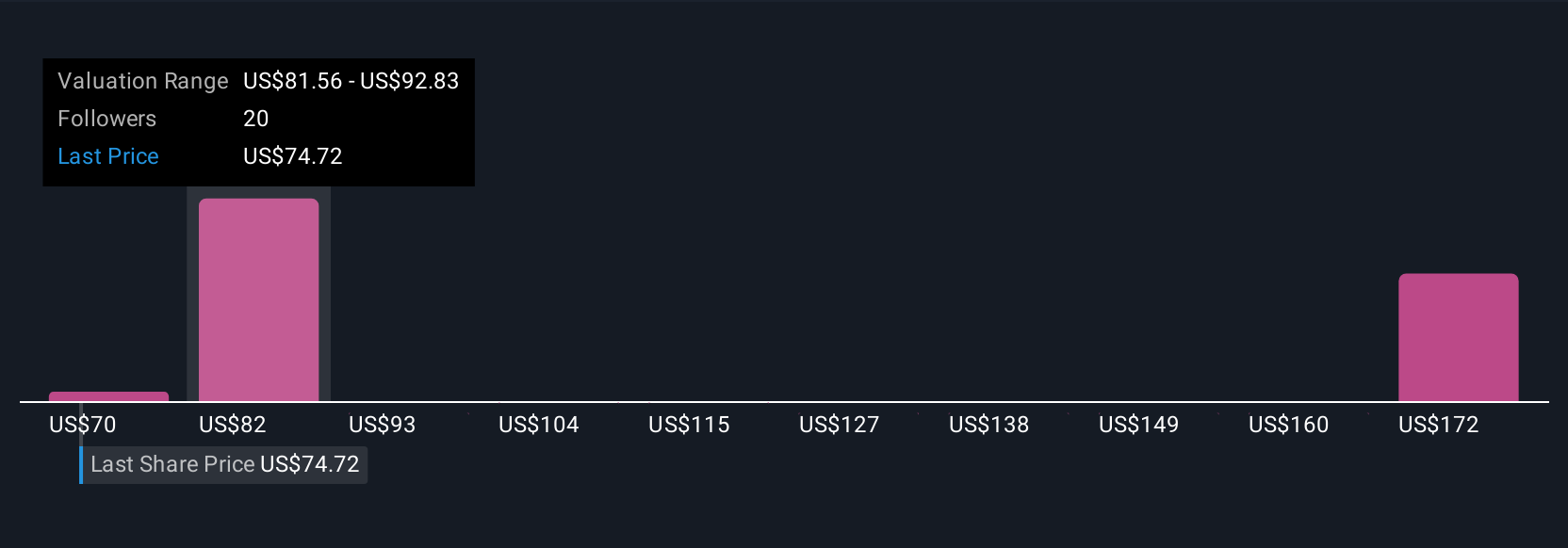

Six community-sourced fair value estimates for Aptiv range from US$70.29 to US$158.93. With such varied Simply Wall St Community opinions, it is clear that optimism around the software business spin-off is only part of the story.

Explore 6 other fair value estimates on Aptiv - why the stock might be worth as much as 94% more than the current price!

Build Your Own Aptiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aptiv research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aptiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aptiv's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APTV

Aptiv

Engages in design, manufacture, and sale of vehicle components for the automotive and commercial vehicle markets in North America, Europe, the Middle East, Africa, the Asia Pacific, South America, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives