- United States

- /

- Auto Components

- /

- NasdaqGS:SLDP

Why Solid Power (SLDP) Is Up 9.2% After Teaming With BMW and Samsung SDI on Demo Car

Reviewed by Sasha Jovanovic

- Solid Power, Inc. recently announced a collaboration with Samsung SDI and BMW to develop and validate an all-solid-state battery-powered demonstration vehicle, leveraging the company's sulfide-based solid electrolyte and expertise from major automotive partners.

- This partnership stands out as a key milestone in Solid Power’s push toward commercializing solid-state battery technology, offering greater integration into the automotive supply chain and enhanced validation for its core product.

- We'll explore how Solid Power's alliance with BMW and Samsung SDI could shape its prospects for growth and commercial adoption.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Solid Power Investment Narrative Recap

To be a shareholder in Solid Power, an investor needs confidence that its partnerships with major automakers like BMW and Samsung SDI will turn technical milestones into widespread market adoption of solid-state battery technology. The recent collaboration advances industry validation, but does not eliminate the biggest short-term catalyst, successful integration into a demonstration vehicle, while ongoing operating losses remain an unresolved risk.

The Samsung SDI and BMW alliance is particularly relevant, as it brings Solid Power closer to real-world automotive testing, a key step for future commercial contracts and broader market credibility. Concrete progress here could be pivotal to shifting the narrative from technical promise to commercial opportunity.

But with growing optimism comes a contrast investors should not ignore: ongoing financial losses and capital requirements are still...

Read the full narrative on Solid Power (it's free!)

Solid Power's narrative projects $33.2 million in revenue and $1.6 million in earnings by 2028. This requires 13.5% yearly revenue growth and a $95.1 million earnings increase from current earnings of -$93.5 million.

Uncover how Solid Power's forecasts yield a $4.00 fair value, a 42% downside to its current price.

Exploring Other Perspectives

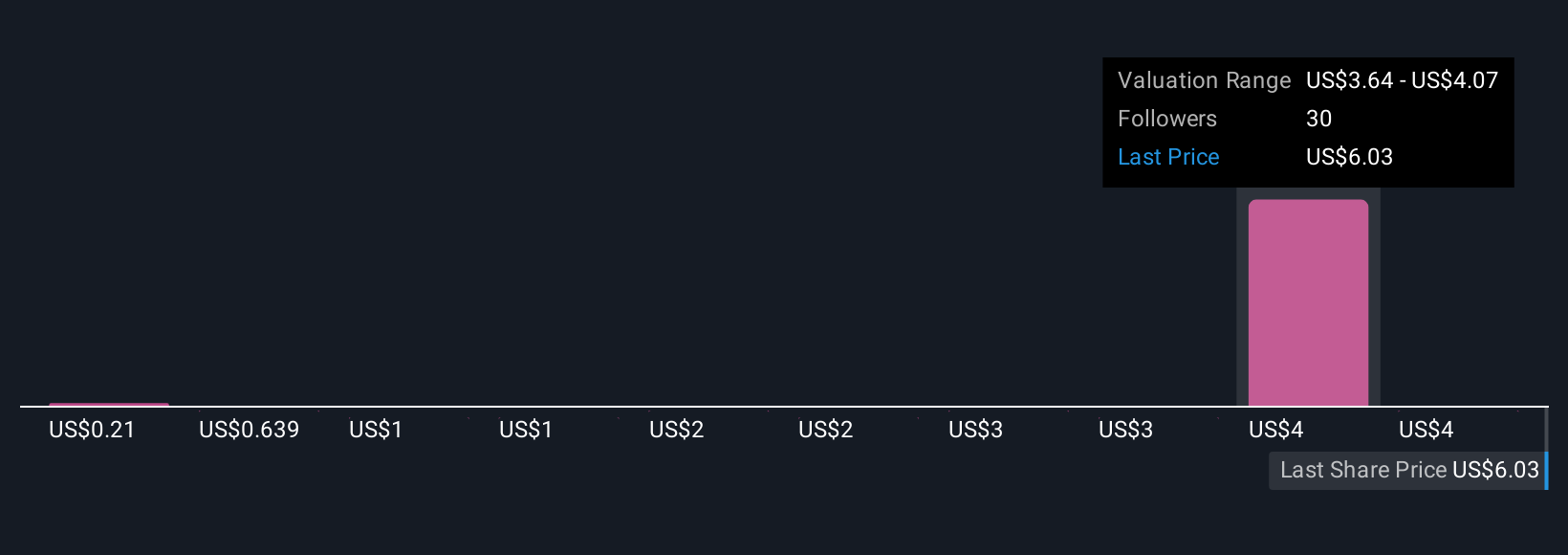

Simply Wall St Community members provided six fair value estimates for Solid Power, ranging from US$0.21 to US$4.50 per share. While views vary widely, many are watching for whether critical partnerships will translate to long-term revenue growth and offset persistent losses.

Explore 6 other fair value estimates on Solid Power - why the stock might be worth less than half the current price!

Build Your Own Solid Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solid Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Solid Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solid Power's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLDP

Solid Power

Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives