- United States

- /

- Auto Components

- /

- NasdaqGS:PATK

Patrick Industries (PATK): Are Shares Fairly Valued After Recent Gains?

Reviewed by Simply Wall St

See our latest analysis for Patrick Industries.

Patrick Industries’ steady move higher has fueled momentum among investors, with today's 3.5% bump adding to a strong year-to-date share price return of 27%. The stock’s long-term credentials really stand out as the total shareholder return clocks in at 37.5% over the past year and an impressive 260% over three years. With recent gains building on an already robust track record, the market seems increasingly optimistic about the company’s growth prospects and underlying value.

If you’re interested in expanding your search, now might be the perfect moment to discover See the full list for free.

But with shares trading just 5% below analyst price targets and boasting strong recent gains, the real question is whether Patrick Industries is still undervalued or if future growth is already fully reflected in the stock price.

Most Popular Narrative: Fairly Valued

With Patrick Industries' last close at $104.37 and the most popular narrative suggesting a fair value of $108, the stock’s current pricing aligns closely with these analyst-led growth assumptions. This tight alignment should catch investors' attention because it signals a notable consensus on what the future holds for the company.

*Strategic investments in automation, advanced manufacturing processes, and full-solution models (for example, greater integration of technology and materials across business units) are expected to yield operational efficiencies and scale benefits, supporting gross margin improvement and higher earnings over time.*

Want to know what financial levers push this stock to its current price? The secret lies in projected profit leaps and a bold new earnings multiple you might not expect. Uncover the surprising, analyst-backed numbers fueling this fair value call.

Result: Fair Value of $108 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as Patrick Industries’ growth is tied to cyclical end markets and inflationary pressures that could impact margins and demand.

Find out about the key risks to this Patrick Industries narrative.

Another View: Multiples Tell a Different Story

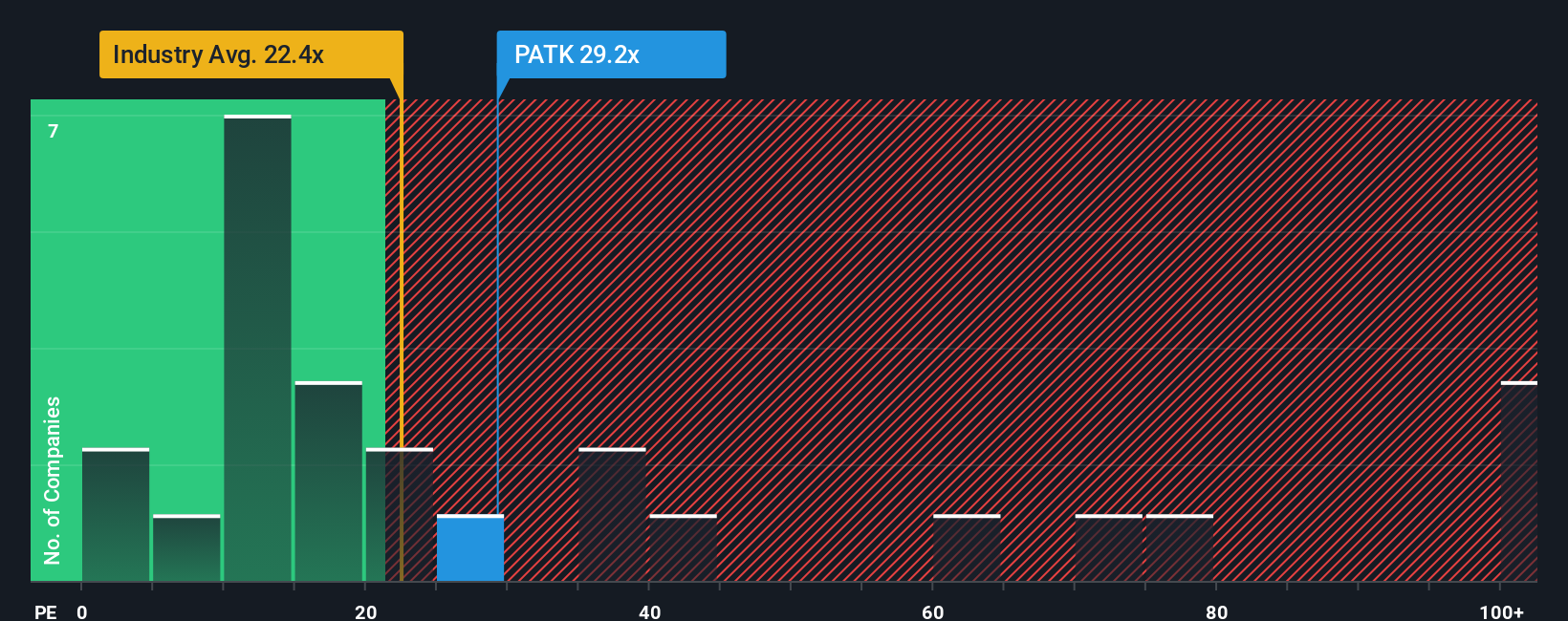

While analysts argue Patrick Industries is fairly valued based on growth assumptions, comparing its current price-to-earnings ratio of 28.8x with industry peers averaging 17.9x and a fair ratio of 18.2x reveals the stock looks richly priced. This wide gap suggests valuation risk if expectations are not met. Could the market be overestimating future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Patrick Industries Narrative

If you see the story differently or want to dig deeper into the numbers yourself, you can easily craft your own narrative in just a few minutes, and Do it your way.

A great starting point for your Patrick Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Stay ahead of the curve. Your next winning idea could be just a click away. Let Simply Wall Street’s unique tools uncover what others might be missing.

- Capture strong income streams and track record as you review these 22 dividend stocks with yields > 3% with yields above 3%.

- Pounce early on innovation trends by checking out these 26 AI penny stocks gaining momentum in artificial intelligence breakthroughs.

- Supercharge your value hunt and seek out tomorrow’s top performers within these 840 undervalued stocks based on cash flows powered by robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PATK

Patrick Industries

Manufactures and distributes component products and materials for the recreational vehicle, marine, powersports, manufactured housing, and industrial markets in the United States, Mexico, China, and Canada.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives