- United States

- /

- Auto Components

- /

- NasdaqGS:HSAI

Hesai Group (NasdaqGS:HSAI): Exploring Valuation After Recent Share Price Uptick

Reviewed by Simply Wall St

See our latest analysis for Hesai Group.

After a modest dip earlier in the week, Hesai Group’s 1-day share price return surged to 9.39% on Friday. Its year-to-date rally now stands at an impressive 42.96%. That momentum has helped power a 411% total shareholder return over the past year, hinting at a market that is waking up to the company’s growth potential and improved sentiment around its future.

If you’re interested in spotting the next wave of auto technology leaders, it’s a great moment to check out the opportunities in our See the full list for free..

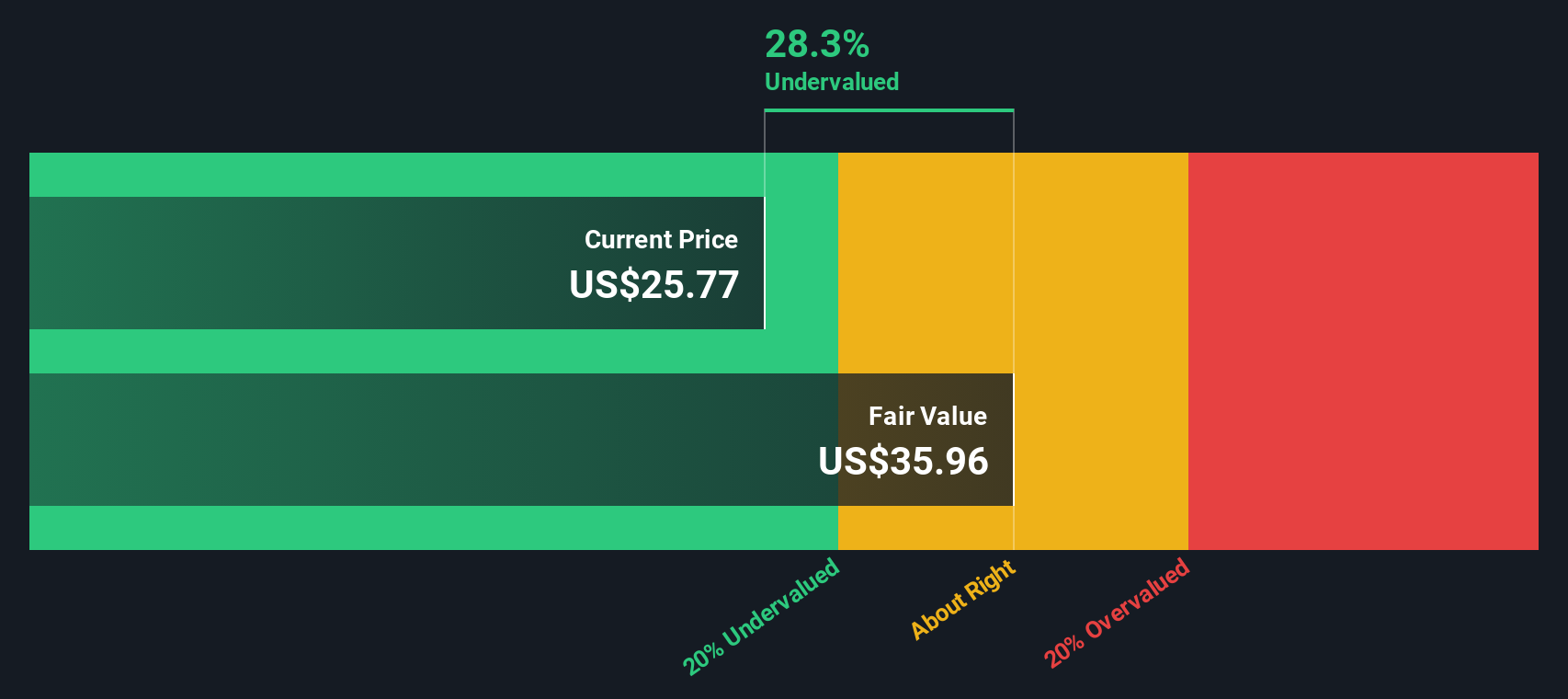

With Hesai’s shares trading below analyst targets and growth numbers outpacing market expectations, the question remains: Are investors overlooking a real bargain, or is the market already baking future gains into today’s price?

Most Popular Narrative: 24.2% Undervalued

At $23.06, Hesai Group’s latest close remains well below the most-followed narrative’s fair value estimate, suggesting that sentiment is running ahead of price momentum. This setup highlights some key bullish assumptions that may be influencing analyst targets and investor outlook.

Expanding global presence and design wins, including with a top European OEM, could significantly diversify and boost revenue streams. Increasing LiDAR adoption in EVs and robotics could enhance market share and revenue growth, driven by anticipated shifts in demand dynamics.

Want to know why analysts are betting on multi-year revenue acceleration and surging profit margins? The secret sauce is a growth forecast combined with game-changing industry trends and ambitious financial targets. Curious about the assumptions fueling this valuation jump? Dive into the narrative to uncover the numbers and story that drive this compelling outlook.

Result: Fair Value of $30.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks in global expansion and heavy reliance on a few major clients could present challenges to Hesai Group’s ambitious growth projections.

Find out about the key risks to this Hesai Group narrative.

Another View: SWS DCF Model Signals Overvaluation

Taking a different approach, our DCF model estimates Hesai Group's fair value at just $12.80, which is significantly below the recent market price of $23.06. This result suggests the stock might be overvalued based on underlying cash flows, rather than industry optimism or revenue multiples. Which outlook will prove more realistic as market trends evolve?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hesai Group Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft your own take on Hesai Group’s story in just a few minutes. Do it your way

A great starting point for your Hesai Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment opportunities?

Don’t stop at Hesai Group. The smartest investors stay ahead by acting fast on opportunities others overlook. Feel confident taking your next step and find your advantage with these handpicked ideas:

- Unlock the potential of future tech by checking out these 28 quantum computing stocks, making waves in next-generation computing and innovation.

- Capture value with these 874 undervalued stocks based on cash flows that the market may have missed but still boast strong fundamentals and promising outlooks.

- Boost your portfolio’s income with these 16 dividend stocks with yields > 3%, consistently offering yields above 3% and a track record of solid payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hesai Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSAI

Hesai Group

Through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR) in Mainland China, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives