- Taiwan

- /

- Gas Utilities

- /

- TWSE:9908

January 2025's Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate choppy waters marked by inflation concerns and political uncertainties, investors are keenly observing the impact on equities, with small-cap stocks underperforming and value stocks showing relative resilience. Amid this backdrop, dividend stocks emerge as an attractive option for those seeking stability and income, offering potential benefits in uncertain times through regular payouts that can cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.31% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.80% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

Click here to see the full list of 2016 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

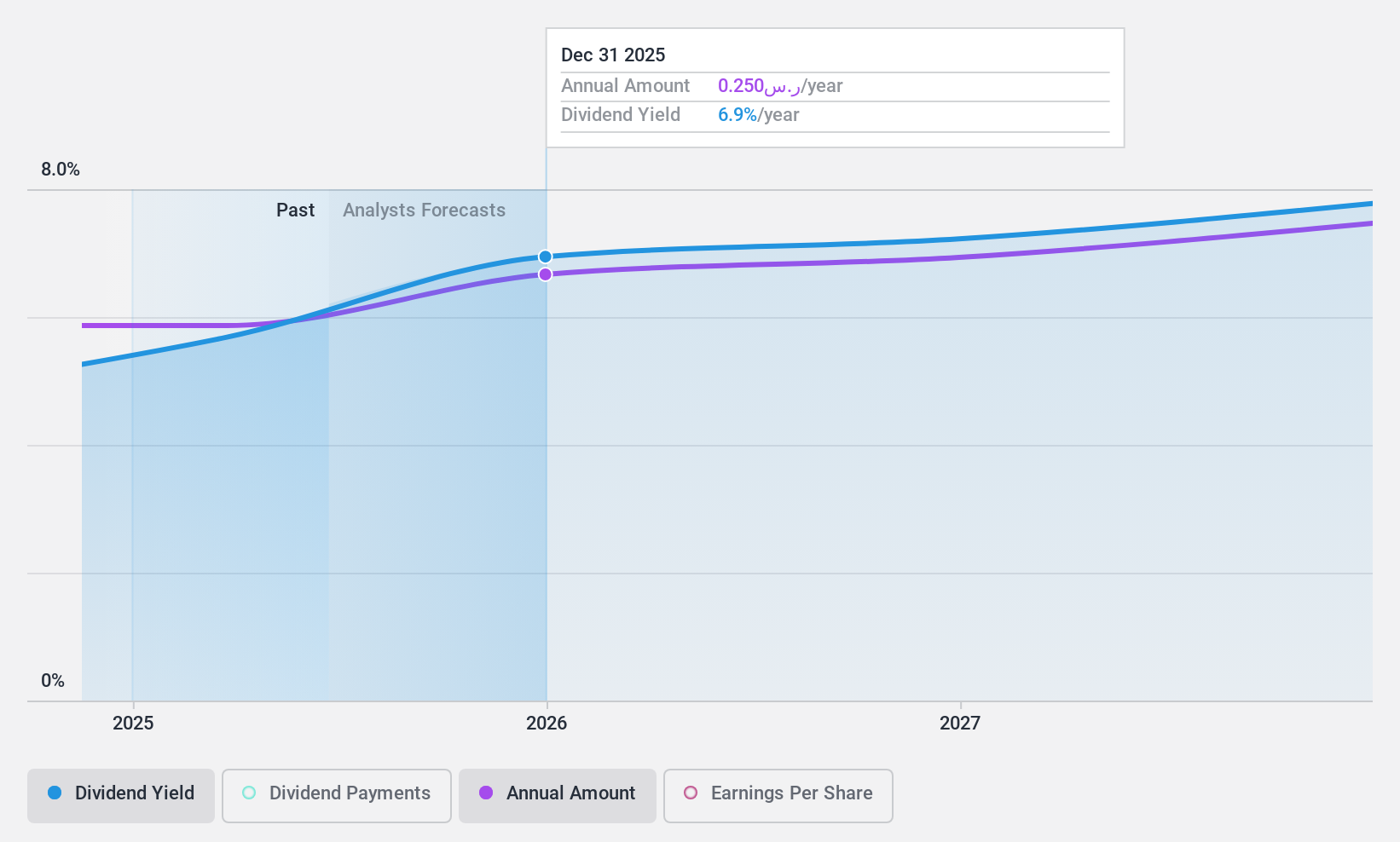

Fourth Milling (SASE:2286)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fourth Milling Company operates in the Kingdom of Saudi Arabia, focusing on the production, packaging, and sale of flour, its byproducts, animal feed, and bran products with a market cap of SAR2.15 billion.

Operations: Fourth Milling Company's revenue is primarily derived from its food processing segment, which amounts to SAR617.23 million.

Dividend Yield: 5.5%

Fourth Milling's dividends are well covered by earnings and cash flows, with payout ratios of 31.8% and 46.4%, respectively, suggesting sustainability. The dividend yield of 5.56% places it in the top quartile of South African market payers, though it's too early to assess reliability or growth trends as they have only recently begun distributions. Trading at a significant discount to estimated fair value, Fourth Milling may present a value opportunity for dividend investors.

- Click to explore a detailed breakdown of our findings in Fourth Milling's dividend report.

- Our valuation report unveils the possibility Fourth Milling's shares may be trading at a discount.

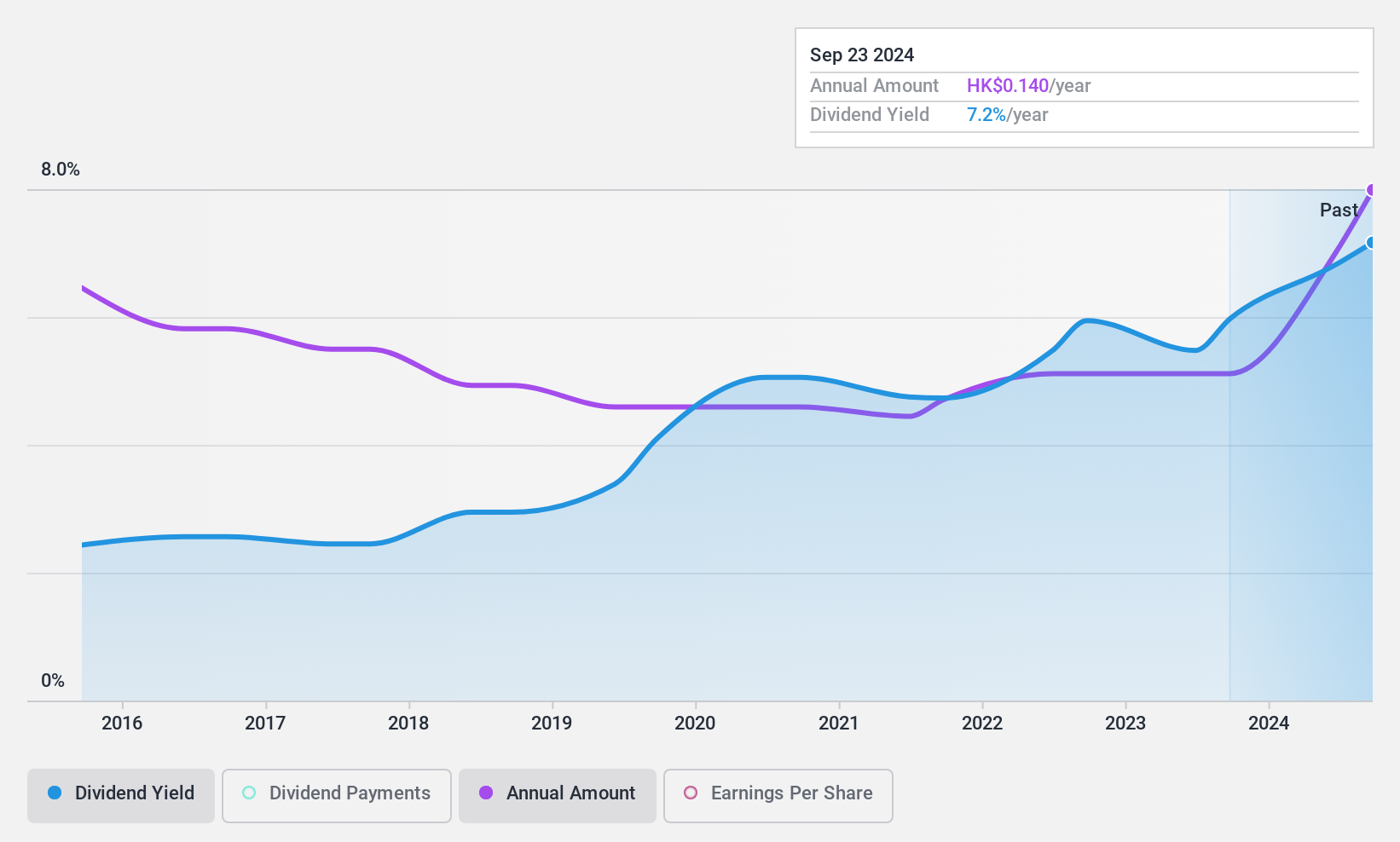

Tianjin Development Holdings (SEHK:882)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tianjin Development Holdings Limited, with a market cap of HK$2.10 billion, operates through its subsidiaries to supply water, heat, thermal power, and electricity to industrial, commercial, and residential customers in the Tianjin Economic and Technological Development Area in China.

Operations: Tianjin Development Holdings Limited generates revenue through its segments: Utilities (HK$1.51 billion), Pharmaceutical (HK$1.50 billion), Electrical and Mechanical (HK$176.09 million), and Hotel (HK$136.51 million).

Dividend Yield: 7.1%

Tianjin Development Holdings offers a stable dividend yield of 7.13%, with payouts well covered by earnings and cash flows, maintaining a payout ratio of 27.2% and a cash payout ratio of 72.6%. The company has consistently grown its dividends over the past decade without volatility, indicating reliability. Recent executive changes could influence strategic direction, while new debt financing arrangements underscore strong government backing, ensuring financial stability for continued dividend payments.

- Click here to discover the nuances of Tianjin Development Holdings with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Tianjin Development Holdings is priced lower than what may be justified by its financials.

Great Taipei Gas (TWSE:9908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Great Taipei Gas Corporation, along with its subsidiaries, supplies natural gas in Taiwan and has a market cap of NT$15.15 billion.

Operations: The Great Taipei Gas Corporation generates revenue primarily from Gas Sales (NT$2.34 billion), Installation services (NT$718.87 million), Investment activities (NT$155.86 million), and the Telecommunication Sector (NT$76.68 million).

Dividend Yield: 4%

Great Taipei Gas offers a dividend yield of 3.97%, which is lower than the top 25% in the Taiwan market. Despite a reasonable payout ratio of 61.1%, dividends are not well covered by free cash flows, with a high cash payout ratio of 92.8%. Earnings have decreased, impacting profitability, yet dividends have grown steadily over the past decade with minimal volatility, suggesting reliability amidst financial challenges.

- Dive into the specifics of Great Taipei Gas here with our thorough dividend report.

- Our expertly prepared valuation report Great Taipei Gas implies its share price may be too high.

Make It Happen

- Navigate through the entire inventory of 2016 Top Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9908

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives