- Taiwan

- /

- Marine and Shipping

- /

- TWSE:2615

Wan Hai Lines Ltd. (TWSE:2615) stock most popular amongst retail investors who own 45%, while private companies hold 43%

Key Insights

- Wan Hai Lines' significant retail investors ownership suggests that the key decisions are influenced by shareholders from the larger public

- The top 12 shareholders own 51% of the company

- Using data from analyst forecasts alongside ownership research, one can better assess the future performance of a company

To get a sense of who is truly in control of Wan Hai Lines Ltd. (TWSE:2615), it is important to understand the ownership structure of the business. We can see that retail investors own the lion's share in the company with 45% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Private companies, on the other hand, account for 43% of the company's stockholders.

Let's take a closer look to see what the different types of shareholders can tell us about Wan Hai Lines.

Check out our latest analysis for Wan Hai Lines

What Does The Institutional Ownership Tell Us About Wan Hai Lines?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

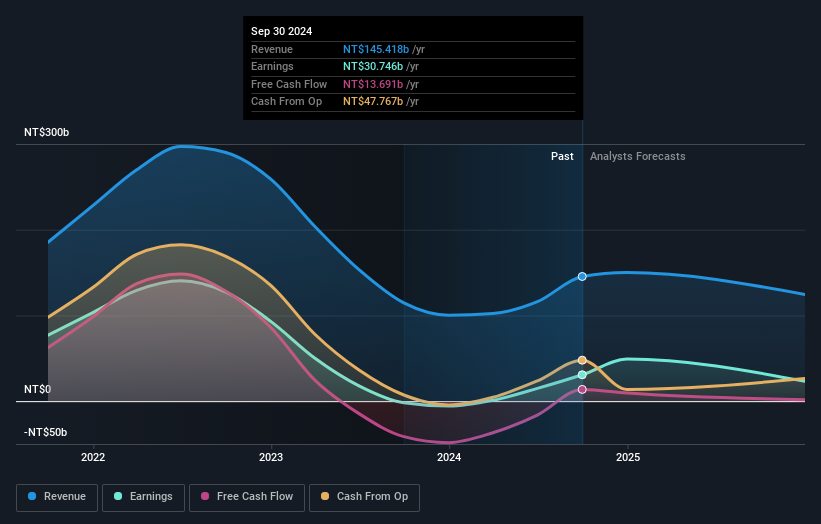

We can see that Wan Hai Lines does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Wan Hai Lines' earnings history below. Of course, the future is what really matters.

We note that hedge funds don't have a meaningful investment in Wan Hai Lines. The company's largest shareholder is Yi Chun Navigation Inc., with ownership of 13%. In comparison, the second and third largest shareholders hold about 8.0% and 7.7% of the stock.

Looking at the shareholder registry, we can see that 51% of the ownership is controlled by the top 12 shareholders, meaning that no single shareholder has a majority interest in the ownership.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Wan Hai Lines

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own some shares in Wan Hai Lines Ltd.. It is a pretty big company, so it is generally a positive to see some potentially meaningful alignment. In this case, they own around NT$3.7b worth of shares (at current prices). It is good to see this level of investment by insiders. You can check here to see if those insiders have been buying recently.

General Public Ownership

With a 45% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Wan Hai Lines. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

It seems that Private Companies own 43%, of the Wan Hai Lines stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Wan Hai Lines (including 1 which can't be ignored) .

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Wan Hai Lines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2615

Wan Hai Lines

Operates as a fully containerized shipping company in Asia, the Middle East, India, Red Sea, the United States, and South America.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives