- China

- /

- Electronic Equipment and Components

- /

- SHSE:688138

High Growth Tech Stocks To Watch In The Global Market

Reviewed by Simply Wall St

As global markets experience a wave of optimism driven by easing trade tensions and robust earnings, the technology-heavy Nasdaq Composite has seen significant gains, reflecting investor confidence in the tech sector's resilience. In this environment, identifying high-growth tech stocks involves looking for companies that can capitalize on favorable market conditions and demonstrate strong innovation capabilities to navigate economic uncertainties effectively.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fositek | 29.05% | 34.17% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.12% | 25.70% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 77.62% | ★★★★★★ |

| CD Projekt | 33.48% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Shenzhen Qingyi Photomask (SHSE:688138)

Simply Wall St Growth Rating: ★★★★☆☆

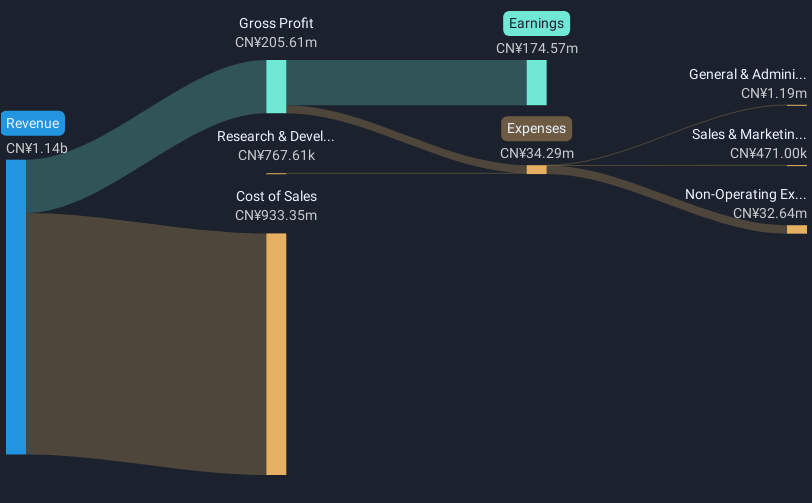

Overview: Shenzhen Qingyi Photomask Limited focuses on the research, design, production, and sales of high precision masks in China with a market capitalization of CN¥8.95 billion.

Operations: Shenzhen Qingyi Photomask Limited specializes in high precision mask production and sales, concentrating its operations within China. The company is involved in research and design to support its manufacturing processes.

Shenzhen Qingyi Photomask has demonstrated robust financial performance, with a reported revenue increase to CNY 298.54 million in Q1 2025 from CNY 271.82 million the previous year, reflecting a growth of nearly 10%. This growth is complemented by an earnings surge from CNY 49.59 million to CNY 51.74 million in the same period, showcasing a solid upward trajectory in profitability. Notably, the company's annual revenue and earnings growth rates stand at an impressive 20.8% and 23.3%, respectively, outpacing the broader Chinese market averages of 12.6% for revenue and slightly lagging behind at 23.8% for earnings growth forecasts. These figures highlight Shenzhen Qingyi Photomask's potential as it continues to expand its footprint in the high-tech sector, driven by substantial investments in R&D that align with industry demands for innovative photomask technologies.

- Take a closer look at Shenzhen Qingyi Photomask's potential here in our health report.

Learn about Shenzhen Qingyi Photomask's historical performance.

CICT Mobile Communication Technology (SHSE:688387)

Simply Wall St Growth Rating: ★★★★☆☆

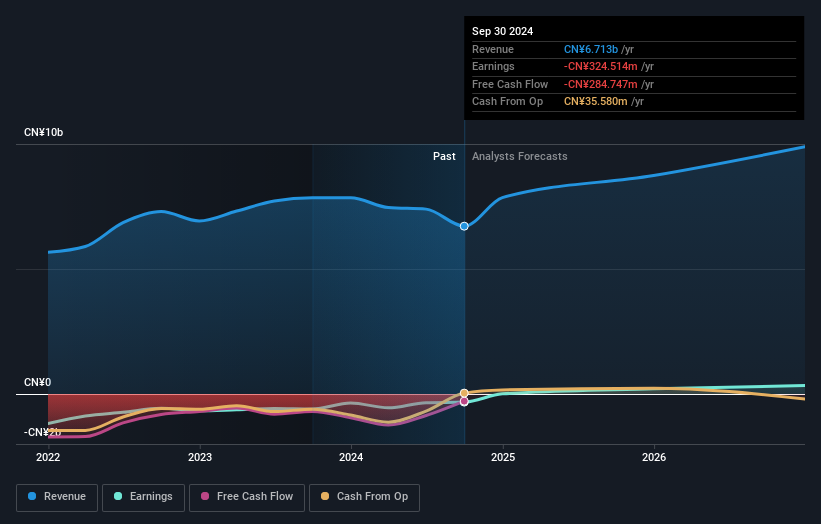

Overview: CICT Mobile Communication Technology Co., Ltd. is a company that operates in the mobile communication technology sector with a market cap of CN¥19.01 billion.

Operations: CICT Mobile Communication Technology generates revenue primarily from the mobile communication technology sector. The company has a market capitalization of CN¥19.01 billion, reflecting its significant presence in the industry.

CICT Mobile Communication Technology has shown resilience despite recent financial setbacks, with a slight improvement in its net loss from CNY 158.58 million to CNY 156.3 million year-over-year as of Q1 2025. This performance is underpinned by a notable commitment to innovation, as evidenced by its R&D investments aligning with emerging tech trends. The firm's earnings are expected to surge by an annual rate of 108.2%, signaling potential recovery and growth prospects amid challenging market conditions. As it navigates through profitability hurdles, the strategic focus on R&D could well position CICT for pivotal roles in next-gen mobile technologies, enhancing its competitive edge in the fast-evolving telecommunications sector.

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chenbro Micom Co., Ltd. is involved in the R&D, design, manufacturing, processing, and trading of computer peripherals and expendable systems across the United States, China, Taiwan, Singapore, and other international markets with a market cap of NT$32.91 billion.

Operations: Chenbro Micom focuses on the development and production of computer peripherals and expendable systems, serving markets in the United States, China, Taiwan, Singapore, and beyond. The company has a market capitalization of NT$32.91 billion.

Chenbro Micom has demonstrated robust growth, with its first quarter 2025 sales soaring to TWD 4.15 billion from TWD 2.77 billion in the previous year, a significant jump reflecting a strategic alignment with market demands. This performance is bolstered by a net income rise to TWD 666.8 million, up from TWD 364.92 million, showcasing effective operational efficiency and market adaptability. The company's commitment to R&D is evident as it continues to innovate within the tech sector, positioning itself strongly against competitors and maintaining relevance in rapidly evolving markets.

- Unlock comprehensive insights into our analysis of Chenbro Micom stock in this health report.

Examine Chenbro Micom's past performance report to understand how it has performed in the past.

Taking Advantage

- Explore the 736 names from our Global High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688138

Shenzhen Qingyi Photomask

Engages in the research, design, production, and sales of high precision masks in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives