- Taiwan

- /

- Communications

- /

- TWSE:6285

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, investors are closely watching how these dynamics influence equity performance. While large-cap and growth stocks have shown resilience, the broader market's volatility underscores the importance of stable investment options like dividend stocks, which can provide a steady income stream even in uncertain times. In this context, identifying strong dividend stocks becomes crucial as they offer potential for both income and long-term value amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.55% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2016 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

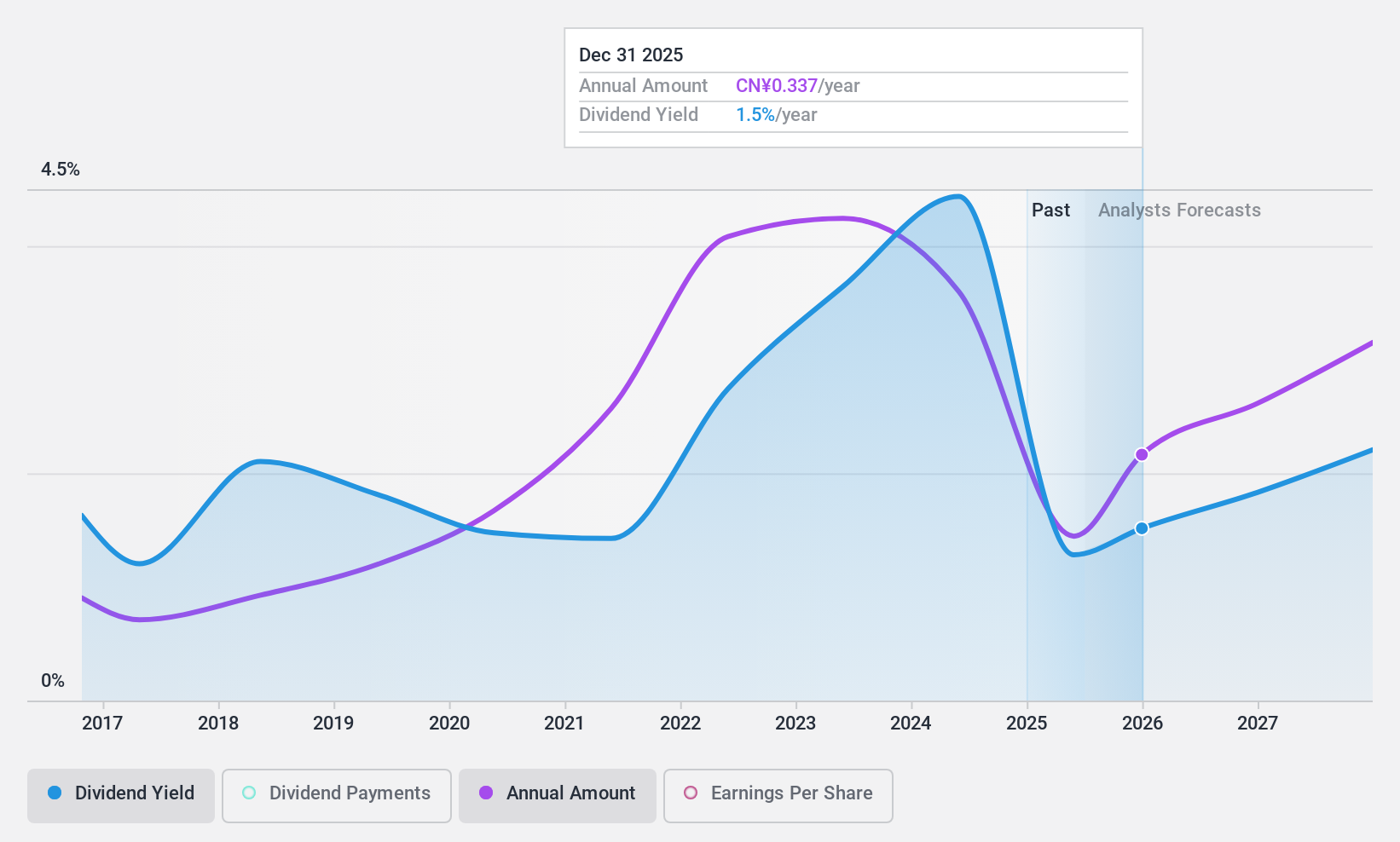

Sinoma Science & TechnologyLtd (SZSE:002080)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinoma Science & Technology Co., Ltd. focuses on the research, development, design, manufacture, and sale of specialty fiber composite materials in China with a market cap of CN¥21.18 billion.

Operations: Sinoma Science & Technology Co., Ltd. generates its revenue primarily through the research, development, design, manufacture, and sale of specialty fiber composite materials in China.

Dividend Yield: 4.3%

Sinoma Science & Technology Ltd. has a dividend yield of 4.32%, placing it in the top 25% of dividend payers in the Chinese market. However, its dividends have been volatile over the past decade and are not well covered by free cash flows, with a high cash payout ratio of 589.7%. Despite trading at a good value with a price-to-earnings ratio below the market average, recent earnings have declined significantly, impacting profitability and dividend sustainability.

- Click to explore a detailed breakdown of our findings in Sinoma Science & TechnologyLtd's dividend report.

- Our valuation report here indicates Sinoma Science & TechnologyLtd may be undervalued.

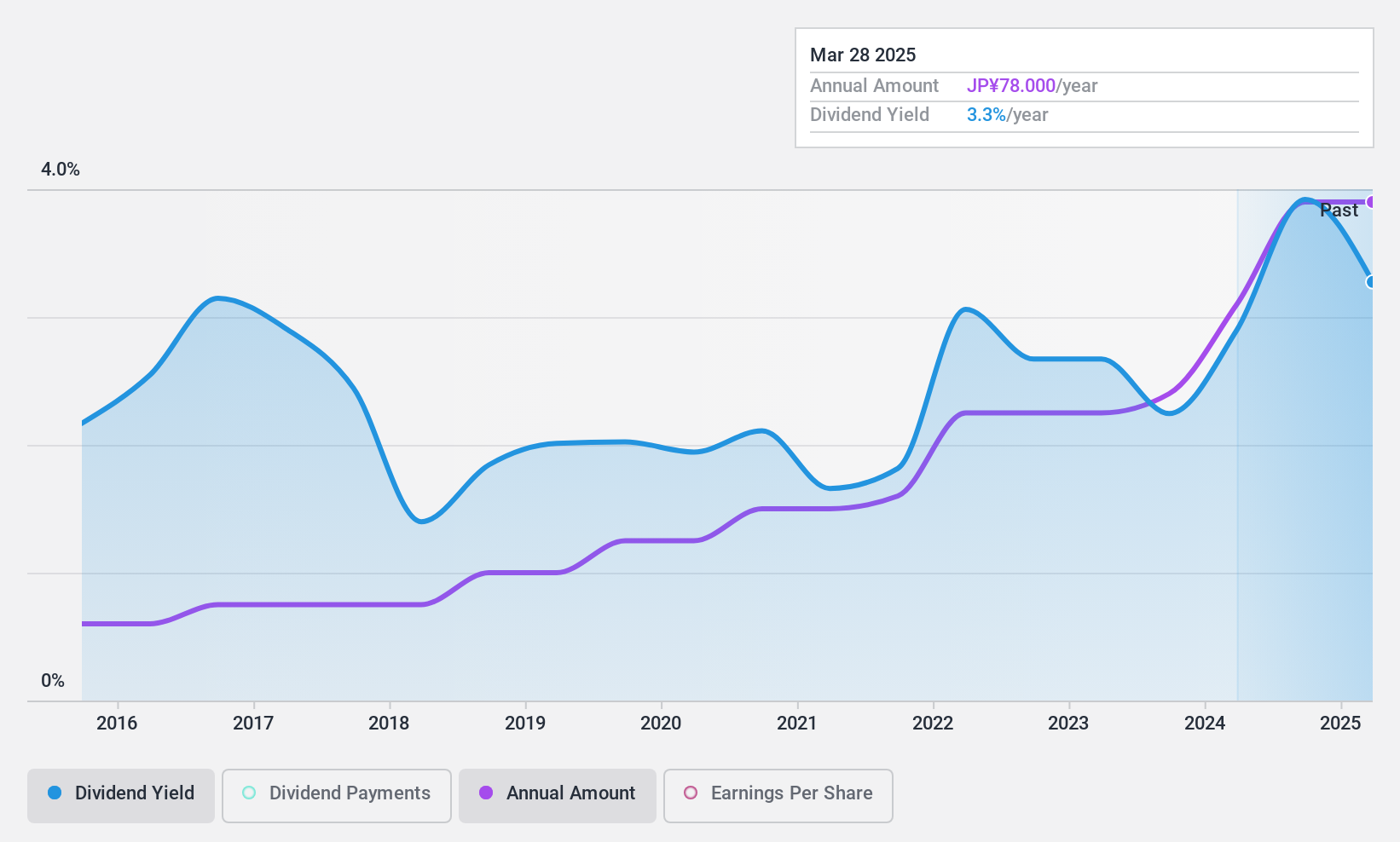

Business Brain Showa-Ota (TSE:9658)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Business Brain Showa-Ota Inc. offers consulting and system development solutions in Japan with a market cap of ¥22.05 billion.

Operations: Business Brain Showa-Ota Inc. generates revenue through its consulting and system development solutions in Japan.

Dividend Yield: 4.2%

Business Brain Showa-Ota offers a dividend yield of 4.18%, ranking it in the top 25% of dividend payers in Japan. Its dividends have been stable and growing over the past decade, supported by a payout ratio of 51.4% and a cash payout ratio of 33%. The company's dividends are well covered by both earnings and free cash flows, indicating sustainability despite recent declines in profit margins from last year’s figures.

- Take a closer look at Business Brain Showa-Ota's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Business Brain Showa-Ota is priced lower than what may be justified by its financials.

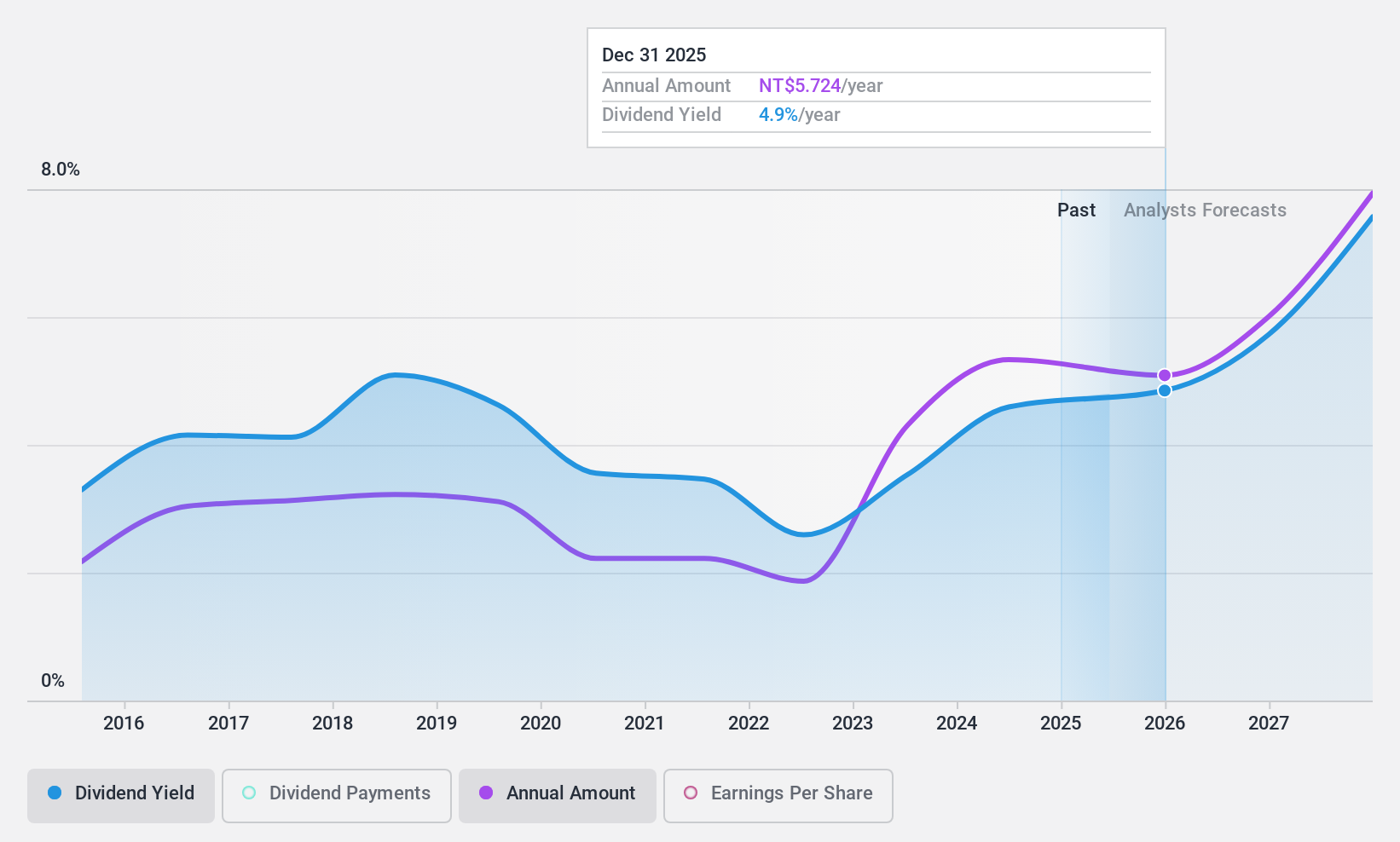

Wistron NeWeb (TWSE:6285)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wistron NeWeb Corporation is involved in the research, development, manufacture, and sale of satellite communication systems and mobile and portable communication equipment across the Americas, Asia, Europe, and internationally with a market cap of NT$59.20 billion.

Operations: Wistron NeWeb Corporation's revenue primarily comes from its Wireless Communications Equipment segment, generating NT$115.19 billion.

Dividend Yield: 4.9%

Wistron NeWeb's dividend yield of 4.92% places it among the top 25% of dividend payers in Taiwan, though its dividends have been volatile over the past decade. Despite this instability, dividends are covered by earnings and cash flows with payout ratios of 65.2% and 57.8%, respectively. The stock trades at a good value relative to peers, being priced 16% below estimated fair value, while recent earnings growth supports potential future payouts.

- Click here to discover the nuances of Wistron NeWeb with our detailed analytical dividend report.

- According our valuation report, there's an indication that Wistron NeWeb's share price might be on the cheaper side.

Taking Advantage

- Embark on your investment journey to our 2016 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wistron NeWeb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6285

Wistron NeWeb

Engages in research and development, manufacture, and sale of satellite communication systems, and mobile and portable communication equipment in the Americas, Asia, Europe, and Internationally.

Excellent balance sheet established dividend payer.