- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6189

3 Top Global Dividend Stocks Yielding Up To 5.7%

Reviewed by Simply Wall St

Amid escalating trade tensions and volatile global markets, investors are navigating a landscape marked by uncertainty and cautious optimism. With consumer sentiment at its lowest in nearly three years, many are turning their attention to dividend stocks as a potential source of stability and income. In such an environment, stocks that offer consistent dividends can be appealing as they provide regular income streams while potentially offsetting some market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.99% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.88% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.49% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.23% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.49% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.20% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.38% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.50% | ★★★★★★ |

Click here to see the full list of 1539 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

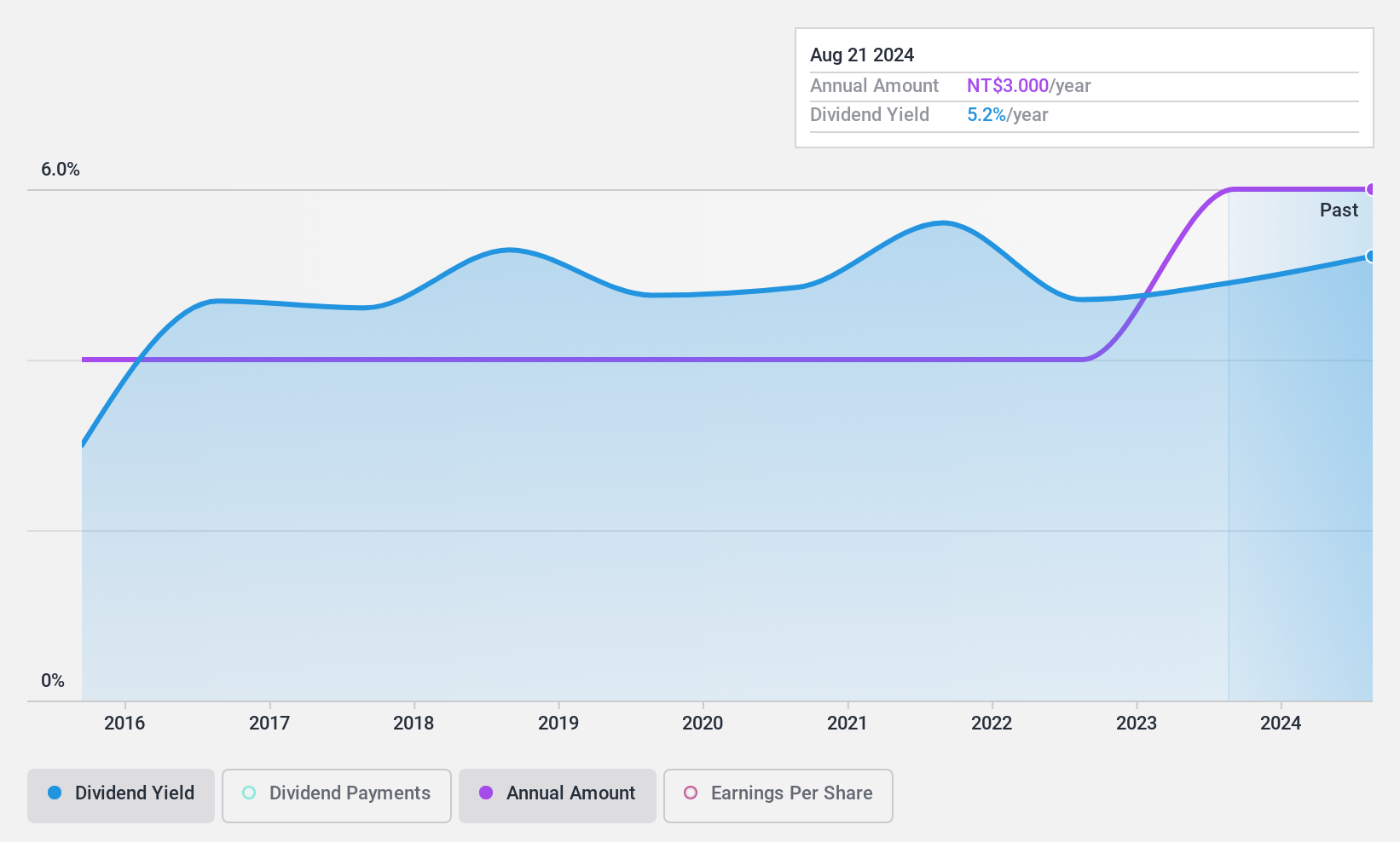

Y.C.C. Parts Mfg (TWSE:1339)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Y.C.C. Parts Mfg. Co., Ltd. specializes in the production and distribution of automotive plastic parts across various regions including North America, Central America, South America, Europe, Asia, and Taiwan with a market capitalization of NT$3.82 billion.

Operations: Y.C.C. Parts Mfg. Co., Ltd.'s revenue is primarily derived from its Y.c.c. segment, generating NT$1.53 billion, and the Liaoning Hetai segment, contributing NT$335.31 million.

Dividend Yield: 5.7%

Y.C.C. Parts Mfg. offers a stable dividend profile, with recent dividends at TWD 3 per share, totaling TWD 222.37 million. Despite a decline in sales and net income for 2024, the company's payout ratio of 59.8% indicates dividends are covered by earnings and cash flows (76.6% coverage). The dividend yield of 5.7% is competitive within the Taiwanese market's top quartile, reflecting its attractiveness to income-focused investors over the past decade.

- Dive into the specifics of Y.C.C. Parts Mfg here with our thorough dividend report.

- Our valuation report here indicates Y.C.C. Parts Mfg may be undervalued.

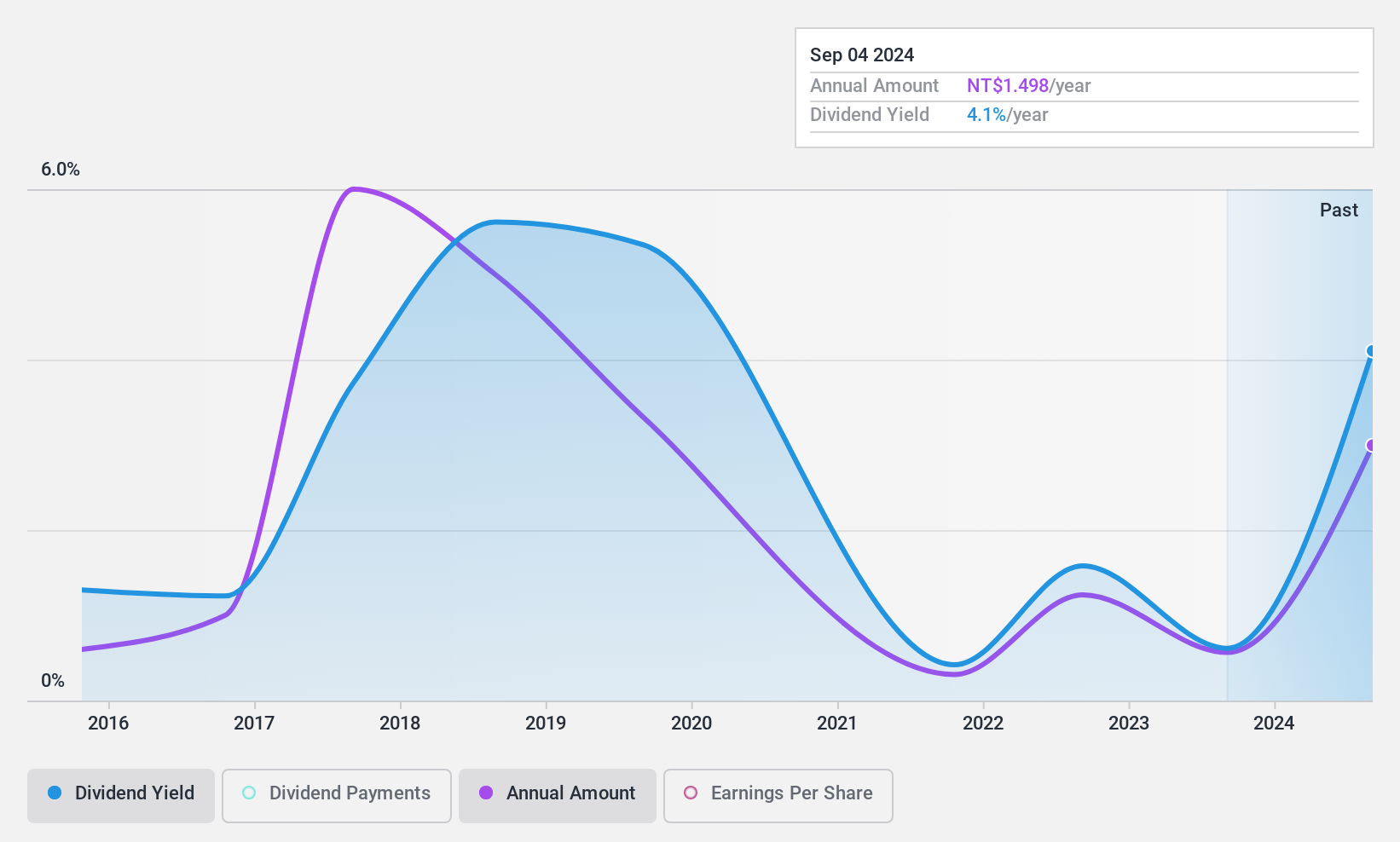

Laster Tech (TWSE:3346)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Laster Tech Co., Ltd. manufactures and sells LED chips and components across Taiwan, China, and Thailand, with a market cap of NT$3.44 billion.

Operations: Laster Tech Co., Ltd.'s revenue is primarily derived from its LASTER Department, which generates NT$2.78 billion, the Laser Tech (Shanghai) Segment with NT$6.44 billion, and the Laser Tech (Dong Guan) Segment contributing NT$635.53 million.

Dividend Yield: 4.1%

Laster Tech's dividend payments are covered by earnings (50.9% payout ratio) and cash flows (26.2% cash payout ratio), though they have been volatile over the past decade. The stock trades at a favorable P/E ratio of 13.1x compared to the TW market average of 17.6x, suggesting good value relative to peers. Recent announcements include a share repurchase program worth TWD 2 billion, potentially enhancing shareholder value through reduced share count and increased earnings per share.

- Delve into the full analysis dividend report here for a deeper understanding of Laster Tech.

- The valuation report we've compiled suggests that Laster Tech's current price could be quite moderate.

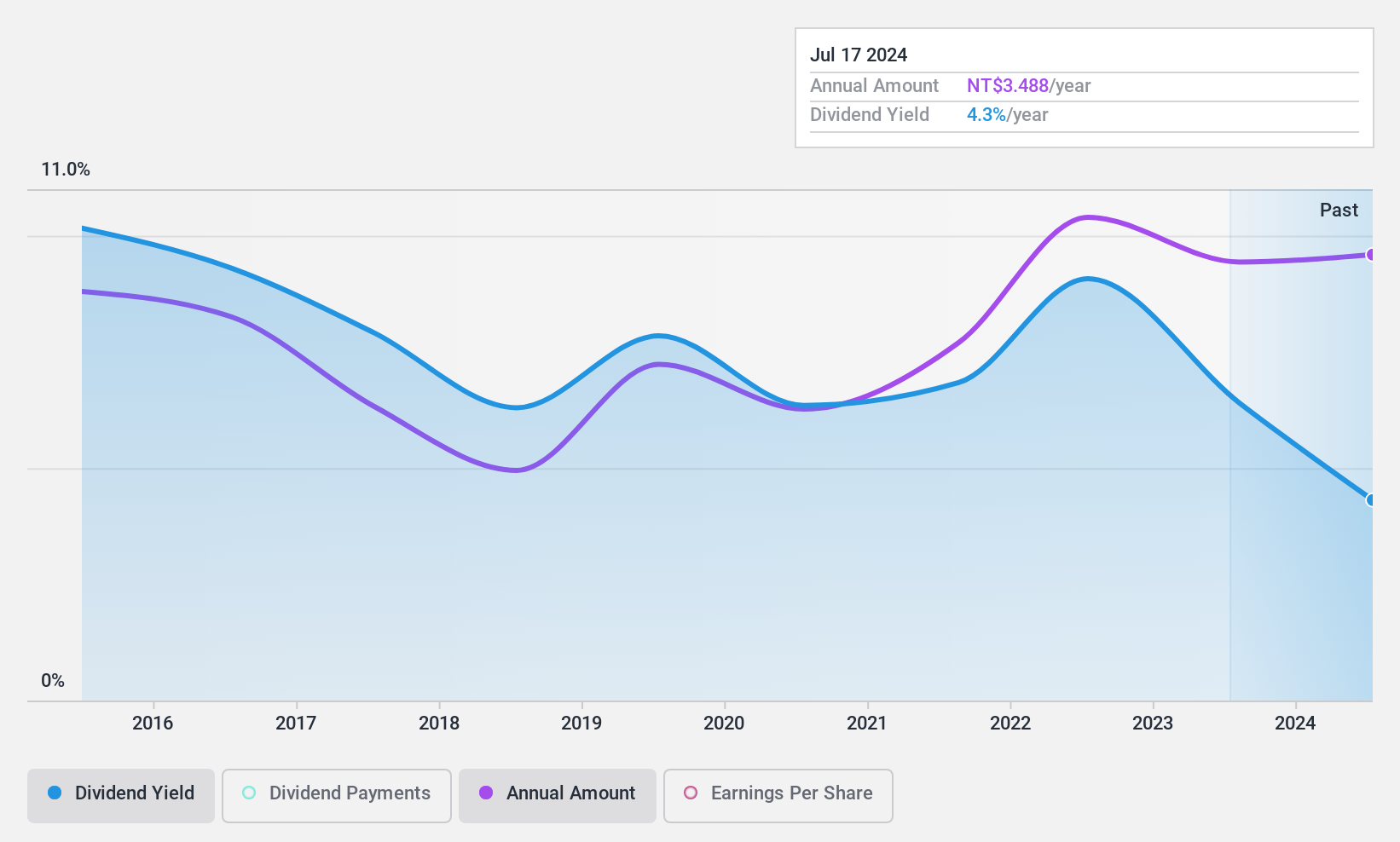

Promate ElectronicLtd (TWSE:6189)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Promate Electronic Co., Ltd. operates in Taiwan, focusing on the distribution and sale of electronic and electrical components, computer software, and electrical products with a market capitalization of NT$14.58 billion.

Operations: Promate Electronic Co., Ltd.'s revenue is derived from two primary segments: NT$9.35 billion from the China Region and NT$28.64 billion from regions outside China.

Dividend Yield: 4.8%

Promate Electronic Co., Ltd.'s recent dividend increase to TWD 4.00 per share, totaling TWD 876.14 million, highlights its commitment to returning value to shareholders despite a history of volatile and unreliable dividends over the past decade. The company's dividends are supported by earnings (63.4% payout ratio) and cash flows (53.1% cash payout ratio), though its yield of 4.83% is below the top quartile in Taiwan's market. Earnings growth has been robust, with net income rising significantly year-over-year.

- Get an in-depth perspective on Promate ElectronicLtd's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Promate ElectronicLtd's share price might be too pessimistic.

Summing It All Up

- Explore the 1539 names from our Top Global Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6189

Promate ElectronicLtd

Engages in the distribution and sale of electronic/electrical components, and computer software and electrical products in Taiwan.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives