- Taiwan

- /

- Communications

- /

- TWSE:6152

Investors in Prime Electronics & Satellitics (TWSE:6152) have seen stellar returns of 179% over the past five years

Prime Electronics & Satellitics Inc. (TWSE:6152) shareholders might be concerned after seeing the share price drop 12% in the last month. But in stark contrast, the returns over the last half decade have impressed. It's fair to say most would be happy with 179% the gain in that time. We think it's more important to dwell on the long term returns than the short term returns. The more important question is whether the stock is too cheap or too expensive today.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Prime Electronics & Satellitics

Prime Electronics & Satellitics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last half decade Prime Electronics & Satellitics' revenue has actually been trending down at about 11% per year. On the other hand, the share price done the opposite, gaining 23%, compound, each year. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, we are a bit cautious in this kind of situation.

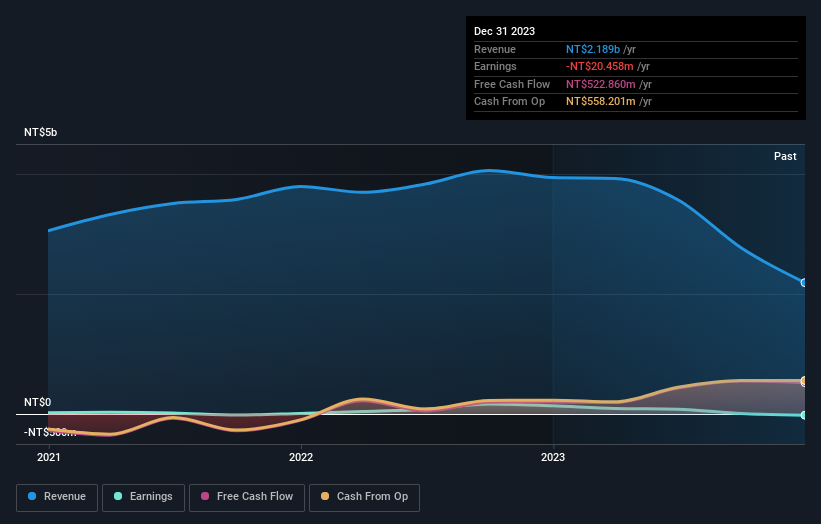

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Prime Electronics & Satellitics stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Prime Electronics & Satellitics has rewarded shareholders with a total shareholder return of 53% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 23% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Prime Electronics & Satellitics .

Of course Prime Electronics & Satellitics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6152

Prime Electronics & Satellitics

Develops, manufactures, and sells digital satellite communication products worldwide.

Flawless balance sheet and good value.