- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:5484

EverFocus Electronics (TWSE:5484) shareholders are still up 600% over 5 years despite pulling back 24% in the past week

EverFocus Electronics Corporation (TWSE:5484) shareholders might be concerned after seeing the share price drop 24% in the last week. But that doesn't change the fact that the returns over the last half decade have been spectacular. In that time, the share price has soared some 582% higher! Arguably, the recent fall is to be expected after such a strong rise. But the real question is whether the business fundamentals can improve over the long term. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the long term performance has been good but there's been a recent pullback of 24%, let's check if the fundamentals match the share price.

View our latest analysis for EverFocus Electronics

EverFocus Electronics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years EverFocus Electronics saw its revenue grow at 3.2% per year. Put simply, that growth rate fails to impress. So shareholders should be pretty elated with the 47% increase per year, in that time. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. Having said that, a closer look at the numbers might surface good reasons to believe that profits will gush in the future.

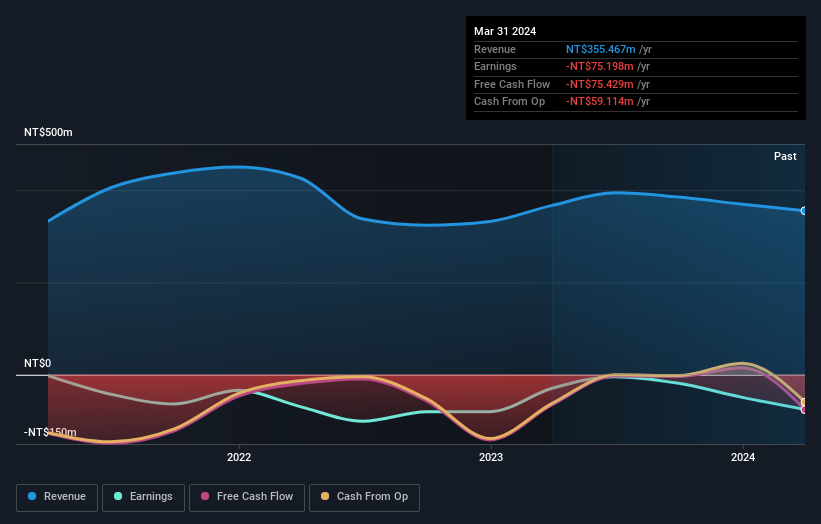

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling EverFocus Electronics stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between EverFocus Electronics' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. EverFocus Electronics hasn't been paying dividends, but its TSR of 600% exceeds its share price return of 582%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that EverFocus Electronics has rewarded shareholders with a total shareholder return of 215% in the last twelve months. That gain is better than the annual TSR over five years, which is 48%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with EverFocus Electronics , and understanding them should be part of your investment process.

But note: EverFocus Electronics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EverFocus Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5484

EverFocus Electronics

Engages in the research and development, manufacture, marketing, and service of CCTV surveillance systems, CCD cameras, and digital image processing equipment worldwide.

Excellent balance sheet minimal.