- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3149

G-TECH Optoelectronics (TWSE:3149 investor three-year losses grow to 46% as the stock sheds NT$440m this past week

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term G-TECH Optoelectronics Corporation (TWSE:3149) shareholders, since the share price is down 47% in the last three years, falling well short of the market return of around 37%. The last week also saw the share price slip down another 11%.

If the past week is anything to go by, investor sentiment for G-TECH Optoelectronics isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for G-TECH Optoelectronics

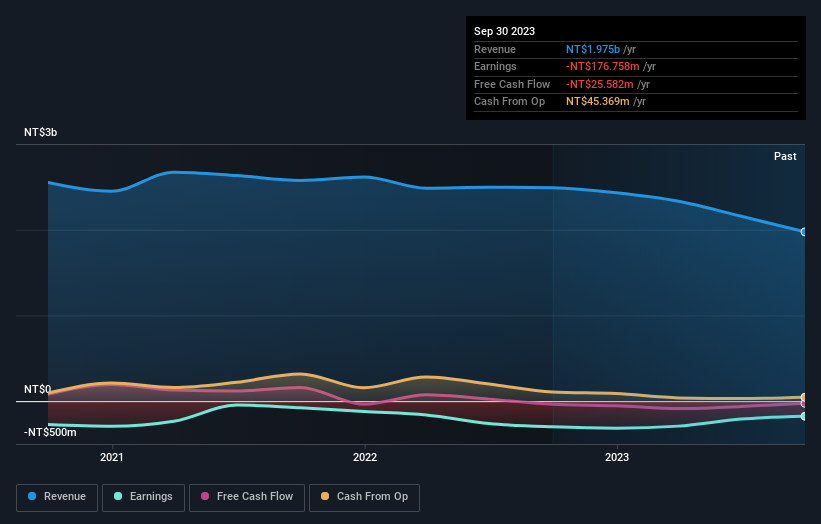

Given that G-TECH Optoelectronics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years G-TECH Optoelectronics saw its revenue shrink by 6.4% per year. That's not what investors generally want to see. The stock has disappointed holders over the last three years, falling 14%, annualized. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in G-TECH Optoelectronics had a tough year, with a total loss of 15%, against a market gain of about 31%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand G-TECH Optoelectronics better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for G-TECH Optoelectronics you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3149

G-TECH Optoelectronics

Engages in the optoelectronic glass processing business in Taiwan, Mainland China, the United States, and internationally.

Flawless balance sheet low.