- Taiwan

- /

- Tech Hardware

- /

- TWSE:3021

Welltend Technology's (TWSE:3021) five-year total shareholder returns outpace the underlying earnings growth

It's been a soft week for Welltend Technology Corporation (TWSE:3021) shares, which are down 14%. On the bright side the share price is up over the last half decade. However we are not very impressed because the share price is only up 53%, less than the market return of 142%.

In light of the stock dropping 14% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Welltend Technology

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

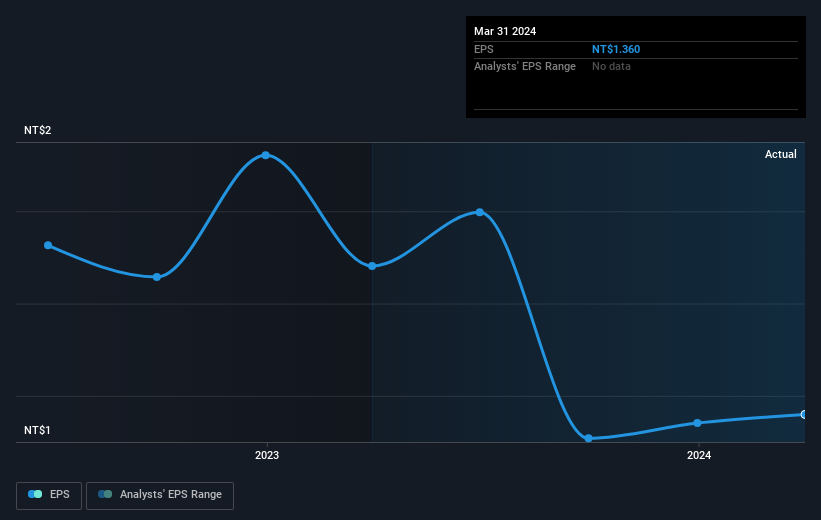

During five years of share price growth, Welltend Technology achieved compound earnings per share (EPS) growth of 1.3% per year. This EPS growth is lower than the 9% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Welltend Technology's TSR for the last 5 years was 73%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Investors in Welltend Technology had a tough year, with a total loss of 5.6% (including dividends), against a market gain of about 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 12% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Welltend Technology has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Welltend Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3021

Welltend Technology

Produces and sells electronic components and wire connectors in Taiwan and internationally.

Excellent balance sheet second-rate dividend payer.