- China

- /

- Communications

- /

- SHSE:603496

3 High-Growth Insider-Owned Stocks With Earnings Growth Up To 75%

Reviewed by Simply Wall St

As global markets rally to new highs following the Federal Reserve's first rate cut in over four years, investors are increasingly focusing on high-growth opportunities. In this buoyant environment, stocks with significant insider ownership and robust earnings growth stand out as attractive prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★☆☆

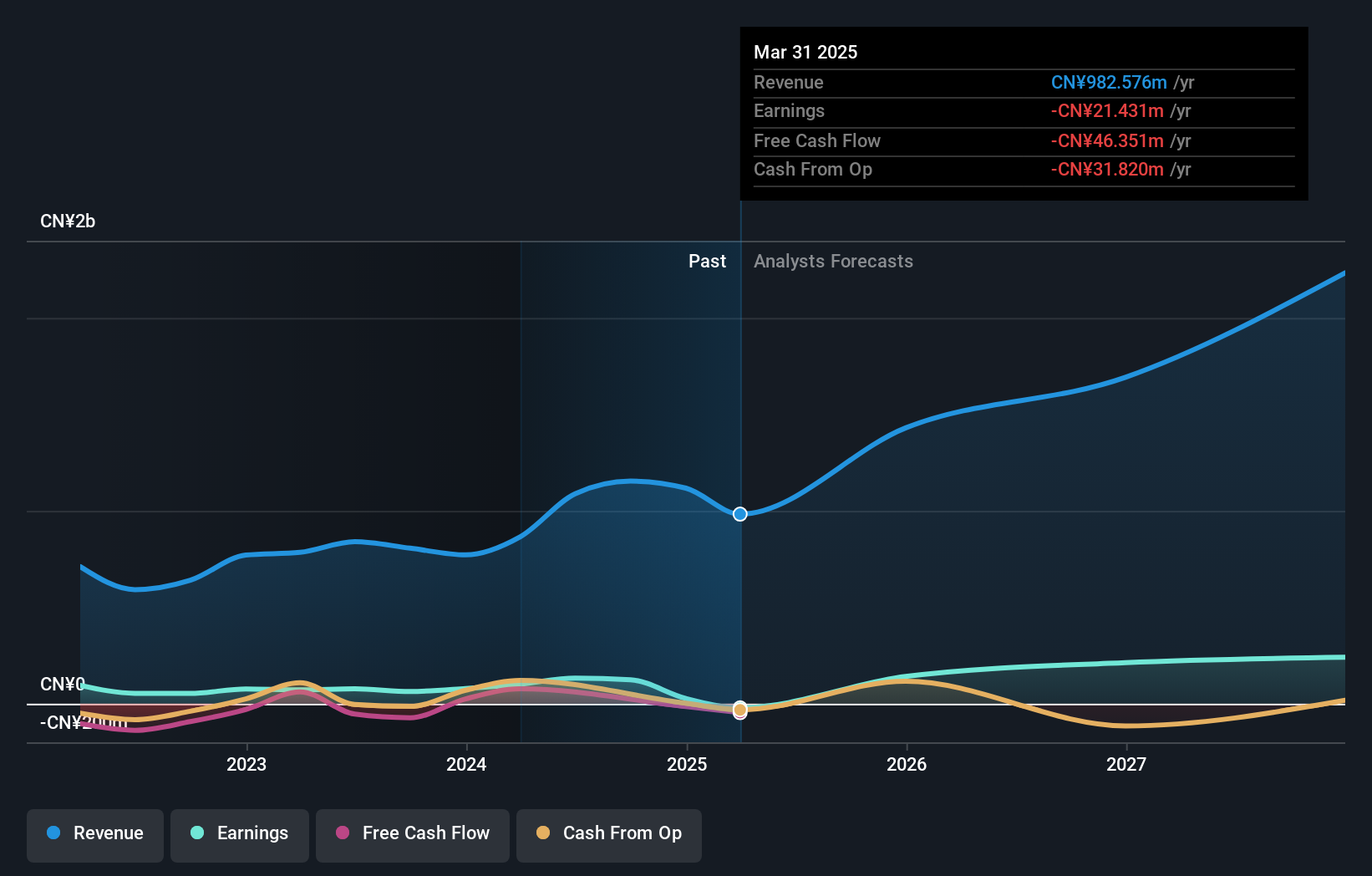

Overview: EmbedWay Technologies (Shanghai) Corporation, with a market cap of CN¥6.38 billion, operates as a network visibility infrastructure and intelligent system platform vendor in China.

Operations: The company generates revenue primarily from the Computer, Communication, and Other Electronic Equipment Manufacturing segment, which amounts to CN¥1.09 billion.

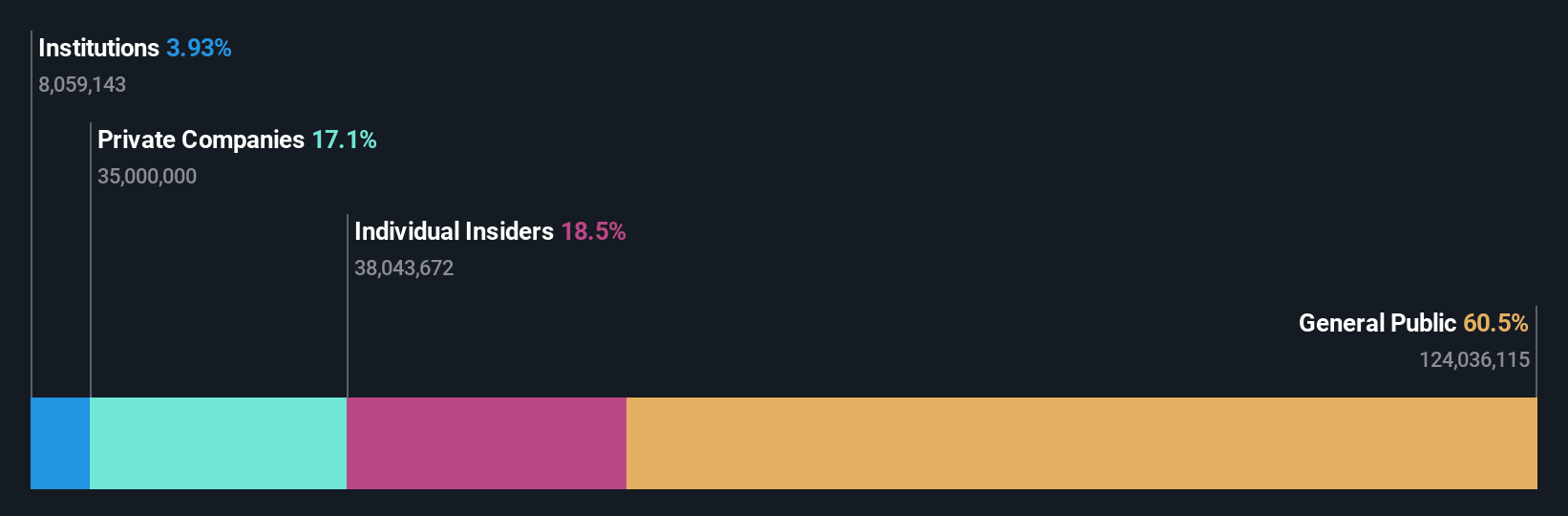

Insider Ownership: 32.1%

Earnings Growth Forecast: 29.7% p.a.

EmbedWay Technologies (Shanghai) has shown robust growth, with earnings increasing by 72.2% over the past year and forecasted to grow at 29.74% annually, outpacing the CN market's 23%. Despite slower revenue growth at 18.3% per year, it still surpasses the market average of 13.1%. Recent inclusion in the S&P Global BMI Index highlights its rising prominence. However, Return on Equity is expected to be low at 13.4% in three years.

- Navigate through the intricacies of EmbedWay Technologies (Shanghai) with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report EmbedWay Technologies (Shanghai) implies its share price may be too high.

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

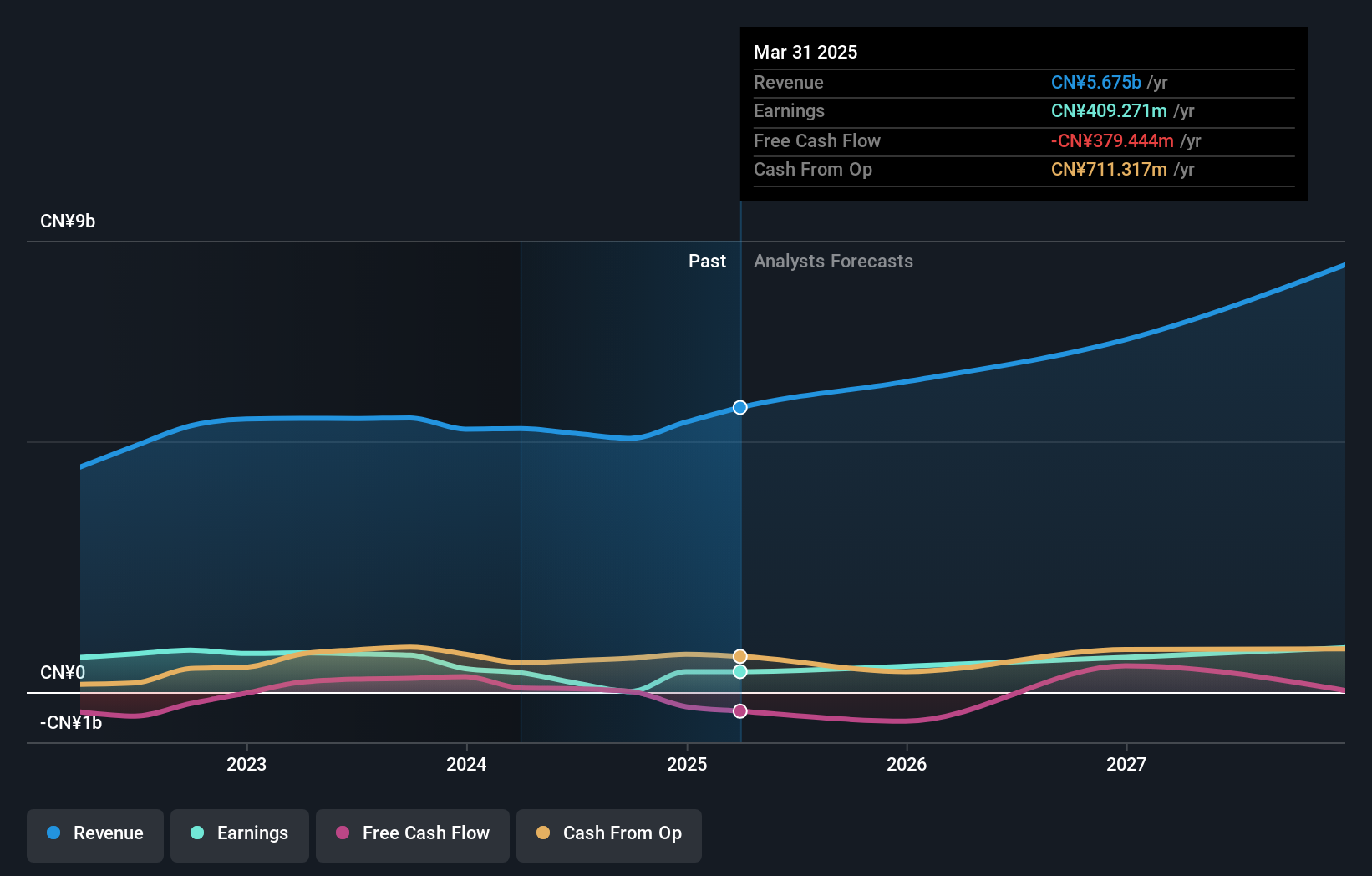

Overview: Thunder Software Technology Co., Ltd. offers operating-system products across China, Europe, the United States, Japan, and other international markets with a market cap of approximately CN¥15.12 billion.

Operations: Thunder Software Technology Co., Ltd. generates revenue from operating-system products across various regions including China, Europe, the United States, Japan, and other international markets.

Insider Ownership: 27.7%

Earnings Growth Forecast: 34.8% p.a.

Thunder Software Technology Ltd. exhibits strong growth potential with forecasted annual earnings growth of 34.8%, outpacing the CN market's 23%. Despite a volatile share price and lower profit margins (3.5% vs. last year's 14%), its revenue is expected to grow at 17% per year, surpassing the market average of 13.1%. Recent dividend affirmations and substantial insider ownership further underscore investor confidence in the company's future prospects.

- Unlock comprehensive insights into our analysis of Thunder Software TechnologyLtd stock in this growth report.

- Upon reviewing our latest valuation report, Thunder Software TechnologyLtd's share price might be too optimistic.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chenming Electronic Tech. Corp., an OEM/ODM manufacturer with a market cap of NT$24.05 billion, specializes in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally.

Operations: The company generates revenue primarily from the production and sales of computer and mobile device components, amounting to NT$7.64 billion.

Insider Ownership: 20.1%

Earnings Growth Forecast: 75.5% p.a.

Chenming Electronic Tech. demonstrates significant growth potential, with earnings forecasted to grow 75.5% annually, outpacing the Taiwan market's 18.4%. Recent Q2 results show a substantial increase in revenue (TWD 2.60 billion) and net income (TWD 193.17 million). Despite high share price volatility and past shareholder dilution, the company trades at a considerable discount to its estimated fair value and benefits from strong insider ownership, indicating confidence in its future performance.

- Get an in-depth perspective on Chenming Electronic Tech's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Chenming Electronic Tech is trading behind its estimated value.

Next Steps

- Gain an insight into the universe of 1522 Fast Growing Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EmbedWay Technologies (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603496

EmbedWay Technologies (Shanghai)

Operates as a network visibility infrastructure and intelligent system platform vendor in China.

Solid track record with reasonable growth potential.