- Taiwan

- /

- Tech Hardware

- /

- TWSE:3011

Ji-Haw IndustrialLtd (TWSE:3011) shareholder returns have been fantastic, earning 330% in 3 years

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. You won't get it right every time, but when you do, the returns can be truly splendid. One bright shining star stock has been Ji-Haw Industrial Co.,Ltd. (TWSE:3011), which is 330% higher than three years ago. And in the last week the share price has popped 11%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Ji-Haw IndustrialLtd

Ji-Haw IndustrialLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Ji-Haw IndustrialLtd's revenue trended up 1.9% each year over three years. Considering the company is losing money, we think that rate of revenue growth is uninspiring. Therefore, we're a little surprised to see the share price gain has been so strong, at 63% per year, compound, over three years. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. The company will need to continue to execute on its business strategy to justify this rise.

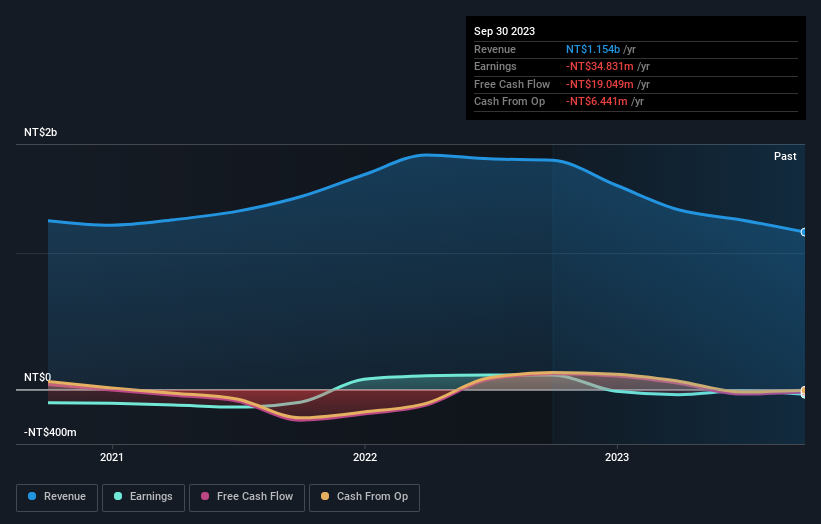

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Ji-Haw IndustrialLtd's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Ji-Haw IndustrialLtd shareholders have received a total shareholder return of 35% over one year. That gain is better than the annual TSR over five years, which is 33%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3011

Ji-Haw IndustrialLtd

Engages in the manufacturing and sale of precision electric ports and sockets, connectors, electric wires and cables, electronics components, and other industrial and commercial services in Taiwan, China, and Thailand.

Excellent balance sheet very low.