- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2305

Microtek International (TWSE:2305) swells 11% this week, taking five-year gains to 300%

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Microtek International, Inc. (TWSE:2305) stock is up an impressive 300% over the last five years. It's also up 16% in about a month.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Microtek International

Microtek International isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, Microtek International can boast revenue growth at a rate of 0.8% per year. Put simply, that growth rate fails to impress. In comparison, the share price rise of 32% per year over the last half a decade is pretty impressive. While we wouldn't be overly concerned, it might be worth checking whether you think the fundamental business gains really justify the share price action. It may be that the market is pretty optimistic about Microtek International.

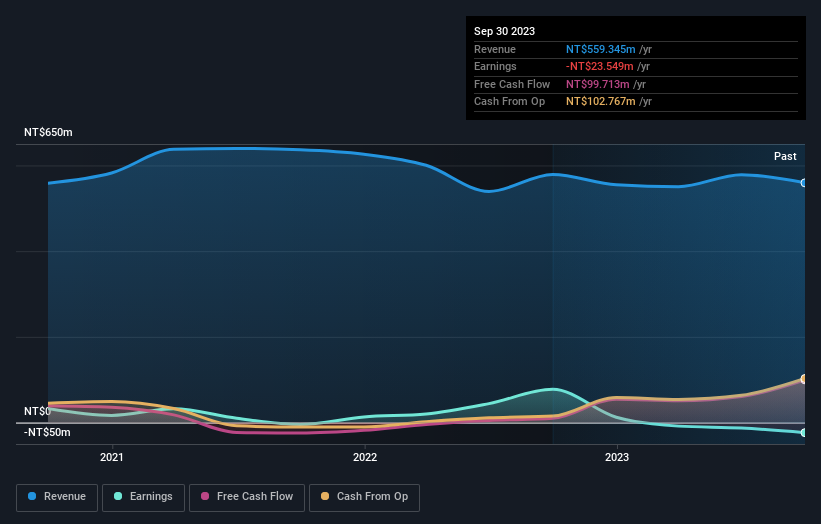

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Microtek International's financial health with this free report on its balance sheet.

A Different Perspective

Microtek International provided a TSR of 11% over the last twelve months. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 32% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2305

Microtek International

Designs, manufactures, and sells smart scanners and computer information peripherals in China and Taiwan.

Excellent balance sheet and slightly overvalued.