- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:1582

Earnings grew faster than the notable 67% return delivered to Syncmold Enterprise (TWSE:1582) shareholders over the last year

It's been a soft week for Syncmold Enterprise Corp. (TWSE:1582) shares, which are down 11%. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. In that time we've seen the stock easily surpass the market return, with a gain of 61%.

Although Syncmold Enterprise has shed NT$1.9b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Syncmold Enterprise

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

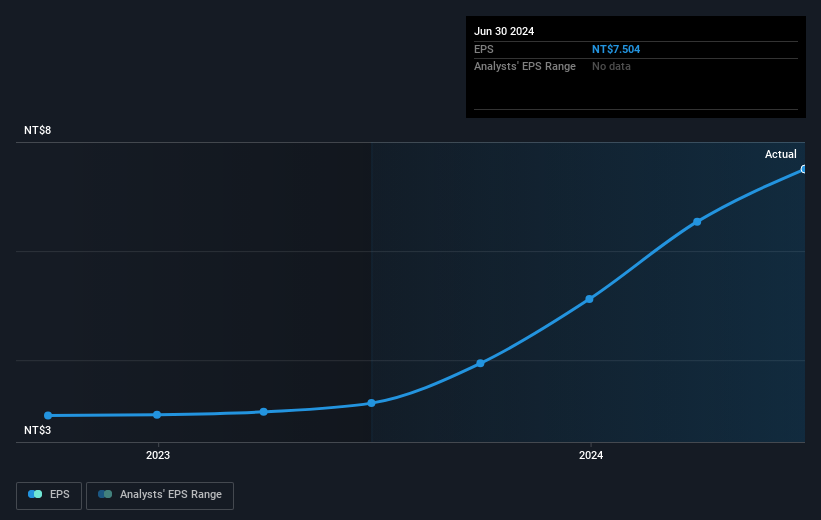

Syncmold Enterprise was able to grow EPS by 134% in the last twelve months. This EPS growth is significantly higher than the 61% increase in the share price. Therefore, it seems the market isn't as excited about Syncmold Enterprise as it was before. This could be an opportunity.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Syncmold Enterprise has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Syncmold Enterprise, it has a TSR of 67% for the last 1 year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Syncmold Enterprise shareholders have received a total shareholder return of 67% over one year. And that does include the dividend. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Syncmold Enterprise (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1582

Syncmold Enterprise

Engages in the processing, manufacturing, trading, technology authorization, import and export of various metal molds, plastic molds, and electronic parts in Taiwan.

Excellent balance sheet with proven track record.