- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3416

3 Top Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As global markets react to recent political shifts and economic policy changes, U.S. stocks have rallied to record highs, driven by optimism around growth and tax reforms. In this dynamic environment, dividend stocks can offer a compelling opportunity for investors seeking steady income streams and potential portfolio stability amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.19% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.06% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

SiS Distribution (Thailand) (SET:SIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SiS Distribution (Thailand) Public Company Limited, with a market cap of THB8.33 billion, operates in Thailand distributing computer components, smartphones, and office automation equipment.

Operations: SiS Distribution (Thailand) Public Company Limited generates revenue from several segments, including Phones at THB5.12 billion, Consumer Products at THB8.11 billion, Value Add Products at THB5.20 billion, and Commercial Products at THB6.26 billion.

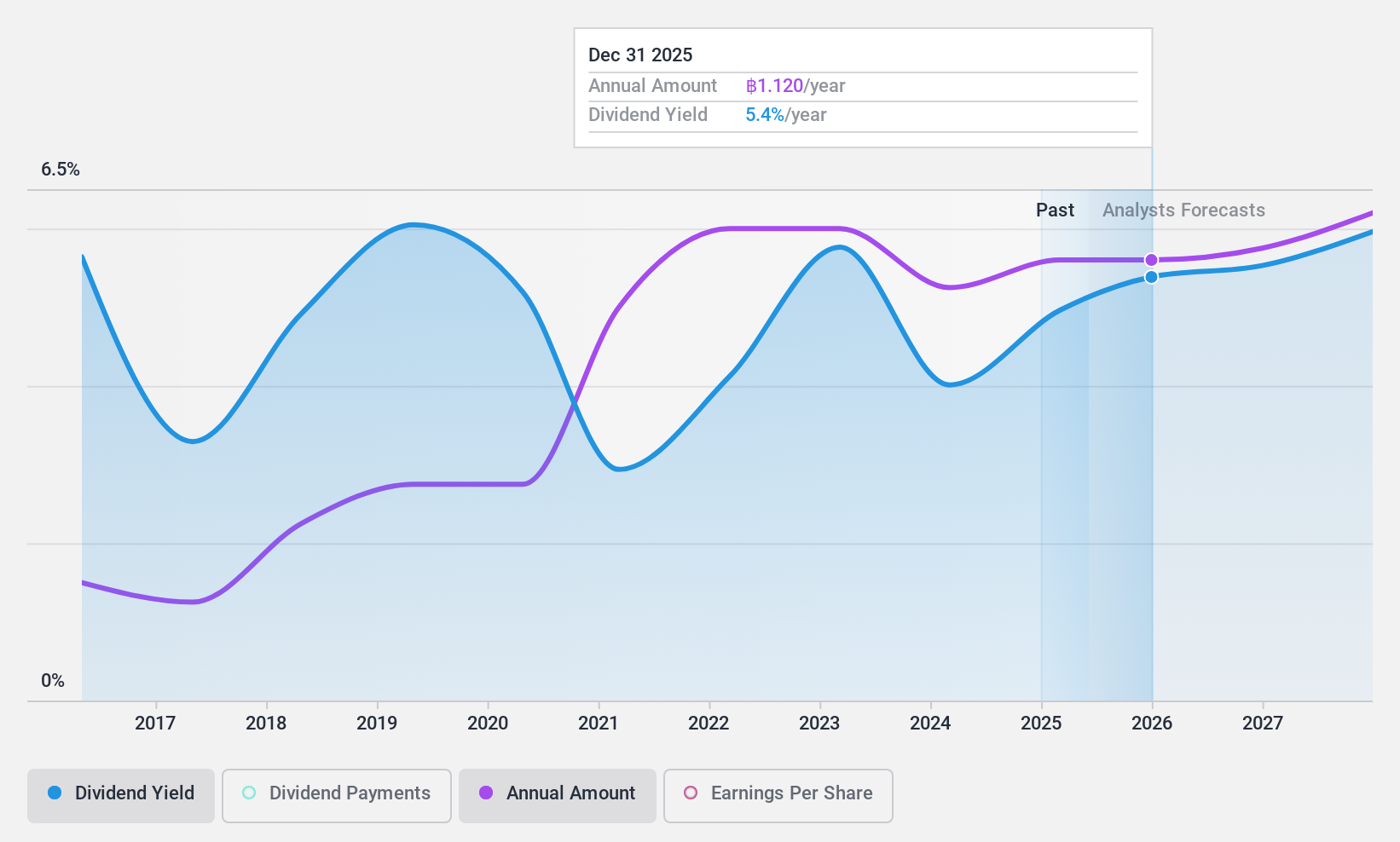

Dividend Yield: 3.9%

SiS Distribution (Thailand) offers a stable dividend with payments reliably growing over the past decade. Dividends are well-covered by earnings and cash flows, with payout ratios of 53.8% and 15.7%, respectively, indicating sustainability despite high debt levels. However, its yield of 3.85% is below top-tier Thai market payers at 6.54%. Recent board changes following the passing of a key director may impact governance but do not directly affect dividend stability.

- Get an in-depth perspective on SiS Distribution (Thailand)'s performance by reading our dividend report here.

- Upon reviewing our latest valuation report, SiS Distribution (Thailand)'s share price might be too pessimistic.

Info-Tek (TPEX:8183)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Info-Tek Corporation manufactures, assembles, processes, sells, and distributes information electronic products across Taiwan, China, the rest of Asia, and Europe with a market cap of NT$4.90 billion.

Operations: Info-Tek Corporation's revenue segments include NT$407.65 million from PCBA - EMS1 and NT$6.10 billion from PCBA - EMS3.

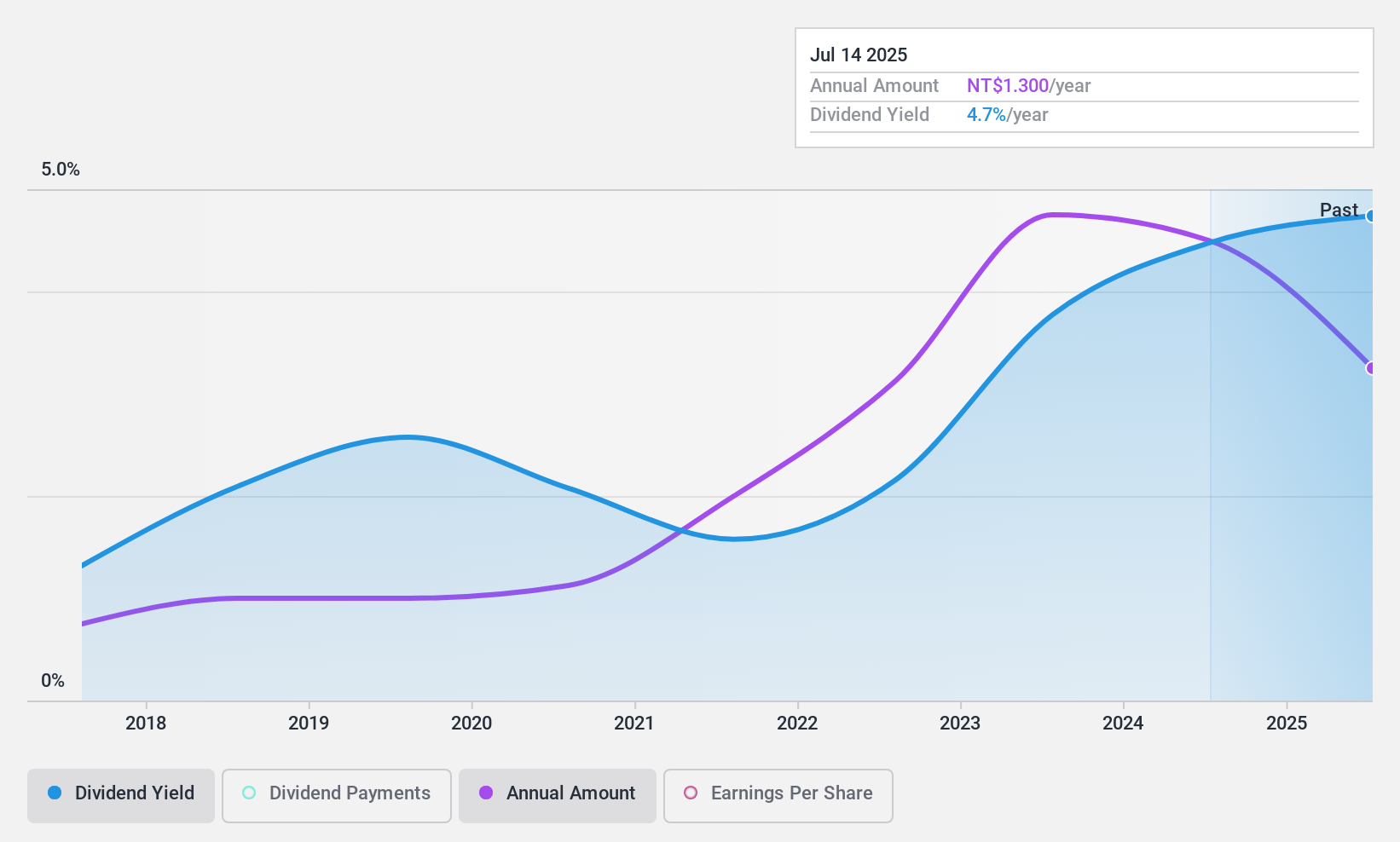

Dividend Yield: 4.3%

Info-Tek's dividend payments are well-covered by earnings and cash flows, with payout ratios of 47.8% and 29.1%, respectively, suggesting sustainability. However, the dividends have been volatile over the past decade, experiencing significant annual drops exceeding 20%. Despite this instability, Info-Tek's dividend yield is in the top 25% of payers in Taiwan's market. Recent financial reports show declining net income and EPS compared to last year, which could impact future payouts.

- Take a closer look at Info-Tek's potential here in our dividend report.

- According our valuation report, there's an indication that Info-Tek's share price might be on the cheaper side.

Winmate (TWSE:3416)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Winmate Inc. specializes in the research, development, manufacture, and sales of rugged display equipment and mobile computers globally, with a market cap of NT$11.32 billion.

Operations: Winmate Inc.'s revenue is primarily derived from its operations in rugged display equipment and rugged mobile computers across Europe, Asia, the United States, and other international markets.

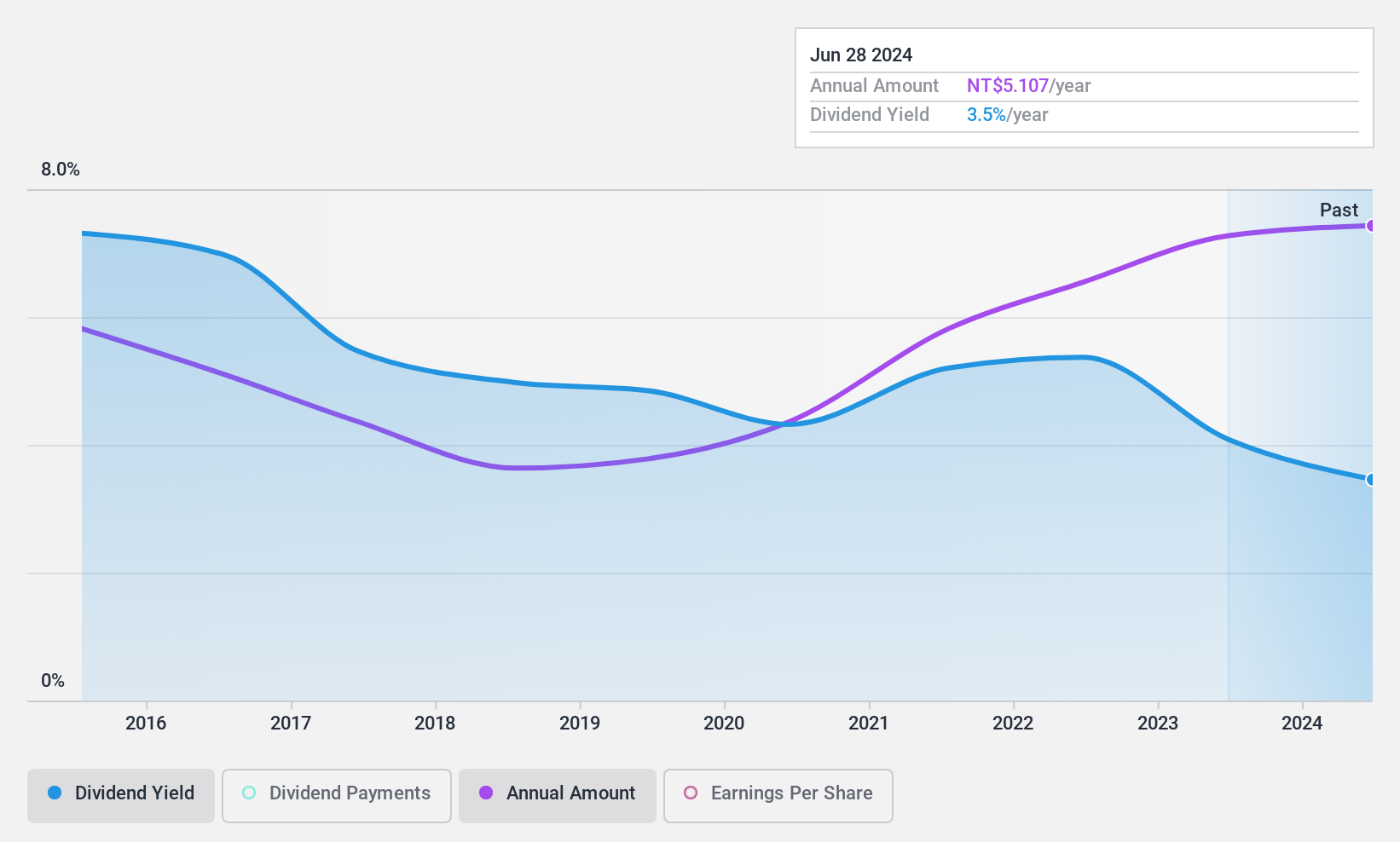

Dividend Yield: 3.4%

Winmate's dividends have grown consistently over the past decade, yet they remain low compared to Taiwan's top dividend payers. The payout ratio of 79.4% indicates earnings cover dividends, but a high cash payout ratio of 128.1% suggests inadequate free cash flow coverage, raising sustainability concerns. Despite trading below estimated fair value and stable revenue growth forecasts, recent earnings show minimal net income improvement and shareholder dilution occurred last year, potentially affecting future dividend reliability.

- Click here to discover the nuances of Winmate with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Winmate is trading behind its estimated value.

Next Steps

- Reveal the 1940 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winmate might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3416

Winmate

Engages in the research and development, manufacture, and sales of rugged display equipment and rugged mobile computer in Europe, Asia, the United States, and internationally.

Excellent balance sheet, good value and pays a dividend.