- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8069

Top Growth Companies With High Insider Ownership For September 2024

Reviewed by Simply Wall St

As global markets rebound and growth stocks outpace value shares, investors are keenly observing the sectors driving this momentum. In this environment, companies with strong insider ownership often signal confidence in their future prospects, making them attractive targets for those seeking robust growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 94.1% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

Unisem (M) Berhad (KLSE:UNISEM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Unisem (M) Berhad, with a market cap of MYR5.16 billion, provides semiconductor assembly and test services across Asia, Europe, and the United States through its subsidiaries.

Operations: The company generates MYR1.47 billion from the manufacturing of semiconductor devices and related services.

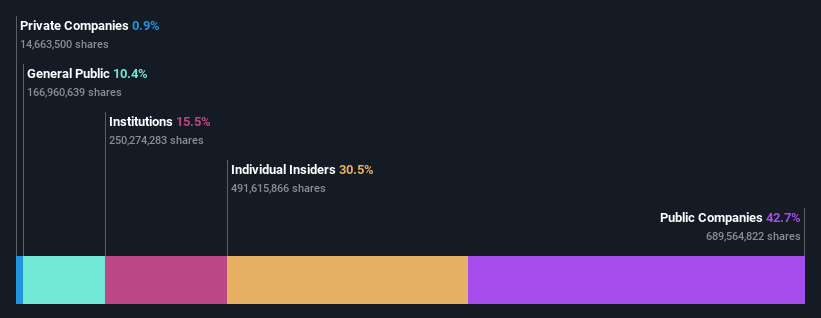

Insider Ownership: 30.5%

Earnings Growth Forecast: 37.8% p.a.

Unisem (M) Berhad, with significant insider ownership, is forecast to grow earnings significantly at 37.84% per year over the next three years, outpacing the Malaysian market's growth rate of 10.4%. However, its return on equity is projected to be low at 8.3%, and profit margins have declined from 9.6% to 5%. Recent earnings reports show increased sales but reduced net income compared to last year.

- Navigate through the intricacies of Unisem (M) Berhad with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Unisem (M) Berhad's shares may be trading at a premium.

Nordic Semiconductor (OB:NOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordic Semiconductor ASA is a fabless semiconductor company that designs, sells, and delivers integrated circuits for short- and long-range wireless applications across Europe, the Americas, and the Asia Pacific with a market cap of NOK25.25 billion.

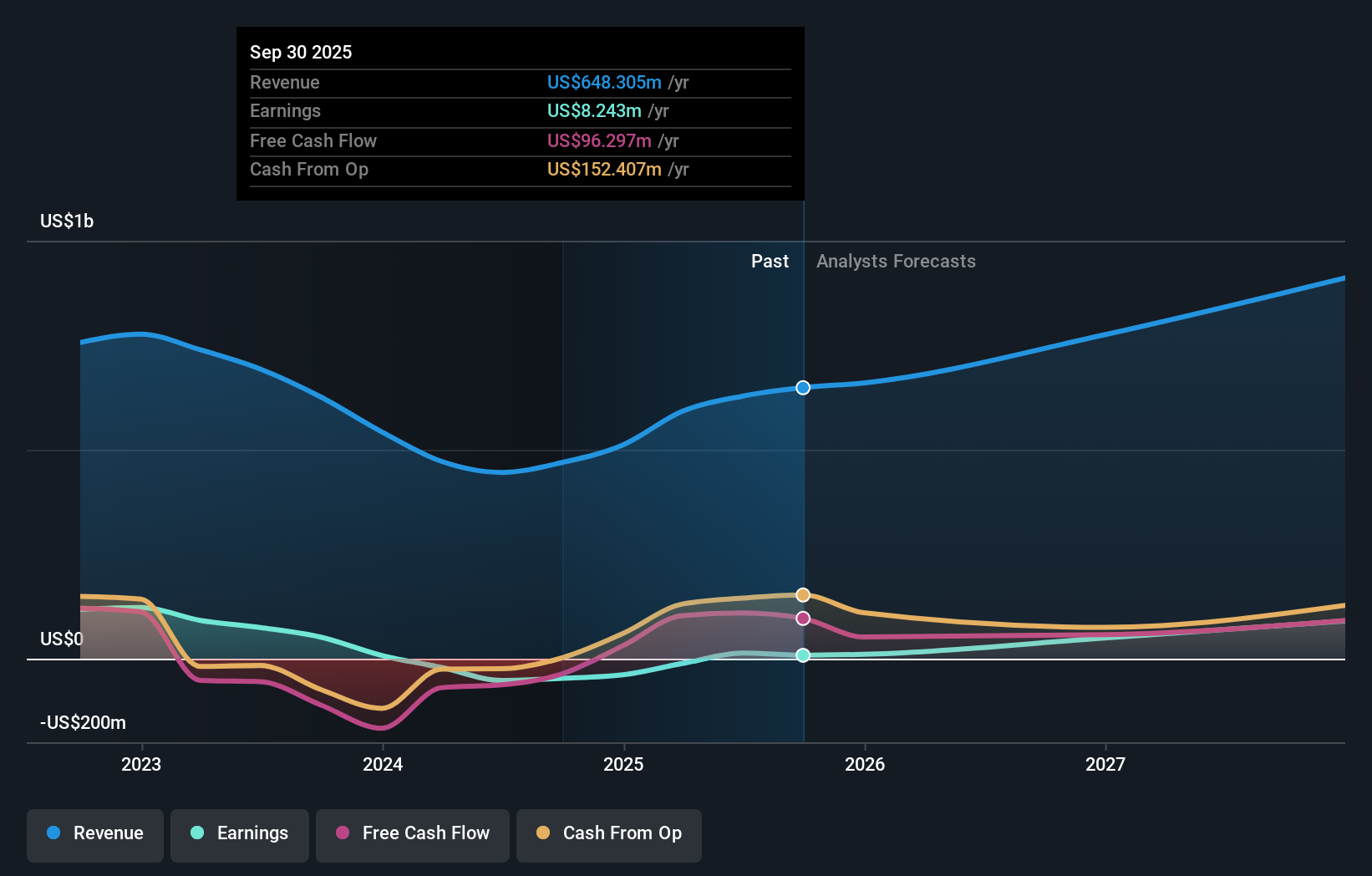

Operations: The company generates $445.67 million in revenue from the design and sale of integrated circuits and related solutions for wireless applications across Europe, the Americas, and the Asia Pacific.

Insider Ownership: 10.6%

Earnings Growth Forecast: 68.2% p.a.

Nordic Semiconductor, with high insider ownership, is forecast to grow earnings by 68.16% annually and become profitable within three years. Revenue is expected to increase by 18.7% per year, outpacing the Norwegian market's growth of 2.1%. Despite a recent quarterly net loss of US$15.05 million and a decline in sales to US$127.95 million, the company anticipates third-quarter revenue between US$150 million and US$170 million due to seasonally higher demand.

- Click to explore a detailed breakdown of our findings in Nordic Semiconductor's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Nordic Semiconductor shares in the market.

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

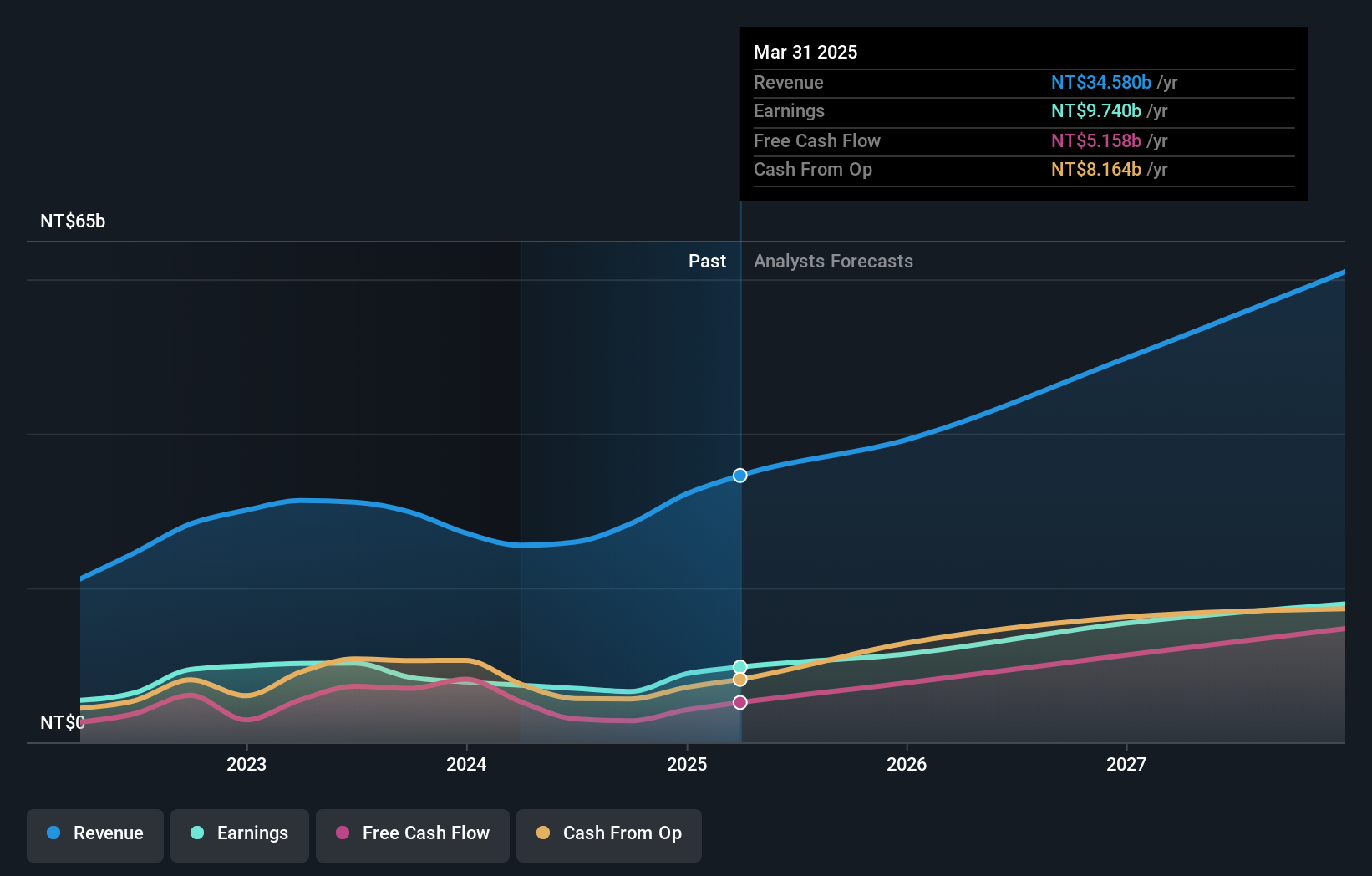

Overview: E Ink Holdings Inc. researches, develops, manufactures, and sells electronic paper display panels worldwide and has a market cap of NT$333.03 billion.

Operations: The company generates revenue primarily from electronic components and parts, amounting to NT$25.95 billion.

Insider Ownership: 10.8%

Earnings Growth Forecast: 35.8% p.a.

E Ink Holdings, with significant insider ownership, is forecast to grow revenue by 30.6% annually and earnings by 35.8% per year, outpacing the Taiwan market. Despite a recent decline in net income to TWD 2.02 billion for Q2 2024 from TWD 2.42 billion a year ago, the company remains undervalued at 28.9% below its fair value estimate and has announced major expansions including new production equipment worth TWD 1.49 billion and a syndicated loan of TWD 12 billion for operational capital enhancement.

- Unlock comprehensive insights into our analysis of E Ink Holdings stock in this growth report.

- Upon reviewing our latest valuation report, E Ink Holdings' share price might be too optimistic.

Taking Advantage

- Embark on your investment journey to our 1506 Fast Growing Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if E Ink Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8069

E Ink Holdings

Researches, develops, manufactures, and sells electronic paper display panels worldwide.

Exceptional growth potential with excellent balance sheet.