Stock Analysis

- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8069

High Growth Tech Stocks To Watch Now

Reviewed by Simply Wall St

With global markets responding positively to the recent Federal Reserve rate cut, small-cap indexes like the Russell 2000 have shown notable resilience, though they remain below their previous peaks. This environment of renewed investor optimism and economic indicators suggesting consumer strength creates an opportune moment to explore high-growth tech stocks that could benefit from these conditions. A good stock in this sector typically demonstrates strong revenue growth potential, innovative product offerings, and the ability to capitalize on current market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

Click here to see the full list of 1294 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

AppFolio (NasdaqGM:APPF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppFolio, Inc., along with its subsidiaries, offers cloud business management solutions tailored for the real estate sector in the United States and has a market cap of approximately $8.48 billion.

Operations: The company generates revenue primarily from its cloud-based business management software and value-added platforms, totaling $722.08 million. The focus is on providing tailored solutions for the real estate industry in the United States.

AppFolio's recent trajectory underscores a strategic pivot towards robust growth, evidenced by a significant uptick in R&D spending aimed at enhancing its software solutions. This investment in innovation is paying off, with revenue expected to climb by 16.9% annually, outpacing the US market average of 8.7%. Moreover, earnings are projected to surge by 20.5% per year, reflecting not only a recovery but also an aggressive expansion strategy that leverages advanced technologies and new executive leadership to streamline customer acquisition and service delivery. The appointment of Marcy Campbell as Chief Revenue Officer further aligns with this vision, promising to integrate and optimize sales processes while expanding market reach—a move critical for sustaining long-term growth in the competitive tech landscape.

- Unlock comprehensive insights into our analysis of AppFolio stock in this health report.

Gain insights into AppFolio's historical performance by reviewing our past performance report.

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

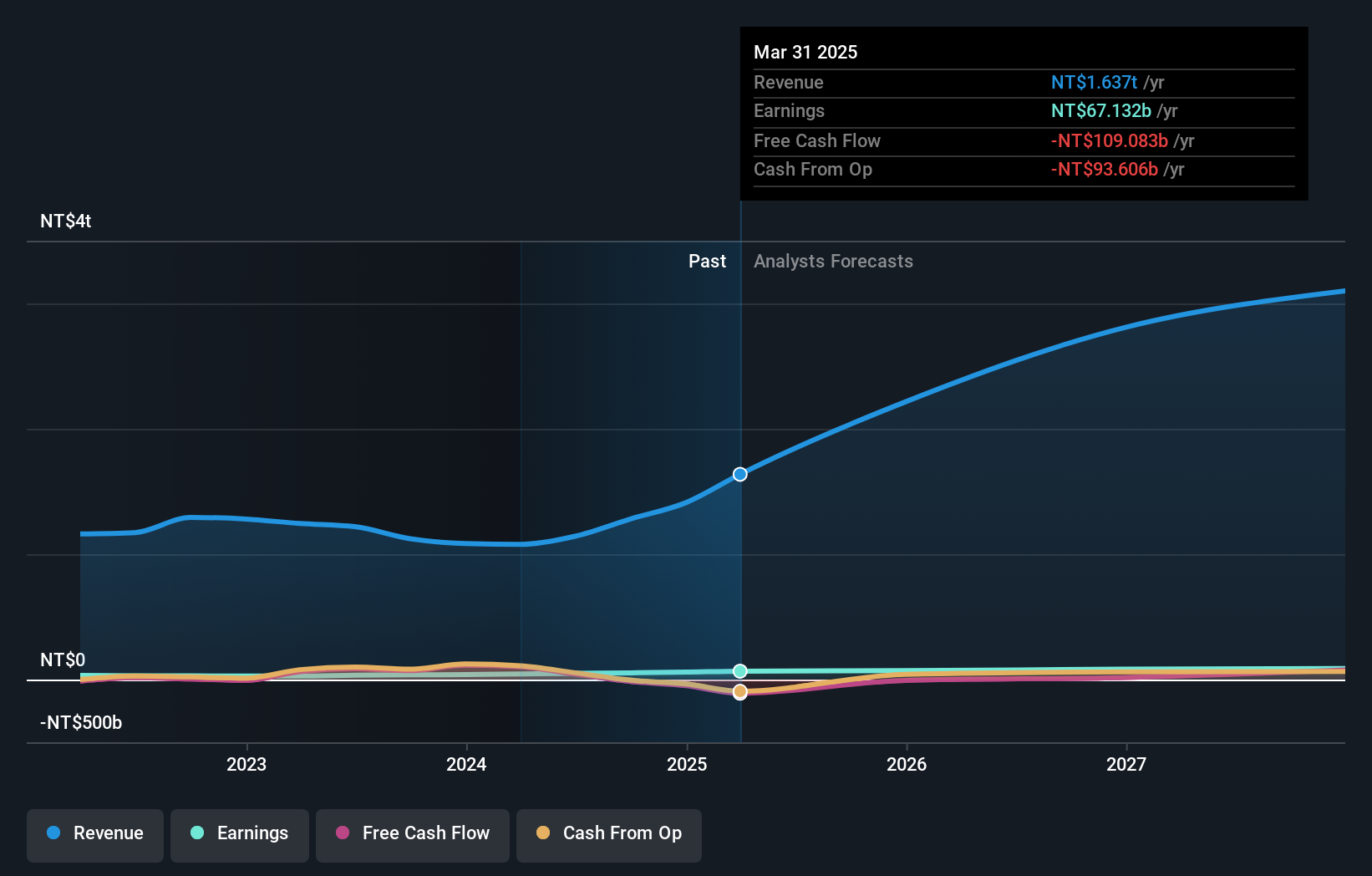

Overview: E Ink Holdings Inc. researches, develops, manufactures, and sells electronic paper display panels worldwide with a market cap of NT$356.06 billion.

Operations: E Ink Holdings generates revenue primarily from the sale of electronic components and parts, totaling NT$25.95 billion. The company focuses on the research, development, manufacturing, and sales of electronic paper display panels globally.

E Ink Holdings, amidst a challenging backdrop with a 31.9% dip in earnings last year, is steering towards recovery with strategic expansions and technological advancements. The company's commitment to innovation is evident from its recent launch of the T2000 TCON for color ePaper displays, enhancing speed and reducing power consumption—critical for the future of digital reading platforms. Despite these efforts, revenue dipped slightly to TWD 13.3 billion in the first half of 2024 from TWD 14.5 billion previously; however, E Ink's projected annual revenue growth at 30.6% and earnings surge at 35.8% suggest robust future prospects if current strategies hold steady.

- Delve into the full analysis health report here for a deeper understanding of E Ink Holdings.

Review our historical performance report to gain insights into E Ink Holdings''s past performance.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quanta Computer Inc. manufactures and sells notebook computers globally, with a market cap of NT$990.61 billion.

Operations: The company generates revenue primarily from its Electronics Sector, which accounted for NT$2.50 trillion. The cost breakdown includes adjustments and eliminations amounting to -NT$1.36 trillion.

Quanta Computer, amidst a backdrop of strategic financial maneuvers including a $1 billion unsecured overseas convertible bond issue, continues to demonstrate robust financial health with a 36.8% annual revenue growth rate outpacing the Taiwanese market's 11.7%. This growth is complemented by an impressive earnings surge of 44.3% over the past year, significantly ahead of the tech industry's average of 11.9%. The company's commitment to R&D is evident as it channels substantial funds into innovation—19.3% of its revenue—fueling advancements that could redefine competitive dynamics in technology sectors, particularly in hardware integration and AI solutions development.

- Get an in-depth perspective on Quanta Computer's performance by reading our health report here.

Assess Quanta Computer's past performance with our detailed historical performance reports.

Where To Now?

- Gain an insight into the universe of 1294 High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E Ink Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8069

E Ink Holdings

Researches, develops, manufactures, and sells electronic paper display panels worldwide.