As global markets experience a tumultuous period marked by busy earnings reports and economic uncertainties, small-cap stocks have shown resilience compared to their larger counterparts. Amidst this backdrop, identifying high-growth tech stocks requires a keen eye on innovation potential and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Pharma Mar | 26.94% | 55.09% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.50% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

SUNeVision Holdings (SEHK:1686)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SUNeVision Holdings Ltd. is an investment holding company that offers data centre and IT facility services in Hong Kong, with a market capitalization of approximately HK$15.95 billion.

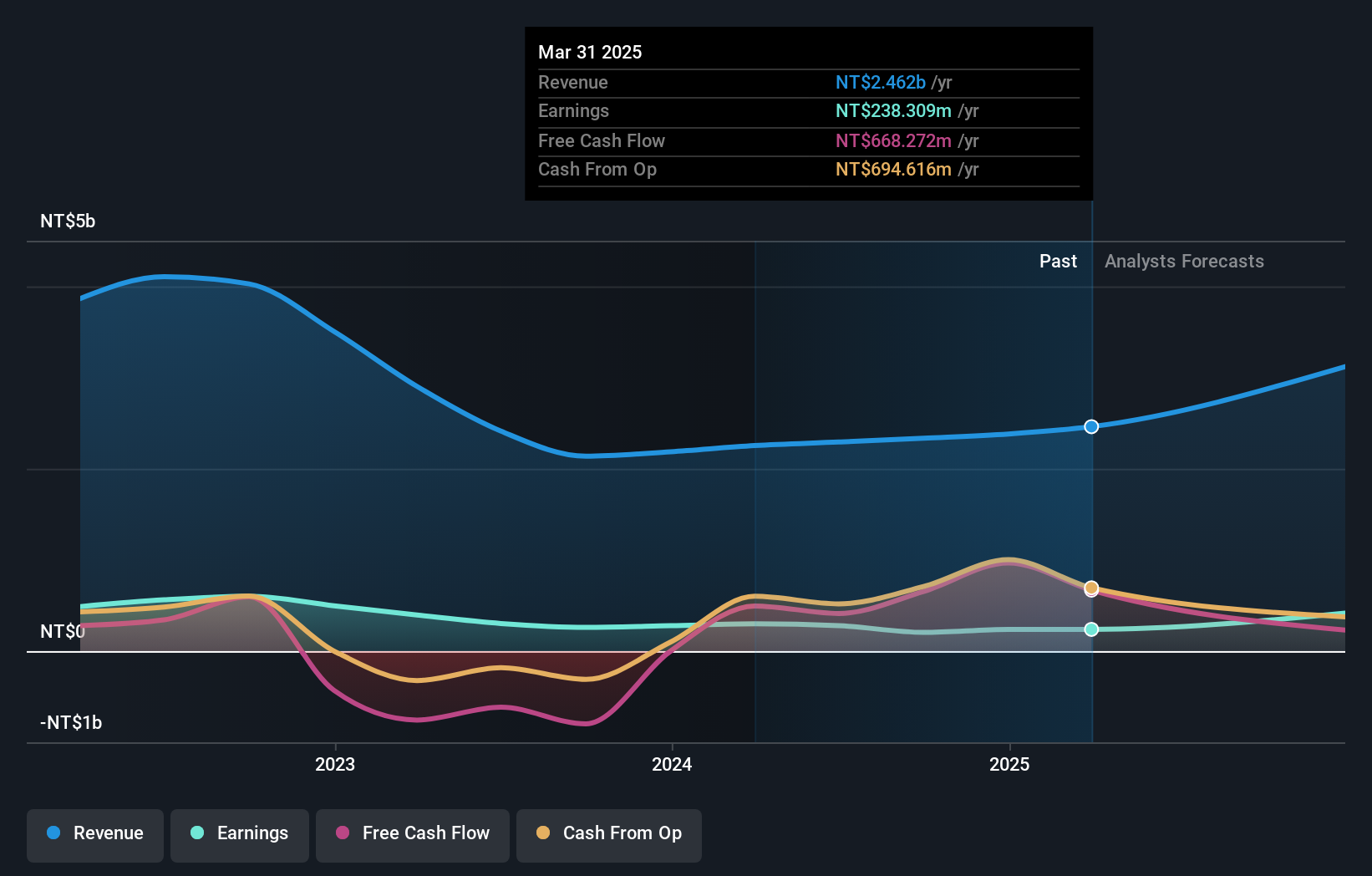

Operations: SUNeVision generates revenue primarily from its data centre and IT facility services, amounting to HK$2.46 billion, and extra-low voltage (ELV) and IT systems, contributing HK$213.03 million.

SUNeVision Holdings, recently added to the S&P Global BMI Index, demonstrates a robust growth trajectory with its revenue expected to increase by 15.1% annually, outpacing Hong Kong's market average of 7.8%. This growth is supported by significant R&D investment, aligning with industry shifts towards more digitally integrated infrastructure solutions. Despite a modest earnings increase of 0.2% over the past year, SUNeVision's strategic amendments in corporate communications and treasury shares management suggest proactive governance adapting to evolving market demands. The company's recent approval of new bylaws at its AGM further exemplifies its commitment to maintaining relevance and competitiveness in the fast-evolving tech landscape.

- Click here to discover the nuances of SUNeVision Holdings with our detailed analytical health report.

Examine SUNeVision Holdings' past performance report to understand how it has performed in the past.

Guangzhou Hexin InstrumentLtd (SHSE:688622)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Hexin Instrument Co., Ltd. focuses on the research and development, production, sale, and technical services of mass spectrometry products in China with a market capitalization of CN¥2.08 billion.

Operations: Hexin Instrument specializes in mass spectrometry products, emphasizing research, development, production, sales, and technical services within China. The company's operations are supported by a market capitalization of CN¥2.08 billion.

Guangzhou Hexin Instrument Co., Ltd. is navigating a challenging landscape with a reported 67% annual revenue growth, significantly outstripping the Chinese market's 14% average. This surge is underpinned by an aggressive R&D strategy, where expenses are strategically allocated to foster innovations that promise substantial market impact. Despite recent financial reports showing a narrowing net loss—from CNY 55 million to CNY 22.15 million—indicating improved operational efficiency, earnings are forecasted to grow by an impressive 201.5% annually over the next three years. This potential turnaround is critical as the company aims to transition from current unprofitability towards sustainable profitability, leveraging its enhanced product offerings and strategic market positioning in high-tech instrumentation.

- Navigate through the intricacies of Guangzhou Hexin InstrumentLtd with our comprehensive health report here.

Learn about Guangzhou Hexin InstrumentLtd's historical performance.

AMPAK Technology (TPEX:6546)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AMPAK Technology Inc. is involved in the research, development, design, production, and marketing of wireless modules in Taiwan with a market capitalization of NT$8.18 billion.

Operations: AMPAK Technology focuses on the production and marketing of wireless communication products, generating revenue of NT$2.29 billion from this segment.

AMPAK Technology, amidst a dynamically shifting tech landscape, reported a modest dip in net income to TWD 60.09 million this quarter from TWD 79.67 million previously, despite an increase in sales to TWD 607.2 million from TWD 568.18 million year-over-year. This performance is set against a backdrop of significant R&D investment aimed at innovation and market adaptation, with forecasts suggesting robust annual earnings growth of 56.92%. The firm's commitment to research has strategically positioned it for anticipated revenue surges of 37.6% annually, outpacing the broader Taiwanese market's growth projections of just 12.3%. This aggressive focus on development underscores AMPAK’s potential within high-tech sectors, despite current earnings fluctuations and a highly volatile share price over the past three months.

Next Steps

- Investigate our full lineup of 1291 High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1686

SUNeVision Holdings

An investment holding company, provides data centre and information technology (IT) facility services in Hong Kong.

Reasonable growth potential and fair value.