- China

- /

- Electronic Equipment and Components

- /

- SHSE:688056

High Growth Tech And 2 Other Promising Stocks with Potential Growth

Reviewed by Simply Wall St

In recent weeks, global markets have been buoyed by record highs in key indices like the Dow Jones Industrial Average and S&P 500, while small-cap stocks such as those in the Russell 2000 Index have also reached new peaks. Against this backdrop of robust market activity and fluctuating geopolitical influences, identifying promising stocks often involves assessing their potential for innovation and growth within sectors that are poised to benefit from current economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.23% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Beijing Labtech Instruments (SHSE:688056)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Labtech Instruments Co., Ltd. manufactures and supplies laboratory products and solutions globally, with a market cap of CN¥2.06 billion.

Operations: Labtech generates revenue primarily from the sale of laboratory products and solutions to the global laboratory industry.

Beijing Labtech Instruments has demonstrated a robust financial performance, with its sales rising to CNY 311.09 million in the recent nine months, up from CNY 299.95 million the previous year, and net income increasing notably to CNY 35.1 million from CNY 26.66 million. This growth is underpinned by a strategic emphasis on R&D investments which are crucial for maintaining competitive advantage in the fast-evolving tech landscape; however, it's worth noting that despite these efforts, their revenue growth forecast of 15.4% annually trails behind the ideal high-growth benchmark of over 20%. Moreover, while earnings are expected to surge by an impressive annual rate of approximately 26.5%, this figure just slightly edges out the broader Chinese market's expectation of a 26.2% increase. The company’s commitment to innovation is evident from its consistent investment in research and development which not only fuels future growth but also enhances its product offerings - crucial for staying relevant in technology sectors where rapid changes are commonplace. Yet, challenges remain as evidenced by their slower-than-desired revenue acceleration and past negative earnings growth compared to industry averages; such factors could impact long-term sustainability if not addressed effectively alongside their promising profit projections.

- Navigate through the intricacies of Beijing Labtech Instruments with our comprehensive health report here.

Understand Beijing Labtech Instruments' track record by examining our Past report.

Innodisk (TPEX:5289)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Innodisk Corporation is engaged in the research, development, manufacturing, and sales of industrial embedded storage devices across various international markets including Taiwan, Asia, Japan, Germany, China, Europe, and the United States with a market capitalization of NT$21.69 billion.

Operations: The company primarily generates revenue through the research and development of various industrial memory storage devices, contributing NT$8.82 billion to its financial performance.

Innodisk's recent financial performance and product innovations underscore its strategic positioning in the tech sector. Despite a dip in net income to TWD 834.64 million from TWD 885.38 million over nine months, sales grew to TWD 6,687.64 million from TWD 6,183.73 million year-over-year, reflecting a solid revenue uptick of 17.8%. The company's commitment to R&D is evident with the launch of its DDR5 6400 DRAM series and AI-based InnoPPE recognition solution, targeting high-demand areas like AI and industrial safety—sectors poised for rapid expansion due to technological advancements and stringent regulatory standards. These initiatives are part of why earnings are expected to surge by an impressive annual rate of approximately 22.7%, outpacing the broader Taiwanese market's growth expectations.

- Click to explore a detailed breakdown of our findings in Innodisk's health report.

Review our historical performance report to gain insights into Innodisk's's past performance.

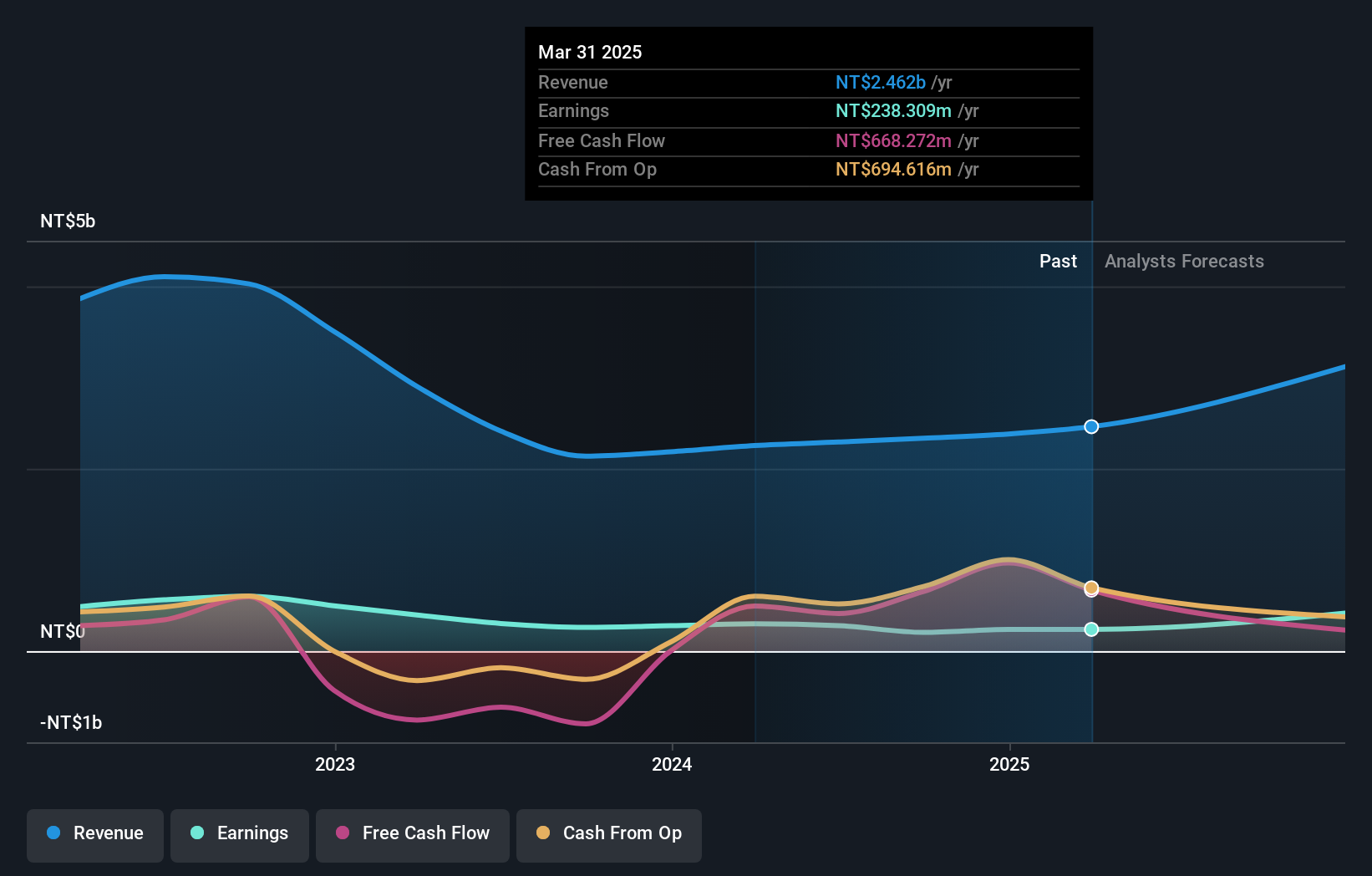

AMPAK Technology (TPEX:6546)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AMPAK Technology Inc. focuses on the research, development, design, production, and marketing of wireless modules in Taiwan with a market capitalization of NT$9.17 billion.

Operations: AMPAK Technology Inc. generates revenue primarily from its wireless communication products, amounting to NT$2.33 billion. The company is involved in various stages of the wireless module value chain, including research and development, design, production, and marketing.

AMPAK Technology, amid a challenging quarter, reported a decline in net income to TWD 44.24 million from TWD 117.87 million year-over-year, despite an increase in sales to TWD 645.47 million from TWD 603.74 million in the same period. This juxtaposition highlights resilience in revenue growth of 41.7% annually, yet underscores pressures on profitability with earnings expected to surge by an impressive annual rate of approximately 83.2%. The company's strategic focus on R&D is evident as expenses soared, reflecting its commitment to capturing emerging tech trends and securing competitive advantage in the fast-evolving telecommunications sector.

Make It Happen

- Take a closer look at our High Growth Tech and AI Stocks list of 1286 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Labtech Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688056

Beijing Labtech Instruments

Manufactures and supplies laboratory products and solutions to laboratory industry worldwide.

Flawless balance sheet with reasonable growth potential.