- Taiwan

- /

- Communications

- /

- TPEX:6546

Exploring Three High Growth Tech Stocks For Potential Opportunities

Reviewed by Simply Wall St

As global markets continue to react positively to potential trade developments and AI investments, major indexes like the S&P 500 have reached record highs, with growth stocks outperforming value shares. In this dynamic environment, identifying high-growth tech stocks involves considering factors such as exposure to emerging technologies and adaptability to evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

LuxNet (TPEX:4979)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LuxNet Corporation, with a market cap of NT$34.15 billion, operates in Taiwan where it manufactures, processes, and sells electric and optical communication components.

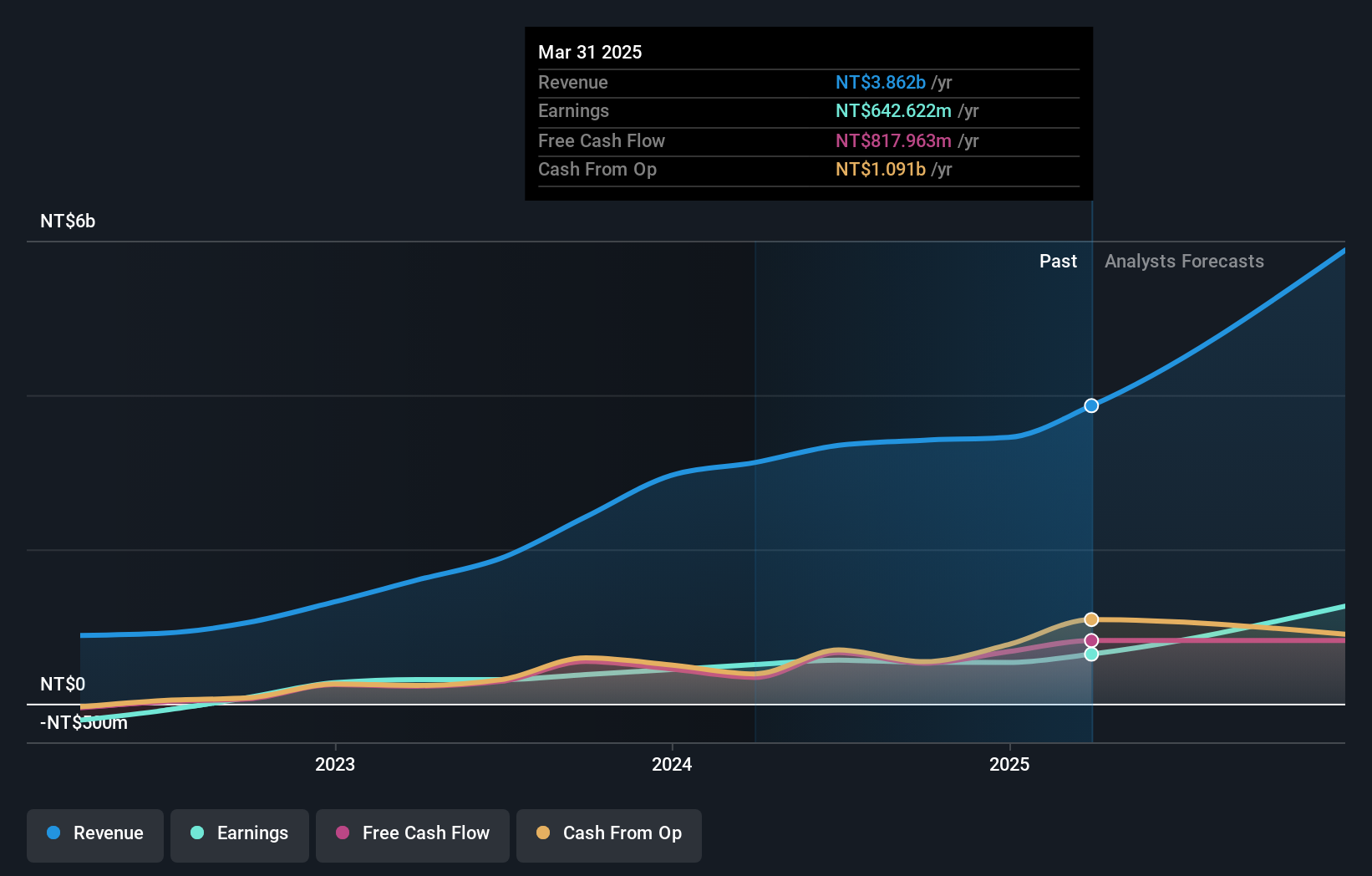

Operations: The company generates revenue primarily through its Optical Communication System Active Components segment, which contributes NT$3.41 billion.

LuxNet, amidst a dynamic tech landscape, is demonstrating robust growth with its annual revenue and earnings expanding by 26% and 29.5% respectively. This performance outpaces the broader Taiwanese market's growth rates of 11.3% for revenue and 17.4% for earnings, underscoring LuxNet's competitive edge in the communications sector. Recent strategic executive shifts aim to further enhance this trajectory, with new appointments poised to leverage deep industry expertise for continued innovation and market expansion. Notably, the company's commitment to R&D is evident from its significant investment in this area, ensuring LuxNet remains at the forefront of technological advancements while fostering sustainable growth.

- Dive into the specifics of LuxNet here with our thorough health report.

Explore historical data to track LuxNet's performance over time in our Past section.

Innodisk (TPEX:5289)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Innodisk Corporation is engaged in the research, development, manufacturing, and sales of industrial embedded storage devices across Taiwan and globally, with a market capitalization of approximately NT$18.68 billion.

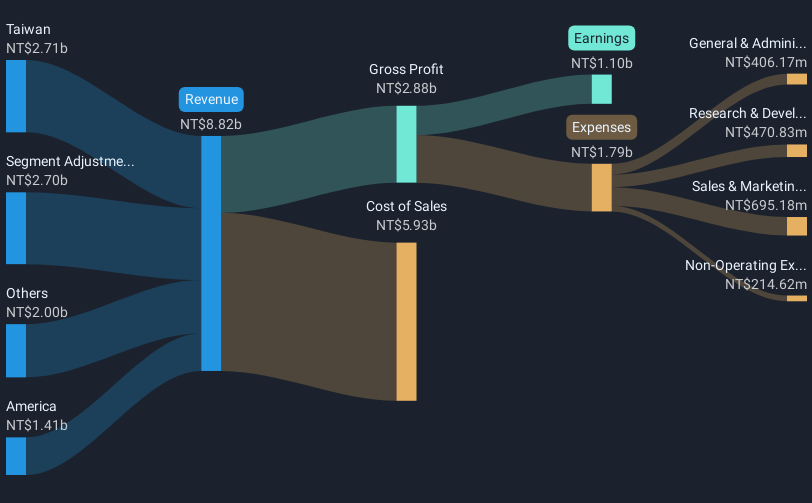

Operations: Innodisk Corporation generates revenue primarily from the research and development of various industrial memory storage devices, amounting to NT$8.82 billion. The company operates in multiple regions, including Asia, Japan, Germany, China, Europe, and the United States.

Innodisk's recent unveiling of its DDR5 6400 DRAM series marks a strategic pivot towards high-performance memory solutions, essential for AI and edge computing applications. This innovation, featuring the industry's first 64GB module, aligns with a 14.6% annual revenue growth, outstripping the broader Taiwanese market's 11.3%. Despite a dip in net income to TWD 834.64 million from TWD 885.38 million over nine months, Innodisk is poised for robust future earnings growth projected at an impressive rate of 22.1% annually—well above the market average of 17.4%. These developments underscore Innodisk’s commitment to advancing tech infrastructure amidst evolving digital demands.

- Take a closer look at Innodisk's potential here in our health report.

Examine Innodisk's past performance report to understand how it has performed in the past.

AMPAK Technology (TPEX:6546)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AMPAK Technology Inc. is involved in the research, design, development, production, marketing, and sale of wireless modules in Taiwan with a market capitalization of NT$9 billion.

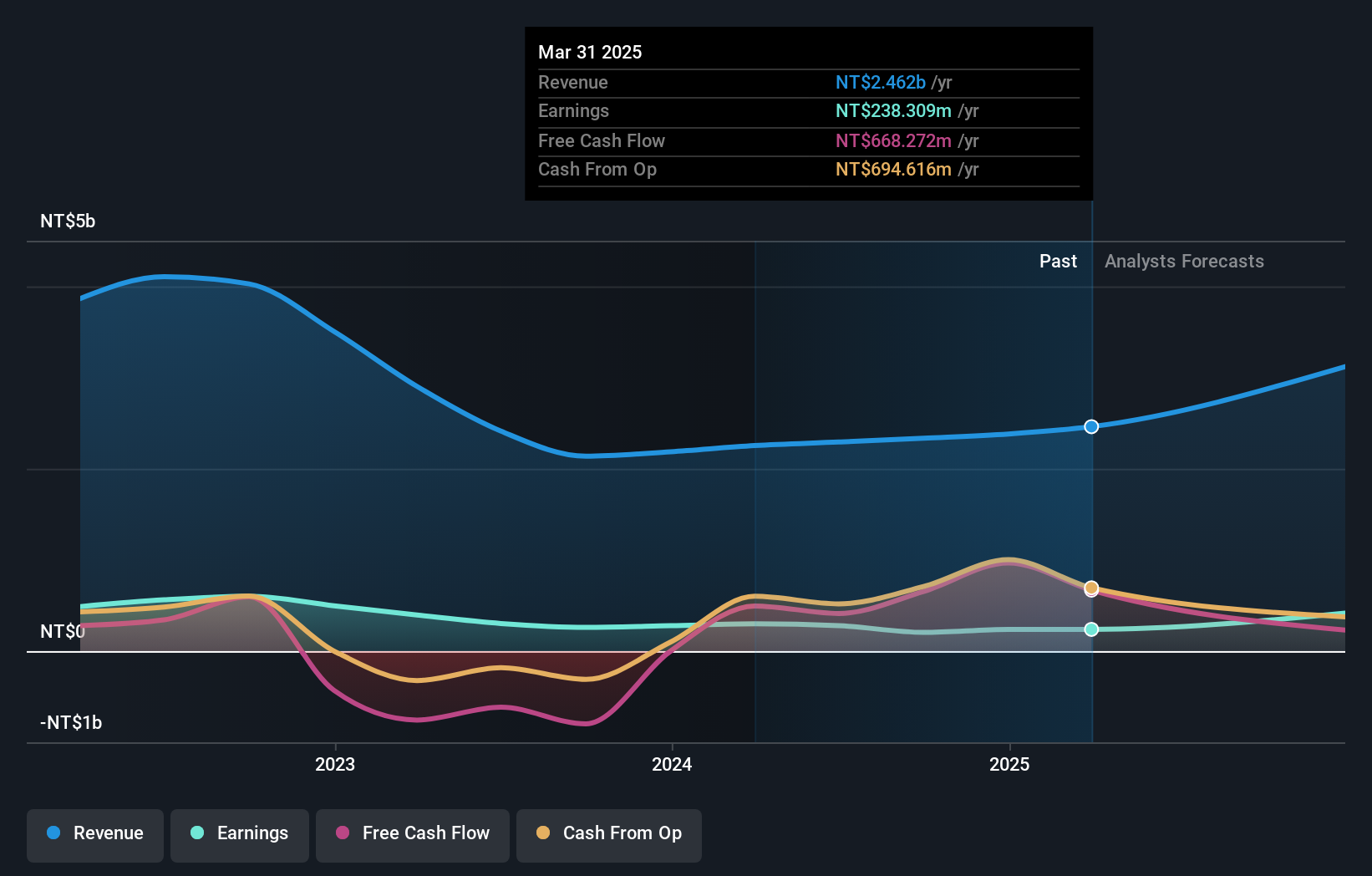

Operations: AMPAK Technology focuses on wireless communication products, generating revenue of NT$2.33 billion. The company's business model centers around the production and sale of these modules, contributing to its market presence in Taiwan.

AMPAK Technology, amidst a challenging quarter, still managed to post a 7% increase in sales to TWD 645.47 million, reflecting resilience in its market positioning. However, the company witnessed a significant reduction in net income to TWD 44.24 million from TWD 117.87 million previously, indicating potential areas for strategic realignment. Despite these hurdles, AMPAK's annual revenue growth of 41.7% outpaces the broader Taiwanese market's expansion by over threefold, underscoring its potential amid industry volatility and evolving technological demands. This performance is bolstered by an aggressive R&D stance which is crucial for sustaining innovation and competitive edge in the fast-paced tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of AMPAK Technology.

Understand AMPAK Technology's track record by examining our Past report.

Next Steps

- Navigate through the entire inventory of 1231 High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6546

AMPAK Technology

Engages in the research, design, development, production, market, and sale of wireless module in Taiwan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives