- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3548

Discovering Undiscovered Gems With Potential In November 2024

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have seen significant movements, with small-cap stocks like those in the Russell 2000 Index experiencing notable gains but still trailing their all-time highs. As investors navigate this dynamic landscape marked by expectations of looser regulations and lower corporate taxes, identifying promising small-cap stocks can be key to capitalizing on potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Realia Business (BME:RLIA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Realia Business, S.A. is involved in the development, management, and rental of real estate activities in Spain and Romania with a market cap of €819.20 million.

Operations: Realia generates revenue primarily through its real estate development, management, and rental activities in Spain and Romania. The company's financial performance is reflected in its market capitalization of €819.20 million.

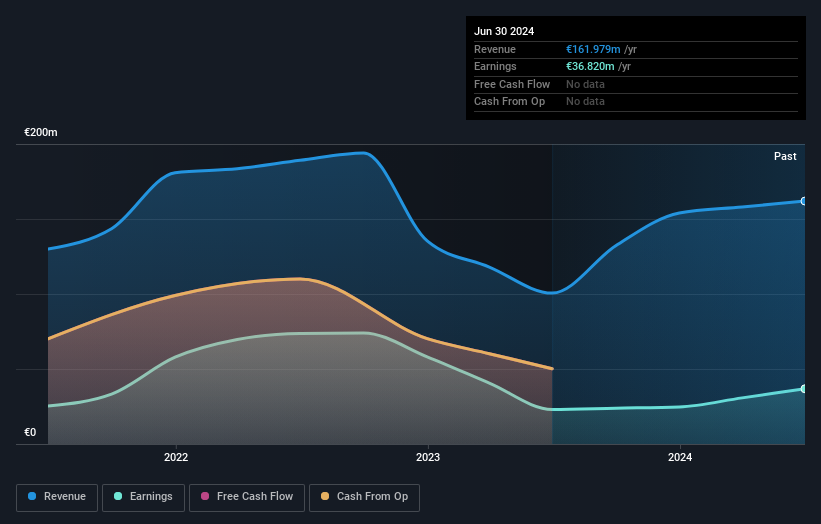

Realia Business, a smaller player in the real estate sector, has shown impressive earnings growth of 59.7% over the past year, outpacing the industry average of 19.5%. However, a significant one-off loss of €24M (€24.1M) affected its recent financial performance as of June 2024. On the brighter side, Realia's debt to equity ratio improved from 47.7% to 38% over five years, with its net debt to equity standing at a satisfactory 33%. Despite these strengths, potential investors should note the stock's high volatility in recent months and limited data on free cash flow sustainability.

- Unlock comprehensive insights into our analysis of Realia Business stock in this health report.

Assess Realia Business' past performance with our detailed historical performance reports.

Pan-United (SGX:P52)

Simply Wall St Value Rating: ★★★★★★

Overview: Pan-United Corporation Ltd is an investment holding company involved in the concrete and logistics sectors both in Singapore and internationally, with a market capitalization of SGD390.39 million.

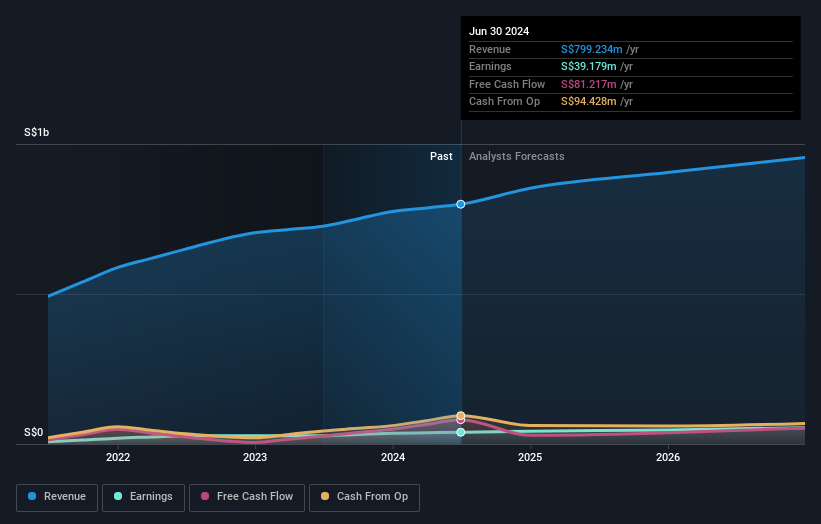

Operations: Pan-United's primary revenue stream comes from its Concrete & Cement segment, generating SGD784.60 million, while its Trading and Shipping segment contributes SGD16.76 million.

Pan-United, a smaller player in the market, showcases promising characteristics with earnings growth of 41.3% over the past year, outpacing its industry peers who saw an 8.2% downturn. The company's debt to equity ratio has impressively decreased from 59.9% to 6.4% in five years, indicating strong financial discipline and management effectiveness. Furthermore, Pan-United's interest payments are comfortably covered by EBIT at a ratio of 20.6 times, reflecting robust operational performance and financial health that supports future growth potential without immediate liquidity concerns or capital constraints.

- Navigate through the intricacies of Pan-United with our comprehensive health report here.

Explore historical data to track Pan-United's performance over time in our Past section.

Jarllytec (TPEX:3548)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jarllytec Co., Ltd. is engaged in the design, development, manufacturing, assembly, inspection, and sale of stamping parts, hinges, and metal injections/MIM across China, the United States, Thailand, Taiwan, and international markets with a market cap of approximately NT$9.95 billion.

Operations: Jarllytec generates revenue primarily from its Hub Segment, contributing NT$9.37 billion, while the Optical Fiber Segment adds NT$222.49 million.

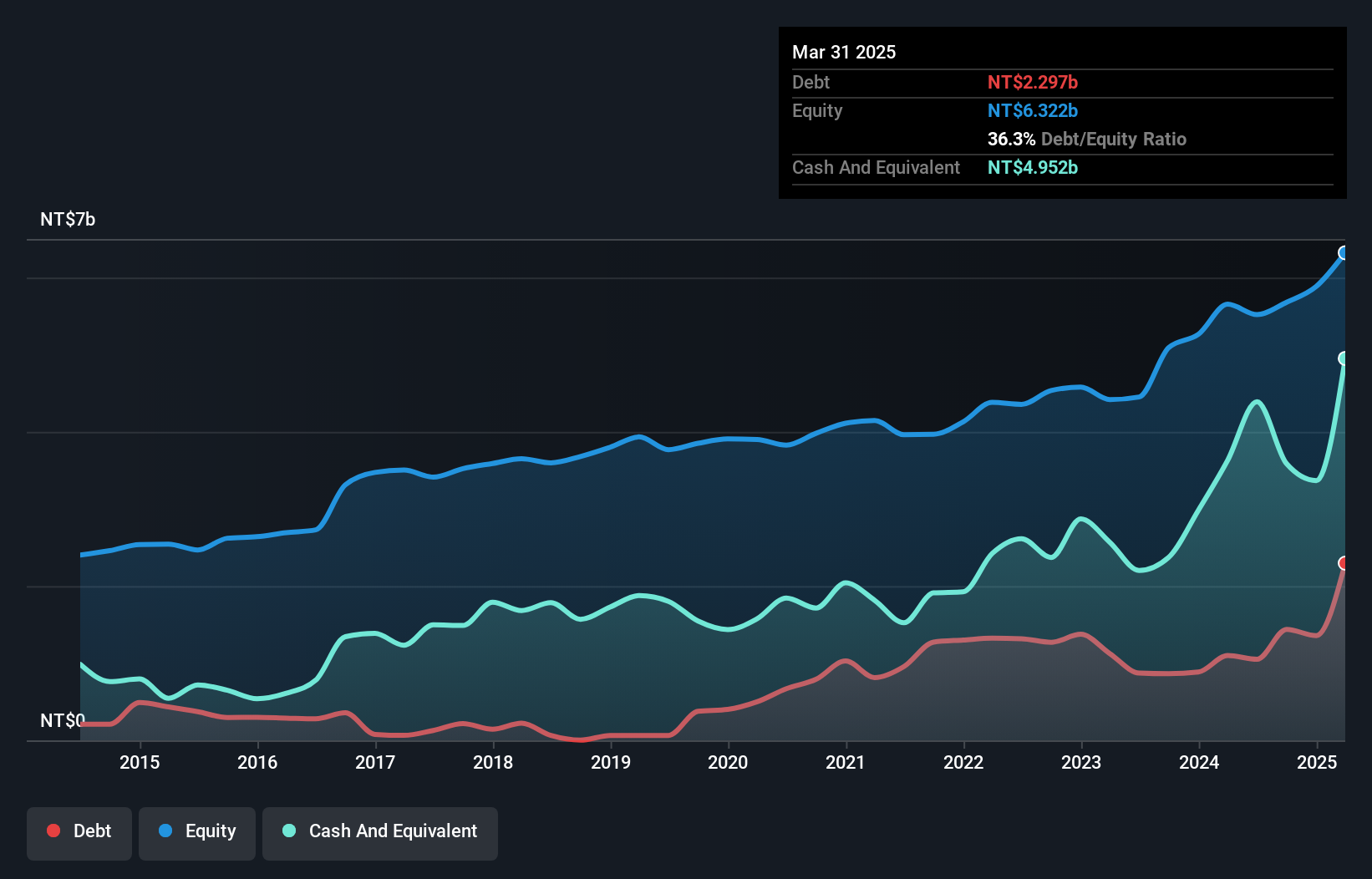

Jarllytec, a nimble player in its field, has shown impressive growth with earnings surging by 111.3% over the past year, outpacing the electronic industry’s 5.8%. Despite a volatile share price recently, it trades at a significant discount of 90.4% below estimated fair value. The company boasts more cash than total debt but saw its debt-to-equity ratio rise from 1.7% to 19% over five years. Recent financials highlight robust performance; second-quarter sales reached TWD 2,284 million compared to TWD 1,971 million last year and net income increased to TWD 164 million from TWD 122 million previously.

- Click here to discover the nuances of Jarllytec with our detailed analytical health report.

Gain insights into Jarllytec's historical performance by reviewing our past performance report.

Key Takeaways

- Gain an insight into the universe of 4666 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3548

Jarllytec

Designs, develops, manufactures, assembles, inspects, and sells stamping parts, hinges, and metal injections/MIM in China, the United States, Thailand, Taiwan, and internationally.

Solid track record with excellent balance sheet and pays a dividend.