Stock Analysis

- Taiwan

- /

- Tech Hardware

- /

- TPEX:3324

Exploring High Growth Tech Stocks In November 2024

Reviewed by Simply Wall St

As global markets respond to the recent U.S. election results, with major indices like the S&P 500 and Russell 2000 experiencing significant gains, investors are keenly observing how these political shifts might influence economic growth and corporate taxation policies. In this dynamic environment, identifying high-growth tech stocks involves assessing companies that can leverage favorable tax conditions and regulatory landscapes to drive innovation and expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1283 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Victory Giant Technology (HuiZhou)Co.Ltd (SZSE:300476)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Victory Giant Technology (HuiZhou) Co., Ltd. is a company engaged in the manufacturing of printed circuit boards, with a market capitalization of approximately CN¥39.74 billion.

Operations: The company primarily generates revenue through its printed circuit board (PCB) manufacturing segment, which accounts for CN¥9.41 billion. The company's net profit margin exhibits a notable trend, reflecting its operational efficiency in the PCB market.

Victory Giant Technology (HuiZhou)Co.Ltd has demonstrated robust financial performance, with revenue surging by 21.6% annually, significantly outpacing the broader Chinese market's growth of 13.9%. This growth trajectory is underpinned by substantial R&D investments, which have consistently accounted for a significant portion of their revenue, emphasizing their commitment to innovation and technological advancement. Moreover, the company's earnings have seen a remarkable increase of 35.2% per year, suggesting efficient operational execution and strategic market positioning. Recent activities also highlight their proactive approach to shareholder value through share repurchase programs and adjustments in corporate governance aimed at enhancing organizational effectiveness and compliance.

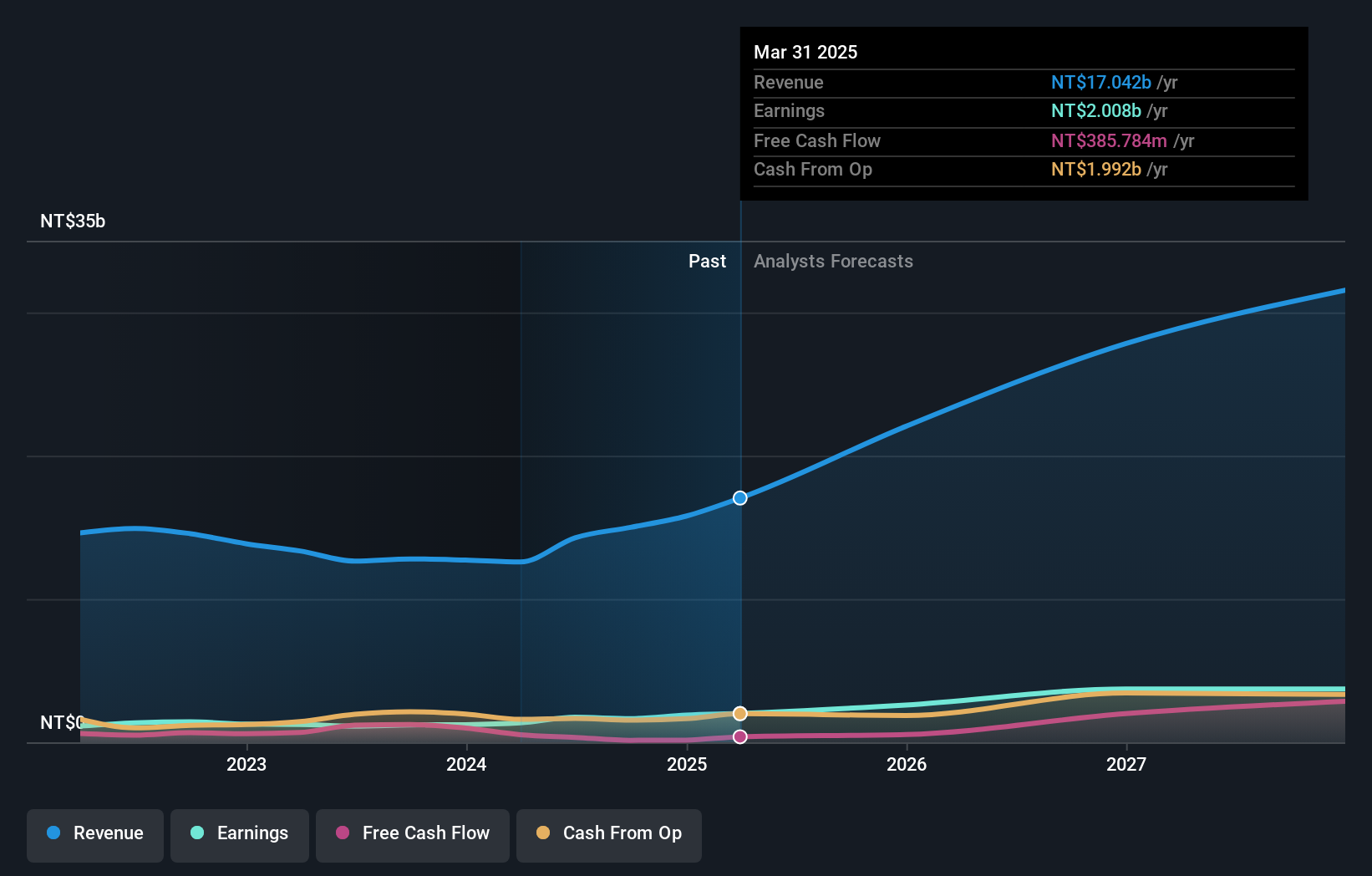

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

Overview: Auras Technology Co., Ltd. is involved in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across China, Taiwan, Ireland, Singapore, the United States, and internationally with a market cap of NT$60.65 billion.

Operations: Auras Technology focuses on producing and selling electronic materials and computer cooling modules globally. The company operates in various international markets, including China, Taiwan, Ireland, Singapore, and the United States.

Auras Technology, amidst a challenging market, reported a notable 25.3% annual revenue growth to TWD 11.65 billion and a surge in net income by 36.3%, reflecting robust operational efficiency and market demand for its innovative tech solutions. The firm's commitment to innovation is evident from its R&D spending, which remains integral to its strategy, fostering advancements that resonate well at numerous industry conferences globally. Despite a volatile share price recently, Auras's aggressive R&D investment aligns with its forward-looking growth trajectory in the tech sector.

- Take a closer look at Auras Technology's potential here in our health report.

Understand Auras Technology's track record by examining our Past report.

Accton Technology (TWSE:2345)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Accton Technology Corporation engages in the research, development, manufacturing, and sale of network communication equipment across Taiwan, America, Asia, Europe, and other international markets with a market cap of NT$326.09 billion.

Operations: Accton Technology focuses on the development and sale of network communication equipment across various global markets, including Taiwan, America, Asia, and Europe. The company operates with a market cap of NT$326.09 billion.

Accton Technology has demonstrated robust financial performance with a 25.7% increase in third-quarter revenue year-over-year, reaching TWD 28.19 billion, and a net income rise to TWD 2.65 billion from TWD 2.39 billion previously. This growth is underpinned by strategic R&D investments, which have surged by 21.7%, emphasizing the company's commitment to innovation in hyperscale data center technologies and AI applications. Recent product launches include advanced network solutions for AI-driven environments, showcasing at industry events like the OCP Global Summit, highlight Accton's pivotal role in evolving tech infrastructures critical for next-gen AI and ML deployments.

Key Takeaways

- Click this link to deep-dive into the 1283 companies within our High Growth Tech and AI Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3324

Auras Technology

Engages in the manufacturing, processing, and retailing of electronic materials and computer cooling modules in China, Taiwan, Ireland, Singapore, the United States, and internationally.