- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3128

Hi Sharp Electronics Co., Ltd. (GTSM:3128) Has Fared Decently But Fundamentals Look Uncertain: What Lies Ahead For The Stock?

Most readers would already know that Hi Sharp Electronics' (GTSM:3128) stock increased by 1.6% over the past week. However, the company's financials look a bit inconsistent and market outcomes are ultimately driven by long-term fundamentals, meaning that the stock could head in either direction. Specifically, we decided to study Hi Sharp Electronics' ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Hi Sharp Electronics

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hi Sharp Electronics is:

4.3% = NT$25m ÷ NT$574m (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each NT$1 of shareholders' capital it has, the company made NT$0.04 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Hi Sharp Electronics' Earnings Growth And 4.3% ROE

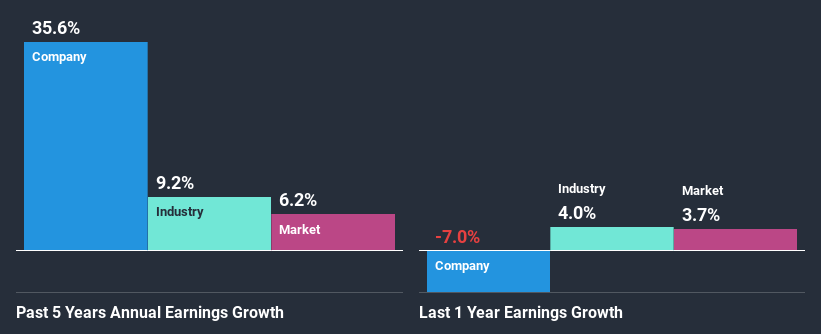

On the face of it, Hi Sharp Electronics' ROE is not much to talk about. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 9.9% either. Despite this, surprisingly, Hi Sharp Electronics saw an exceptional 36% net income growth over the past five years. So, there might be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

As a next step, we compared Hi Sharp Electronics' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 9.2%.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Hi Sharp Electronics''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Hi Sharp Electronics Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 90% (implying that it keeps only 9.9% of profits) for Hi Sharp Electronics suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Moreover, Hi Sharp Electronics is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Summary

Overall, we have mixed feelings about Hi Sharp Electronics. Although the company has shown a pretty impressive growth in earnings, yet the low ROE and the low rate of reinvestment makes us skeptical about the continuity of that growth, especially when or if the business comes to face any threats. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Hi Sharp Electronics and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

When trading Hi Sharp Electronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hi Sharp Intelligence TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:3128

Hi Sharp Intelligence TechnologyLtd

Hi Sharp Intelligence Technology Co.,Ltd.

Proven track record with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026