Easy Come, Easy Go: How ThroughTek (GTSM:6565) Shareholders Got Unlucky And Saw 74% Of Their Cash Evaporate

ThroughTek Co., Ltd. (GTSM:6565) shareholders should be happy to see the share price up 11% in the last month. But the last three years have seen a terrible decline. To wit, the share price sky-dived 74% in that time. Arguably, the recent bounce is to be expected after such a bad drop. Only time will tell if the company can sustain the turnaround.

View our latest analysis for ThroughTek

Because ThroughTek made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, ThroughTek's revenue dropped 9.4% per year. That's not what investors generally want to see. The share price fall of 36% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

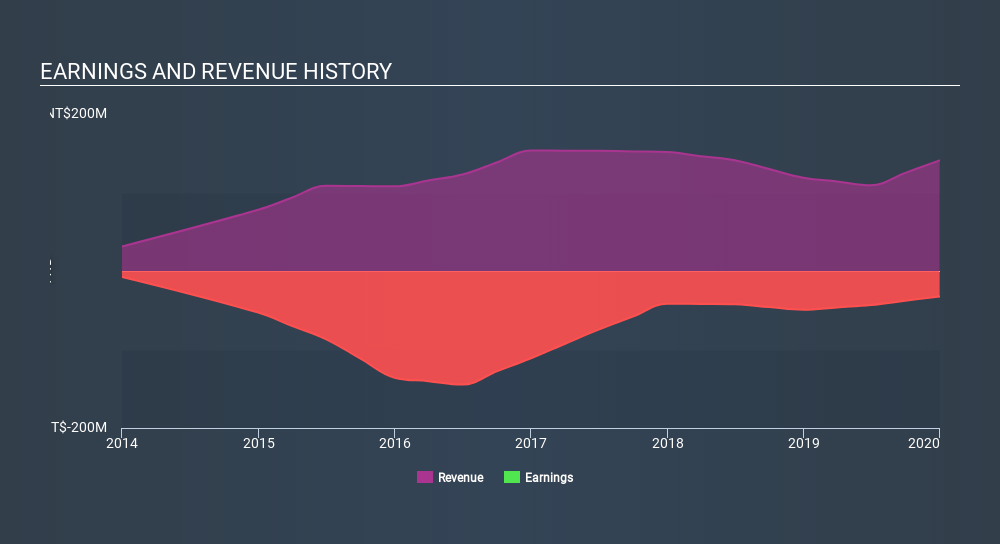

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at ThroughTek's financial health with this free report on its balance sheet.

A Different Perspective

ThroughTek shareholders are up 2.1% for the year. Unfortunately this falls short of the market return of around 2.6%. On the bright side, that's certainly better than the yearly loss of about 36% endured over the last three years, implying that the company is doing better recently. We hope the turnaround in fortunes continues. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with ThroughTek (including 1 which is can't be ignored) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TPEX:6565

ThroughTek

Provides solutions for Internet of Things (IoT) cloud services platforms.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives