- Taiwan

- /

- Semiconductors

- /

- TWSE:6526

Airoha Technology Corp.'s (TWSE:6526) Business Is Trailing The Industry But Its Shares Aren't

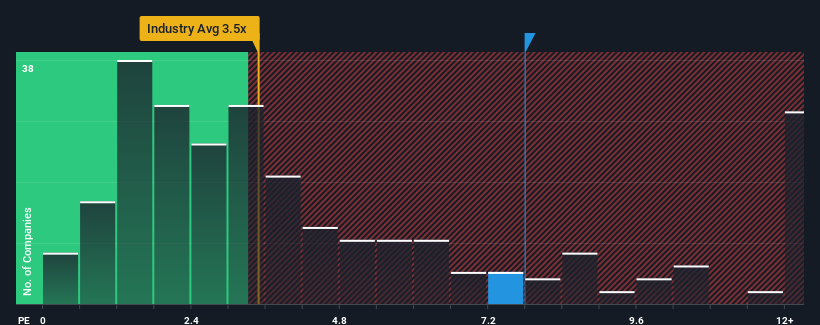

When close to half the companies in the Semiconductor industry in Taiwan have price-to-sales ratios (or "P/S") below 3.5x, you may consider Airoha Technology Corp. (TWSE:6526) as a stock to avoid entirely with its 7.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Airoha Technology

How Has Airoha Technology Performed Recently?

With revenue that's retreating more than the industry's average of late, Airoha Technology has been very sluggish. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Airoha Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Airoha Technology?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Airoha Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 28%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 11% as estimated by the only analyst watching the company. With the industry predicted to deliver 23% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Airoha Technology's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Airoha Technology's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Airoha Technology trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Airoha Technology (at least 1 which is potentially serious), and understanding them should be part of your investment process.

If you're unsure about the strength of Airoha Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6526

Airoha Technology

Engages in the provision of wireless and broadband communications SoC system solutions in Taiwan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives