- Netherlands

- /

- Capital Markets

- /

- ENXTAM:VLK

Van Lanschot Kempen And 2 Other Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In a week marked by mixed performances in major stock indexes, with the S&P 500 and Nasdaq hitting record highs while the Russell 2000 declined, investors are closely watching small-cap stocks for potential opportunities amidst economic shifts and geopolitical developments. As growth shares outpace value stocks, discerning investors might find promise in lesser-known companies that demonstrate resilience and adaptability to current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Van Lanschot Kempen (ENXTAM:VLK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Van Lanschot Kempen NV is a financial services company offering a range of services in the Netherlands and internationally, with a market capitalization of €1.86 billion.

Operations: Van Lanschot Kempen NV generates revenue primarily from its investment banking clients, amounting to €46.60 million. The company has a market capitalization of approximately €1.86 billion.

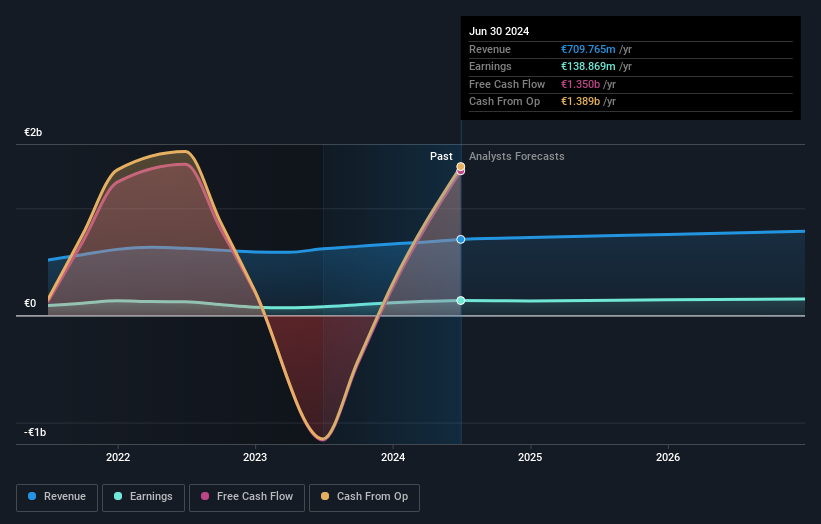

Van Lanschot Kempen, a financial entity with €16.4 billion in assets and €1.3 billion in equity, is making strides with earnings growth at 71%, outpacing the industry average of 24%. Despite its low allowance for bad loans at 30%, it maintains an appropriate level of non-performing loans at 1.4% of total loans. With deposits totaling €12.5 billion and loans reaching €9.1 billion, the bank benefits from primarily low-risk funding sources composed mainly of customer deposits (83%). Recent executive changes include appointing Simon Grossenbacher as COO to strengthen leadership in Switzerland from February 2025 onwards.

- Click here to discover the nuances of Van Lanschot Kempen with our detailed analytical health report.

Assess Van Lanschot Kempen's past performance with our detailed historical performance reports.

Aksa Enerji Üretim (IBSE:AKSEN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aksa Enerji Üretim A.S. is an independent power producer that generates and sells electricity across Turkey, Asia, and Africa, with a market capitalization of TRY45.45 billion.

Operations: Aksa Enerji Üretim generates revenue primarily from its non-regulated utility segment, amounting to TRY18.23 billion.

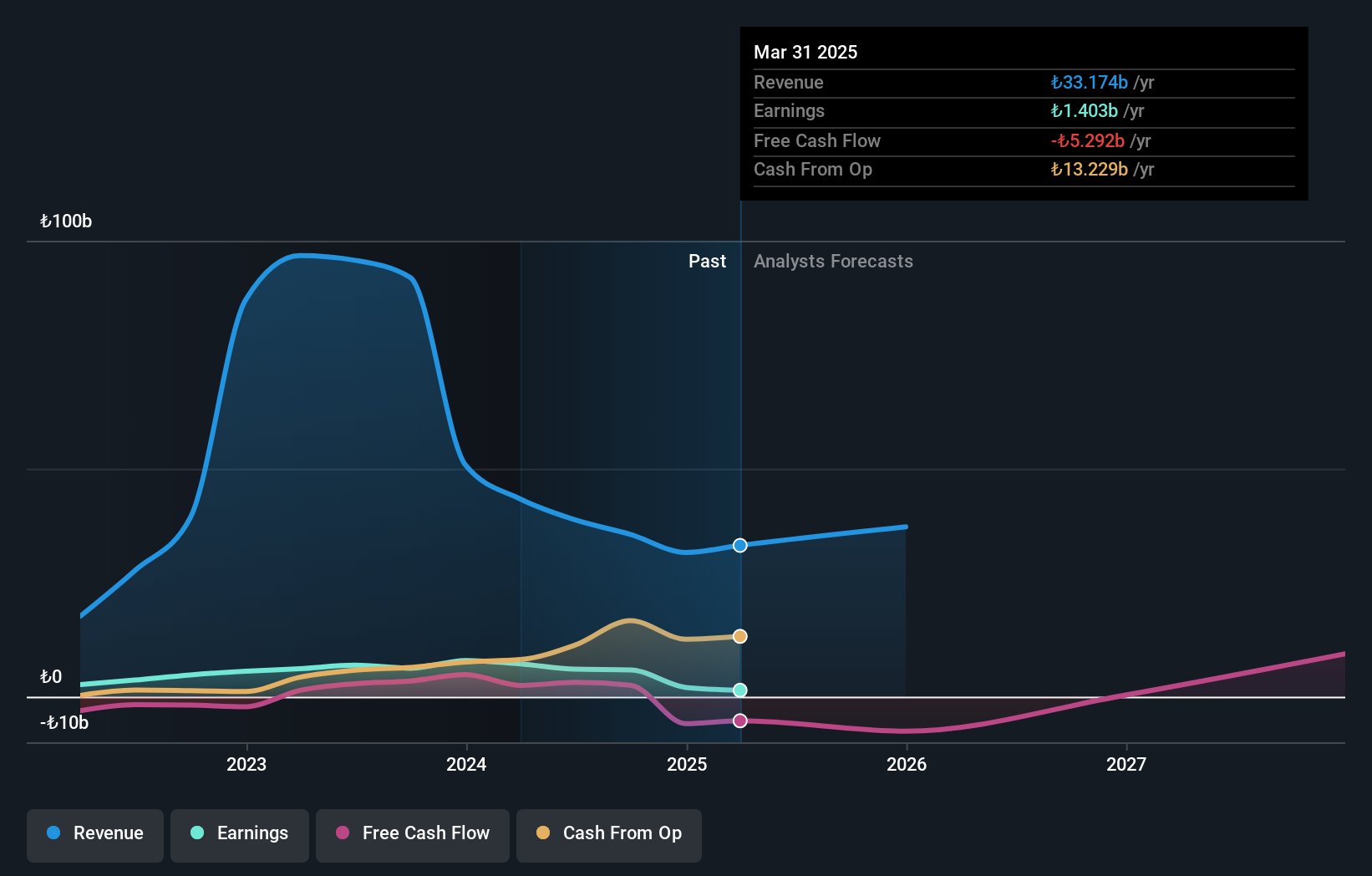

Aksa Enerji, a player in the energy sector, has seen its debt to equity ratio fall from 158.5% to 57.5% over five years, indicating better financial management despite a high net debt to equity ratio of 55.6%. The company's interest payments are comfortably covered by EBIT at 3.6 times, showcasing solid operational efficiency. However, earnings growth was negative at -48.4%, contrasting with the industry average of -17.9%. Recent earnings reveal a drop in sales from TRY 11 billion to TRY 8 billion year-over-year for Q3 and net income decreased from TRY 805 million to TRY 661 million, yet EPS improved from TRY 0.66 to TRY 1.29 due to strategic adjustments likely impacting performance positively amidst challenges.

- Unlock comprehensive insights into our analysis of Aksa Enerji Üretim stock in this health report.

Understand Aksa Enerji Üretim's track record by examining our Past report.

Topco ScientificLtd (TWSE:5434)

Simply Wall St Value Rating: ★★★★★☆

Overview: Topco Scientific Ltd. is involved in supplying precision materials, manufacturing equipment, and components for the semiconductor, LCD, and LED industries across Taiwan, China, and other international markets with a market capitalization of NT$57.29 billion.

Operations: The primary revenue stream for Topco Scientific Ltd. comes from its Semiconductor and Electronic Materials Business Department, generating NT$45.70 billion. The Environmental Engineering Division contributes NT$6.85 billion to the overall revenue.

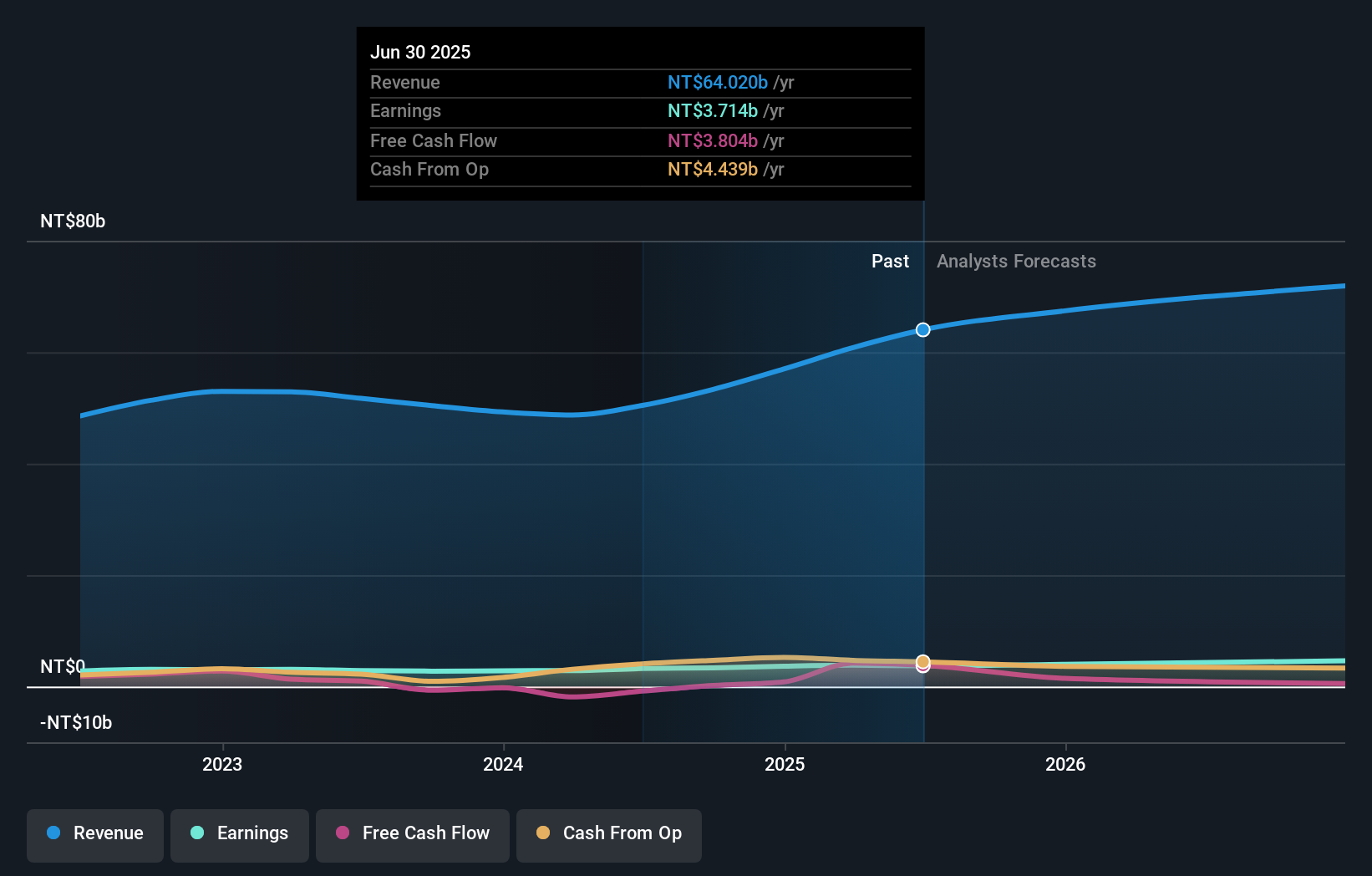

Topco Scientific, a promising player in the semiconductor industry, showcases strong financial health and growth potential. Its recent earnings report highlights a significant increase in quarterly revenue to TWD 15.37 billion from TWD 12.49 billion last year, with net income rising to TWD 936.62 million from TWD 791.91 million. The company's price-to-earnings ratio of 17x is attractive compared to the TW market's average of 21.3x, suggesting good value for investors. Moreover, Topco's net debt to equity ratio stands at a satisfactory 2.8%, indicating prudent financial management amidst an impressive earnings growth rate of 21.7% over the past year.

Turning Ideas Into Actions

- Dive into all 4645 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:VLK

Van Lanschot Kempen

Provides various financial services in the Netherlands and internationally.

Solid track record with excellent balance sheet.