- Taiwan

- /

- Semiconductors

- /

- TWSE:5269

ASMedia Technology's (TWSE:5269) five-year total shareholder returns outpace the underlying earnings growth

It hasn't been the best quarter for ASMedia Technology Inc. (TWSE:5269) shareholders, since the share price has fallen 22% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. We think most investors would be happy with the 220% return, over that period. To some, the recent pullback wouldn't be surprising after such a fast rise. Only time will tell if there is still too much optimism currently reflected in the share price. While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 32% in the last three years.

Since the long term performance has been good but there's been a recent pullback of 11%, let's check if the fundamentals match the share price.

View our latest analysis for ASMedia Technology

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

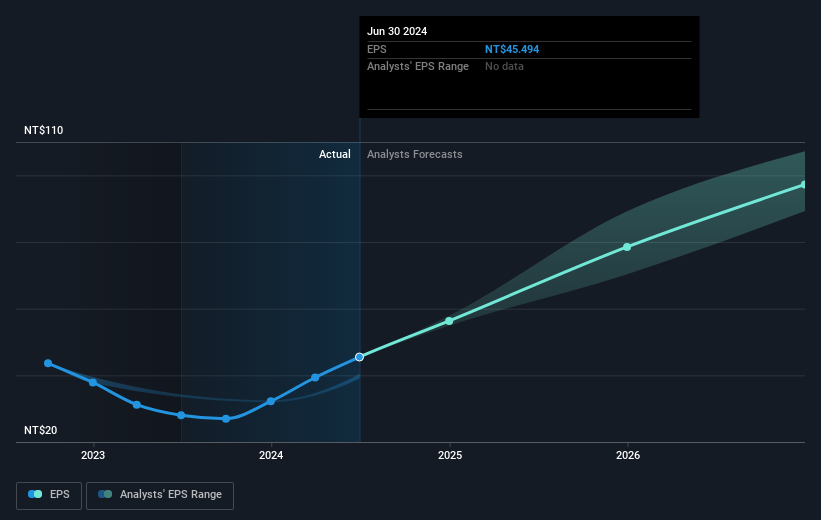

Over half a decade, ASMedia Technology managed to grow its earnings per share at 19% a year. This EPS growth is slower than the share price growth of 26% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that ASMedia Technology has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of ASMedia Technology, it has a TSR of 246% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that ASMedia Technology shareholders have received a total shareholder return of 53% over one year. And that does include the dividend. That's better than the annualised return of 28% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - ASMedia Technology has 2 warning signs (and 1 which is significant) we think you should know about.

Of course ASMedia Technology may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:5269

ASMedia Technology

A fabless IC design company, engages in the design, development, production, manufacture, and sale of high-speed analogue circuit products in the United States, Taiwan, China, Southeast Asia, Northeast Asia, and internationally.

Exceptional growth potential with flawless balance sheet.