- Taiwan

- /

- Semiconductors

- /

- TWSE:3711

ASE Technology Holding (TWSE:3711) Reports Strong Q3 Earnings with 31% Profit Growth Forecast for 2024

Reviewed by Simply Wall St

See the full analysis report here for a deeper understanding of ASE Technology Holding.

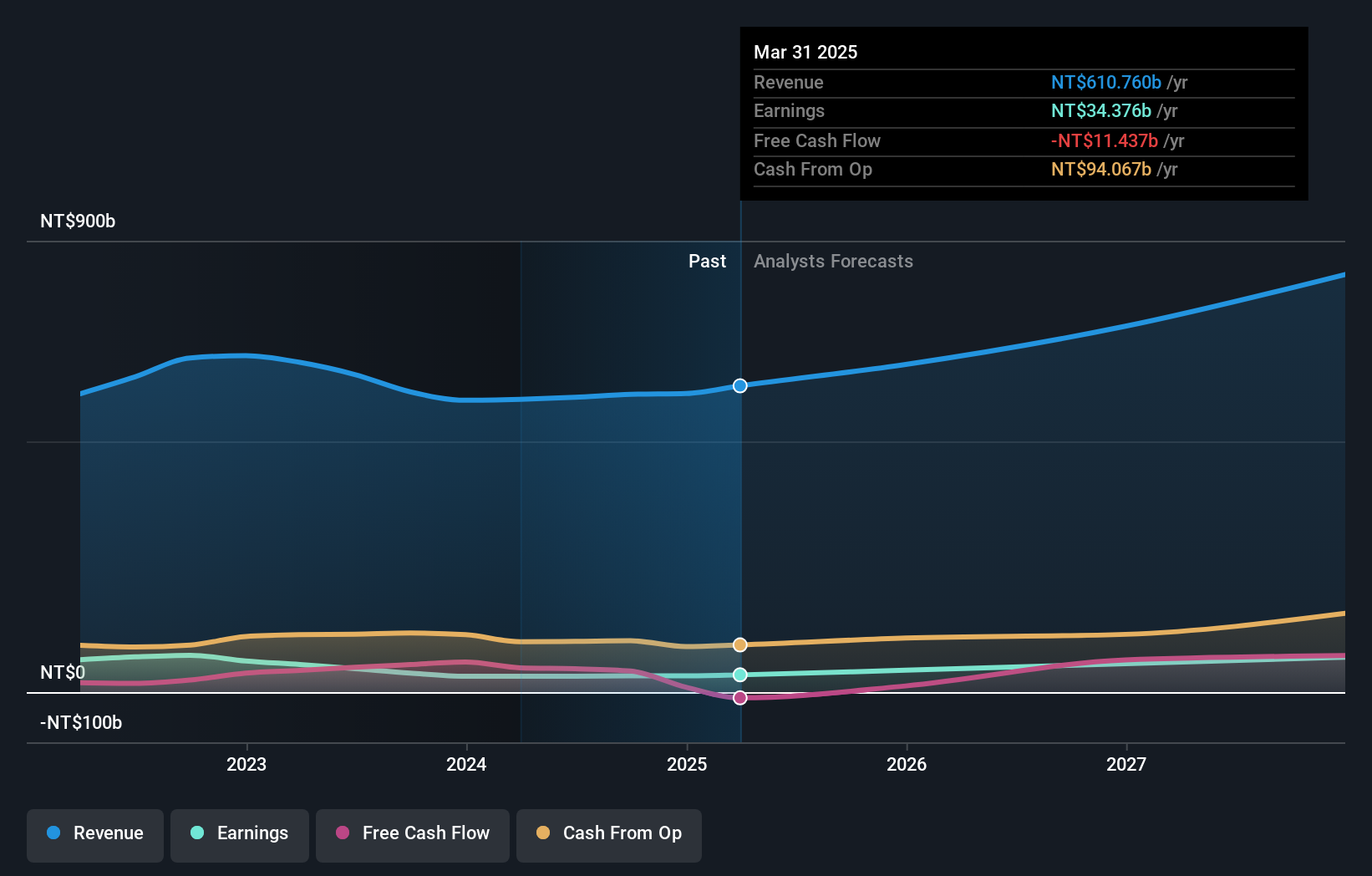

Strengths: Competitive Advantages That Elevate ASE Technology Holding

ASE Technology Holding has demonstrated impressive financial health, with a significant 31% annual profit growth forecast. This is supported by high-quality past earnings, as evidenced by the recent third-quarter results showing net income of TWD 9.67 billion, up from TWD 8.78 billion the previous year. The company's profitability ensures a stable cash runway, and shareholders have not faced dilution over the past year. In the latest earnings call, Joseph Tung, CEO, highlighted a 15% year-over-year revenue increase, driven by strong demand in core segments. This performance is further underscored by the company's undervaluation, trading at NT$152, significantly below its estimated fair value of NT$287.1. To learn about how ASE Technology Holding's valuation metrics are shaping its market position, check out our detailed analysis of ASE Technology Holding's Valuation.

Weaknesses: Critical Issues Affecting the Performance of ASE Technology Holding and Areas for Growth

ASE Technology Holding faces challenges with its revenue growth forecasted at 11% per year, lagging behind the industry average of 12.3% and the market's 20%. The current net profit margin of 5.5% is also lower than last year's 6.3%, indicating pressure on profitability. Additionally, the return on equity stands at a modest 10.3%, and dividend payments have been inconsistent over the past six years. Rising raw material costs have further pressured margins, as noted in the earnings call. Explore the current health of ASE Technology Holding and how it reflects on its financial stability and growth potential.

Opportunities: Areas for Expansion and Innovation for ASE Technology Holding

ASE Technology Holding is poised for growth, with earnings expected to rise significantly, presenting a promising outlook for future profitability. The company is actively exploring new markets in Asia and Europe, as highlighted by Joseph Tung, aiming to tap into these regions' growth potential. Investments in digital capabilities are set to enhance customer experience and operational efficiency, aligning with recent regulatory changes that may open new product development avenues. See what the latest analyst reports say about ASE Technology Holding's future prospects and potential market movements.

Threats: Market Volatility Affecting ASE Technology Holding's Position

ASE Technology Holding faces financial risks due to its high debt level, with a net debt to equity ratio of 40.4%. Ongoing global supply chain disruptions pose significant threats to operations, potentially impacting timely product delivery and customer satisfaction. Additionally, the company's unstable dividend track record may deter investors. The management's proactive monitoring of regulatory developments is crucial to mitigate compliance risks. Learn about ASE Technology Holding's dividend strategy and how it impacts shareholder returns and financial stability.

Conclusion

ASE Technology Holding's impressive financial health, marked by a 31% annual profit growth forecast and strong third-quarter earnings, positions it well for future success. Challenges such as a lower-than-industry-average revenue growth forecast and profit margin pressures exist, but the company's strategic initiatives in expanding into Asian and European markets and investing in digital capabilities offer promising avenues for growth. The current trading price of NT$152, significantly below its estimated fair value of NT$287.1, suggests potential for substantial investor returns as the company capitalizes on these opportunities. However, the high debt level and supply chain disruptions present risks that require careful management to ensure sustained profitability and shareholder confidence.

Next Steps

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TWSE:3711

ASE Technology Holding

Provides semiconductors packaging and testing, and electronic manufacturing services in the United States, Taiwan, Asia, Europe, and internationally.

Excellent balance sheet and good value.