- Taiwan

- /

- Semiconductors

- /

- TWSE:2458

Cautious Investors Not Rewarding ELAN Microelectronics Corporation's (TWSE:2458) Performance Completely

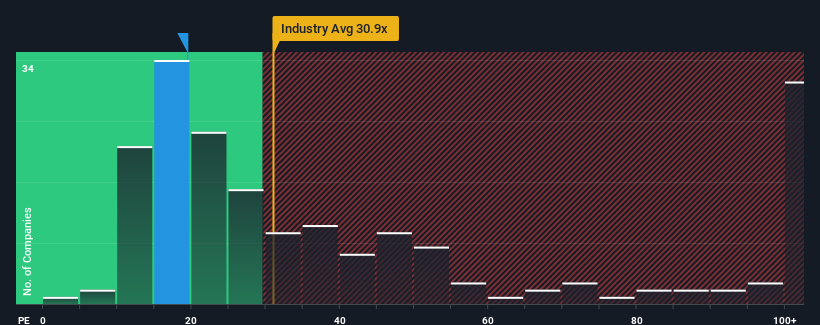

ELAN Microelectronics Corporation's (TWSE:2458) price-to-earnings (or "P/E") ratio of 19.5x might make it look like a buy right now compared to the market in Taiwan, where around half of the companies have P/E ratios above 23x and even P/E's above 40x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been more advantageous for ELAN Microelectronics as its earnings haven't fallen as much as the rest of the market. One possibility is that the P/E is low because investors think this relatively better earnings performance might be about to deteriorate significantly. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's earnings continue outplaying the market.

See our latest analysis for ELAN Microelectronics

Is There Any Growth For ELAN Microelectronics?

There's an inherent assumption that a company should underperform the market for P/E ratios like ELAN Microelectronics' to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 32% decline in EPS over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 27% as estimated by the four analysts watching the company. That's shaping up to be similar to the 26% growth forecast for the broader market.

In light of this, it's peculiar that ELAN Microelectronics' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On ELAN Microelectronics' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of ELAN Microelectronics' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for ELAN Microelectronics you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if ELAN Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2458

ELAN Microelectronics

Operates as a semiconductor company in Taiwan, Mainland China, Hong Kong, the United States, Europe, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives