- Taiwan

- /

- Semiconductors

- /

- TWSE:2449

Why Investors Shouldn't Be Surprised By King Yuan Electronics Co., Ltd.'s (TWSE:2449) 27% Share Price Surge

King Yuan Electronics Co., Ltd. (TWSE:2449) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The last month tops off a massive increase of 100% in the last year.

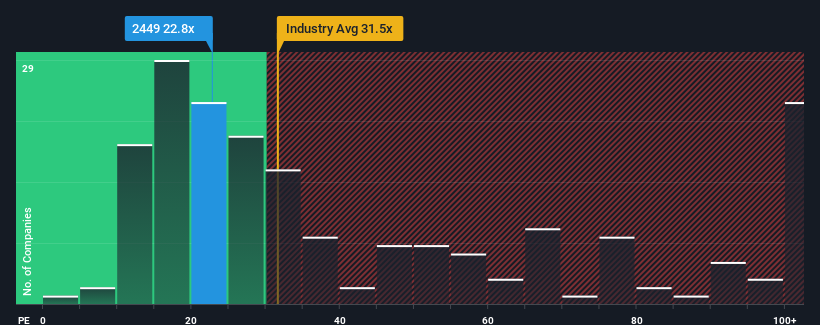

Even after such a large jump in price, it's still not a stretch to say that King Yuan Electronics' price-to-earnings (or "P/E") ratio of 22.8x right now seems quite "middle-of-the-road" compared to the market in Taiwan, where the median P/E ratio is around 23x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, King Yuan Electronics has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for King Yuan Electronics

How Is King Yuan Electronics' Growth Trending?

King Yuan Electronics' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 3.0% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 55% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 11% per year as estimated by the nine analysts watching the company. That's shaping up to be similar to the 12% per annum growth forecast for the broader market.

In light of this, it's understandable that King Yuan Electronics' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

King Yuan Electronics' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of King Yuan Electronics' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for King Yuan Electronics with six simple checks on some of these key factors.

If you're unsure about the strength of King Yuan Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if King Yuan Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2449

King Yuan Electronics

Engages in the designing, manufacturing, selling, testing, and assembly service of integrated circuits.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives