- Taiwan

- /

- Semiconductors

- /

- TWSE:2408

The Price Is Right For Nanya Technology Corporation (TWSE:2408) Even After Diving 26%

Nanya Technology Corporation (TWSE:2408) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

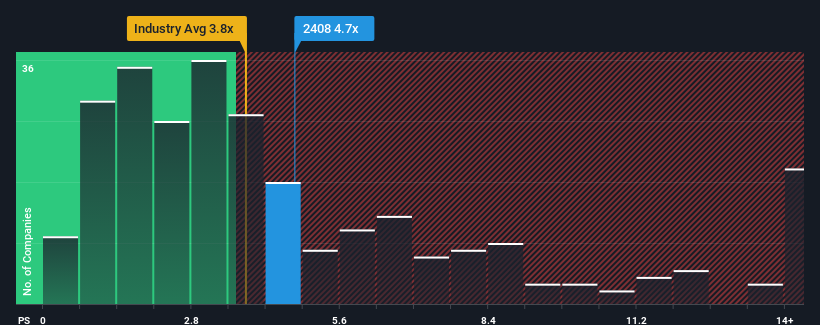

Although its price has dipped substantially, when almost half of the companies in Taiwan's Semiconductor industry have price-to-sales ratios (or "P/S") below 3.8x, you may still consider Nanya Technology as a stock probably not worth researching with its 4.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Nanya Technology

What Does Nanya Technology's P/S Mean For Shareholders?

Recent revenue growth for Nanya Technology has been in line with the industry. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Nanya Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Nanya Technology?

In order to justify its P/S ratio, Nanya Technology would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 49% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 59% as estimated by the twelve analysts watching the company. That's shaping up to be materially higher than the 26% growth forecast for the broader industry.

With this information, we can see why Nanya Technology is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Despite the recent share price weakness, Nanya Technology's P/S remains higher than most other companies in the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Nanya Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Nanya Technology with six simple checks.

If you're unsure about the strength of Nanya Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nanya Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2408

Nanya Technology

Research, develops, manufactures, and sells semiconductor products in Taiwan, Japan, Malaysia, China, the United States, Thailand, Germany, Singapore, Poland and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026