- Taiwan

- /

- Semiconductors

- /

- TWSE:2408

Nanya Technology (TWSE:2408 shareholders incur further losses as stock declines 7.3% this week, taking three-year losses to 0.7%

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Nanya Technology Corporation (TWSE:2408) shareholders, since the share price is down 11% in the last three years, falling well short of the market return of around 52%. And the share price decline continued over the last week, dropping some 7.3%.

If the past week is anything to go by, investor sentiment for Nanya Technology isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Nanya Technology

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

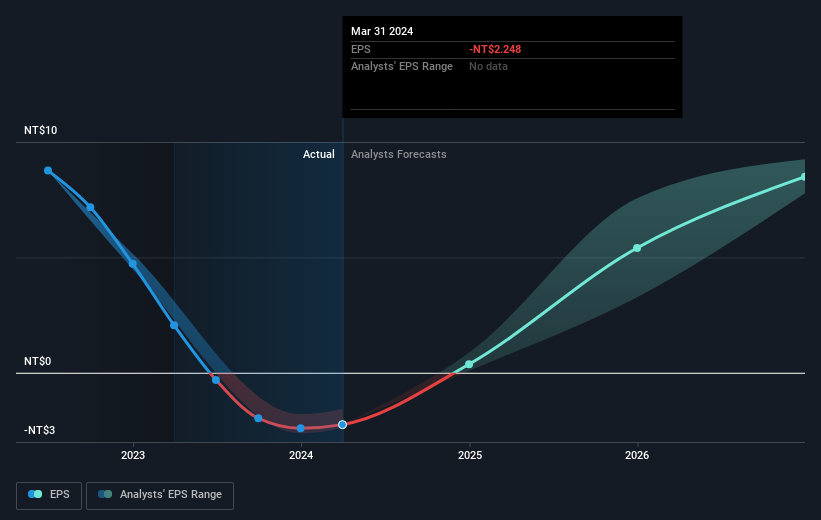

Over the three years that the share price declined, Nanya Technology's earnings per share (EPS) dropped significantly, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Nanya Technology's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Nanya Technology's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Nanya Technology's TSR of was a loss of 0.7% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 45% in the last year, Nanya Technology shareholders lost 4.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Nanya Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nanya Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2408

Nanya Technology

Research, develops, manufactures, and sells semiconductor products in Taiwan, Japan, Malaysia, China, the United States, Thailand, Germany, Singapore, Poland and internationally.

High growth potential and fair value.