- Taiwan

- /

- Semiconductors

- /

- TWSE:2393

There's No Escaping Everlight Electronics Co., Ltd.'s (TWSE:2393) Muted Earnings Despite A 26% Share Price Rise

Everlight Electronics Co., Ltd. (TWSE:2393) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 70% in the last year.

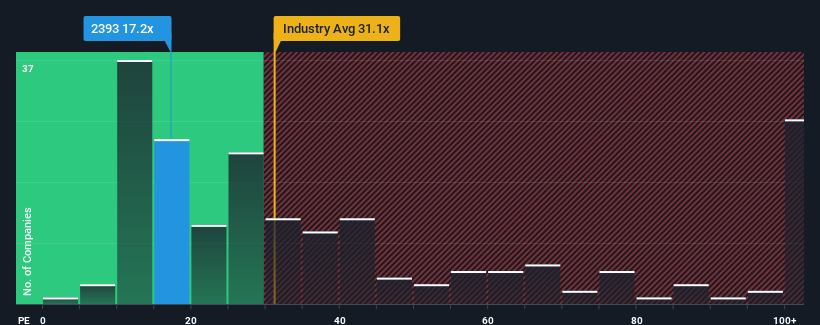

In spite of the firm bounce in price, given about half the companies in Taiwan have price-to-earnings ratios (or "P/E's") above 22x, you may still consider Everlight Electronics as an attractive investment with its 17.2x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Everlight Electronics as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Everlight Electronics

How Is Everlight Electronics' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Everlight Electronics' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 62% gain to the company's bottom line. As a result, it also grew EPS by 14% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 18% during the coming year according to the one analyst following the company. That's shaping up to be materially lower than the 24% growth forecast for the broader market.

In light of this, it's understandable that Everlight Electronics' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Despite Everlight Electronics' shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Everlight Electronics maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Everlight Electronics that you should be aware of.

Of course, you might also be able to find a better stock than Everlight Electronics. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Everlight Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2393

Everlight Electronics

Engages in the manufacture and sale of light-emitting diode (LED) in Taiwan, rest of Asia, the United States, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives