- Taiwan

- /

- Semiconductors

- /

- TWSE:3055

Spirox Corporation's (TPE:3055) Shareholders Might Be Looking For Exit

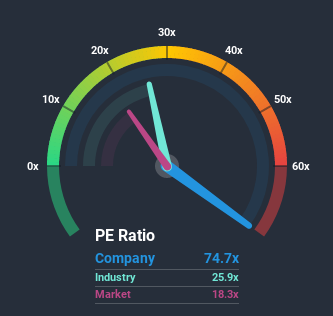

When close to half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 18x, you may consider Spirox Corporation (TPE:3055) as a stock to avoid entirely with its 74.7x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Spirox as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Spirox

How Is Spirox's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Spirox's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 408%. However, this wasn't enough as the latest three year period has seen a very unpleasant 43% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 24% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Spirox is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Spirox revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Spirox that you should be aware of.

Of course, you might also be able to find a better stock than Spirox. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

When trading Spirox or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3055

Spirox

Engages in the provision of integrated solutions to the semiconductor and FPD industries in Taiwan, China, and internationally.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives