- Taiwan

- /

- Semiconductors

- /

- TPEX:4974

Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we approach January 2025, global markets are navigating a complex landscape marked by fluctuating consumer confidence and mixed economic signals. Despite these challenges, major stock indices have shown moderate gains, with technology stocks leading the charge in the U.S., while European and Asian markets also experienced upward trends. In this environment, dividend stocks can offer investors a measure of stability and potential income through regular payouts, making them an appealing option for those looking to balance growth with income amid uncertain market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.85% | ★★★★★★ |

Click here to see the full list of 1942 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

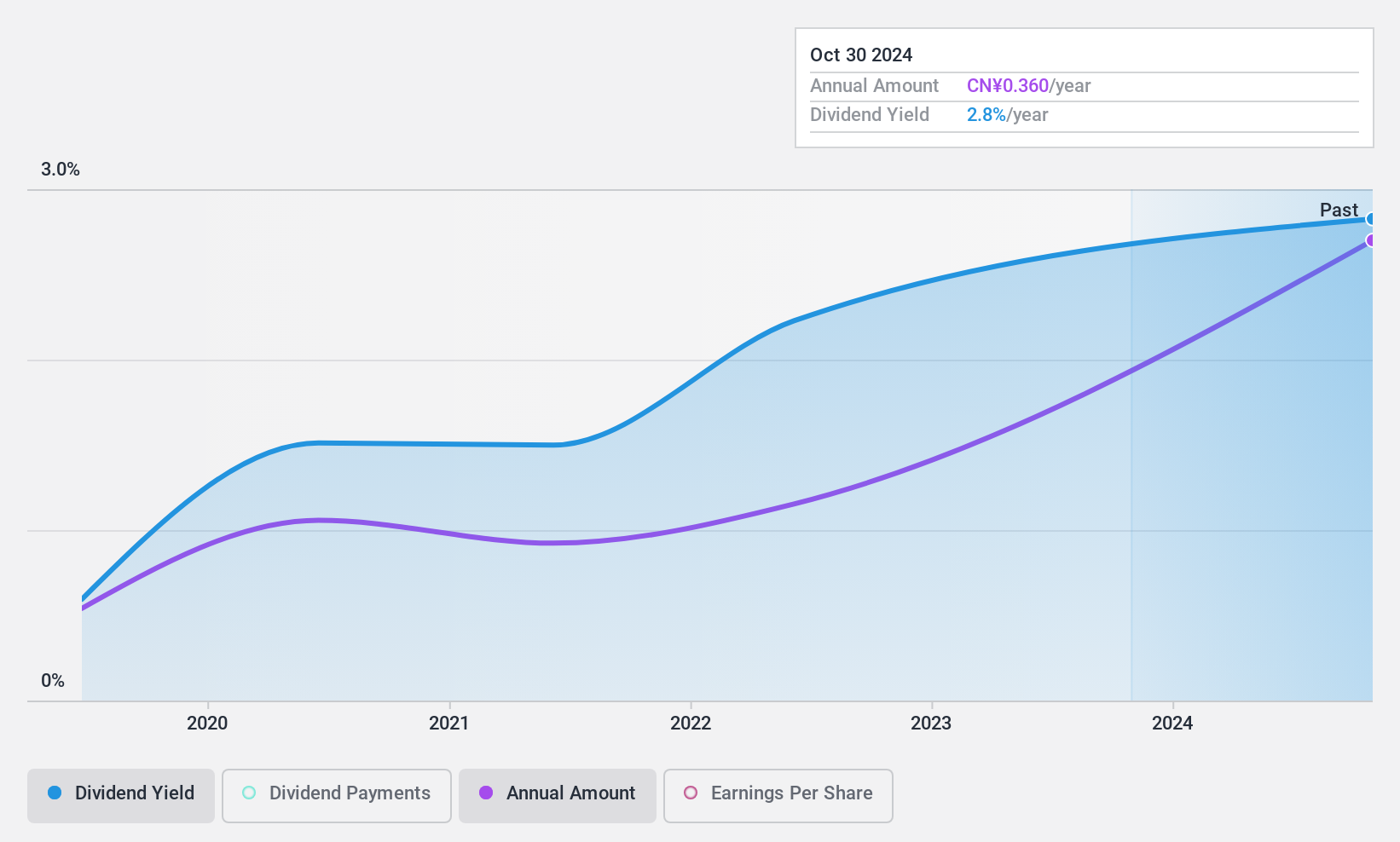

Shanghai Sinotec (SHSE:603121)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Sinotec Co., Ltd. develops, produces, and sells auto parts in China with a market capitalization of CN¥3.73 billion.

Operations: Shanghai Sinotec Co., Ltd.'s revenue is derived from its development, production, and sale of auto parts in China.

Dividend Yield: 3.3%

Shanghai Sinotec's dividend payments are supported by a reasonable payout ratio of 66.7%, indicating coverage by earnings, and a cash payout ratio of 79.4%, showing support from cash flows. Despite its dividend yield being in the top 25% of the CN market, the company's dividends have been volatile and unreliable over its six-year history. Recent earnings reports show sales growth but declining net income, which may impact future dividend stability.

- Unlock comprehensive insights into our analysis of Shanghai Sinotec stock in this dividend report.

- The analysis detailed in our Shanghai Sinotec valuation report hints at an inflated share price compared to its estimated value.

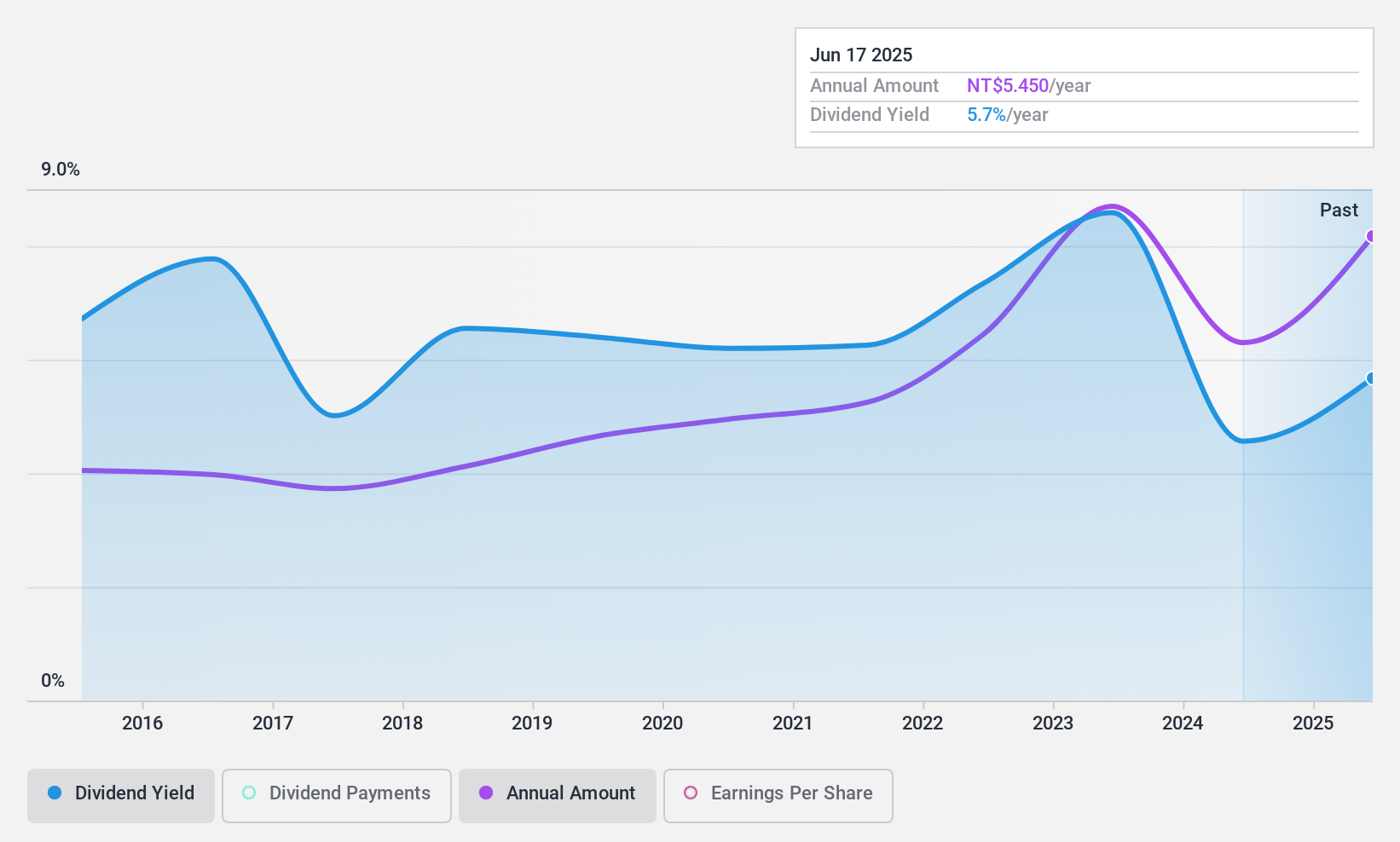

Asia Tech Image (TPEX:4974)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Tech Image Inc. designs, develops, and manufactures customized contact image sensor modules in Taiwan, China, and Myanmar with a market capitalization of NT$10.15 billion.

Operations: Asia Tech Image Inc.'s revenue is derived from two main segments: Asia, contributing NT$5.44 billion, and Domestic sales, accounting for NT$3.86 billion.

Dividend Yield: 3%

Asia Tech Image's dividend payments, while covered by earnings (67.8% payout ratio) and cash flows (51.4% cash payout ratio), have been volatile over the past decade, with a history of significant drops. The current yield of 3% is below Taiwan's top quartile for dividend payers. Recent financial results show increased sales and net income, suggesting potential for improved stability if growth continues to support consistent dividends in the future.

- Click here to discover the nuances of Asia Tech Image with our detailed analytical dividend report.

- Our expertly prepared valuation report Asia Tech Image implies its share price may be lower than expected.

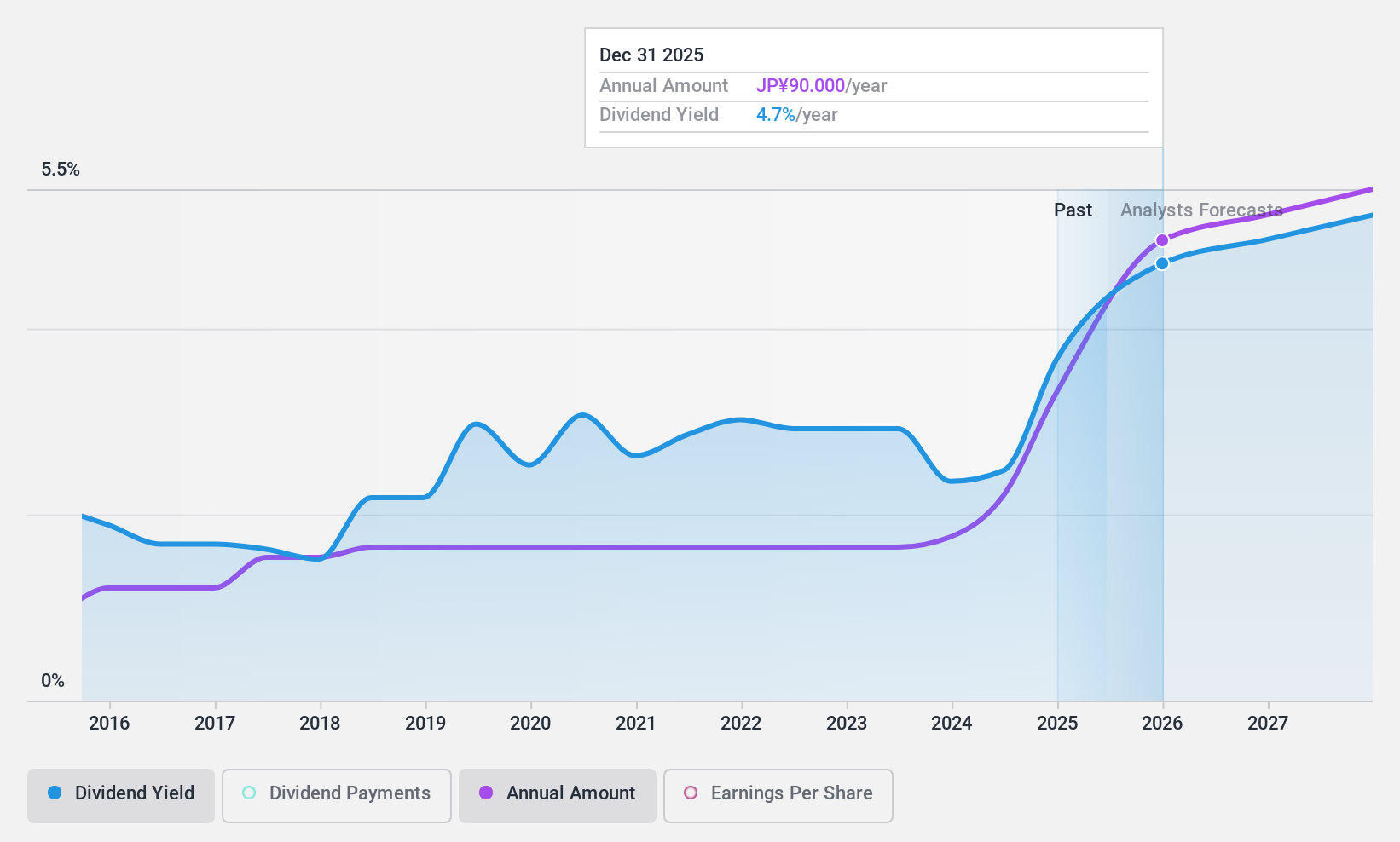

Sakata INX (TSE:4633)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sakata INX Corporation manufactures and sells a range of printing inks and auxiliary agents both in Japan and internationally, with a market cap of ¥86.51 billion.

Operations: Sakata INX Corporation generates revenue through the production and distribution of diverse printing inks and auxiliary agents across domestic and international markets.

Dividend Yield: 3.4%

Sakata INX offers a reliable dividend profile with its payments well-covered by earnings and cash flows, evidenced by payout ratios of 24.5% and 28.4%, respectively. The dividend yield of 3.44% falls short of Japan's top quartile but remains stable and growing over the past decade. Trading significantly below estimated fair value, Sakata INX presents an attractive investment for those seeking stability in dividends, supported by consistent earnings growth at 14.9% annually over five years.

- Take a closer look at Sakata INX's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Sakata INX is priced lower than what may be justified by its financials.

Taking Advantage

- Dive into all 1942 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4974

Asia Tech Image

Designs, develops, and manufactures contact image sensor module (CIS) products in Taiwan, China, and Myanmar.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives